The NSE Nifty 50 and BSE Sensex extended losses to the fifth straight session on Wednesday as HDFC Bank Ltd., Reliance Industries Ltd. and Mahindra & Mahindra Ltd. share prices dragged.

The Nifty 50 ended at over four–month low for the second session in a row. The market–cap of Nifty 50 companies fell Rs 2.5 lakh crore to Rs 188.07 lakh crore as the index entered correction zone. The benchmark large–cap gauge declined over 10% from its life high of 26,277.35.

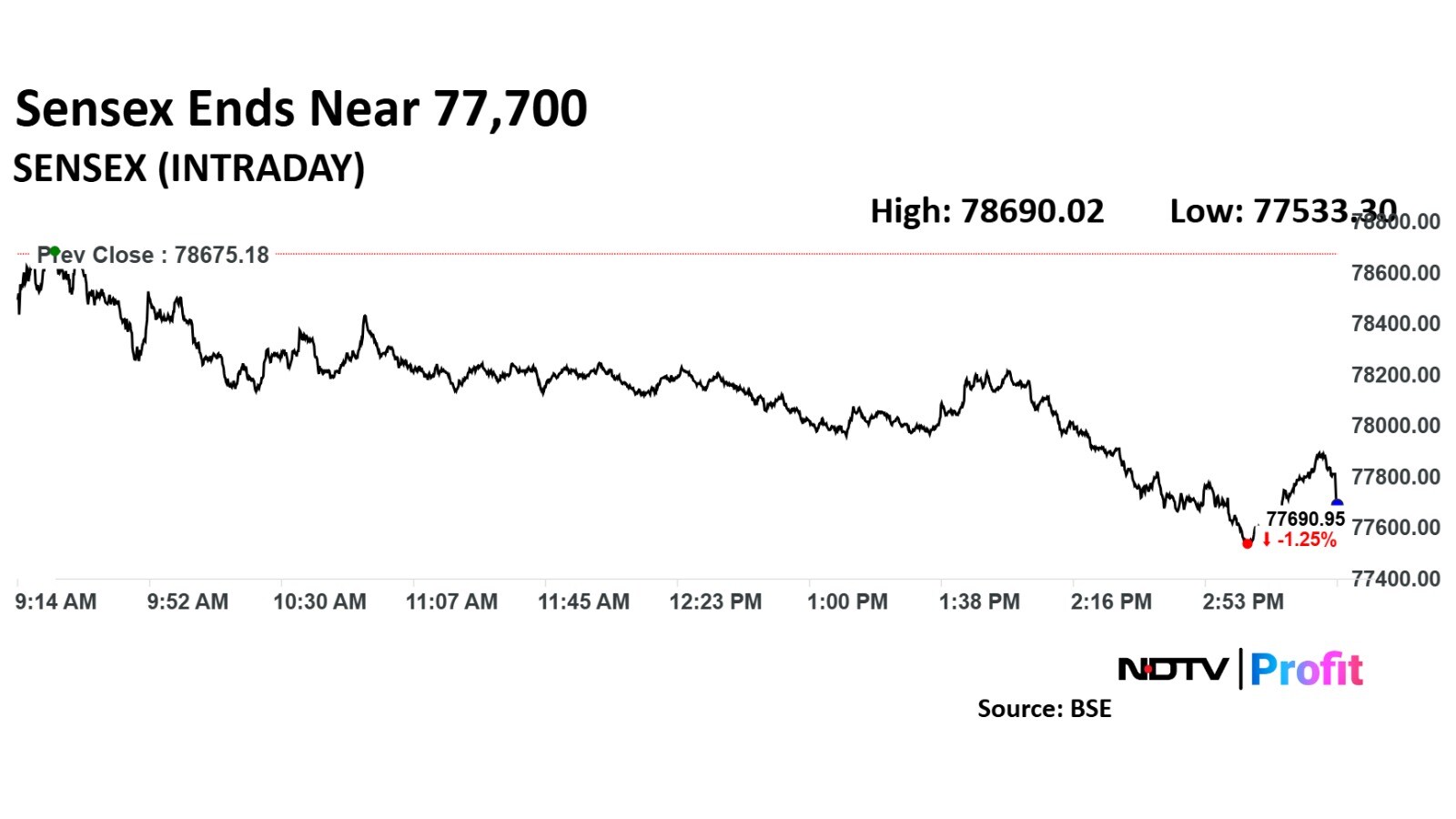

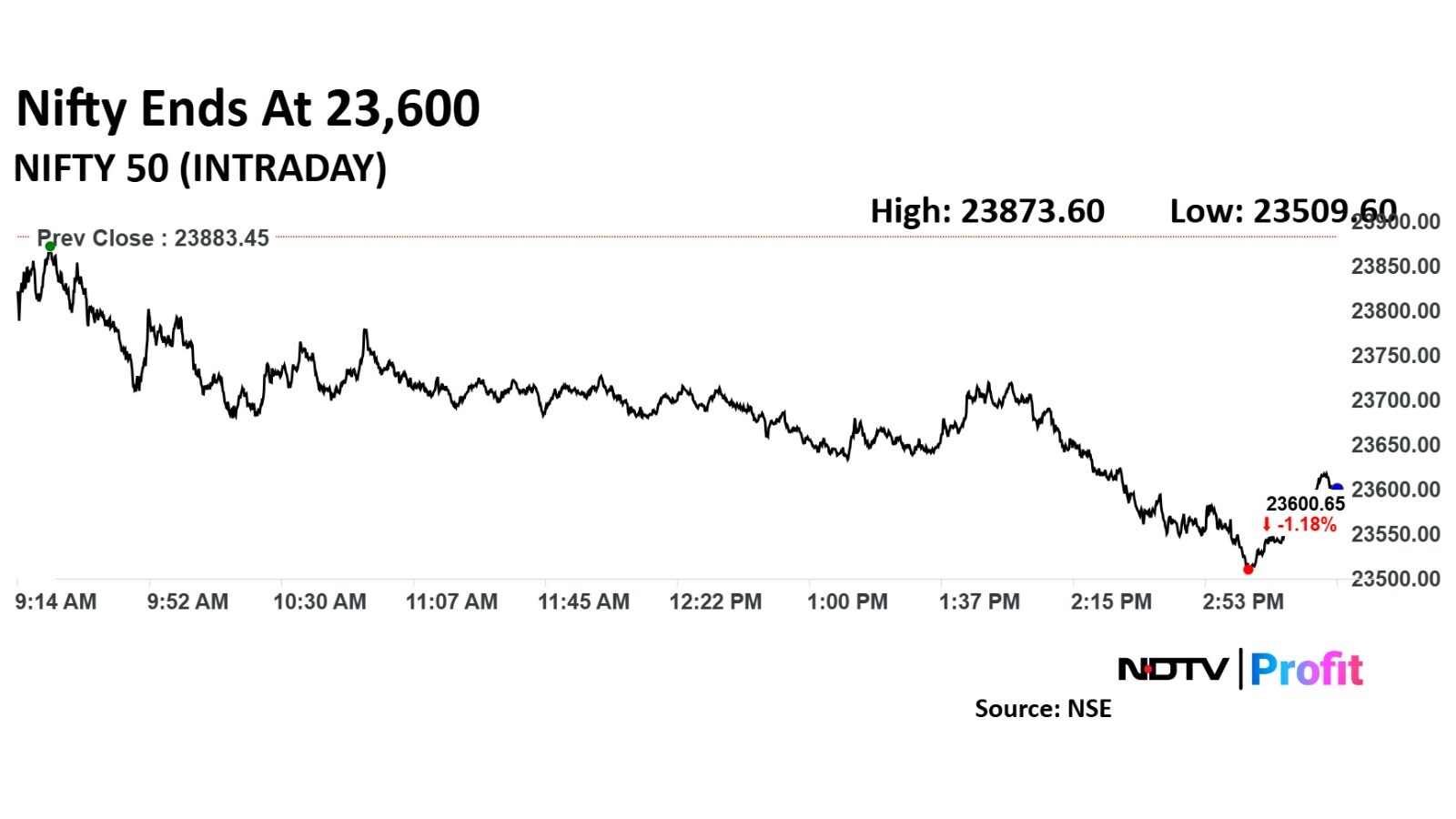

The Nifty ended 324.40 points or 1.36% down at 23,559.05, the lowest level since June 24. The Sensex closed 984.23 points or 1.25% lower at 77,690.95, the lowest since June 24.

During the last leg of the trade, the Nifty 50 declined as much as 1.57% to 23,509.60, and the Sensex plunged 1.45% to 77,533.30.

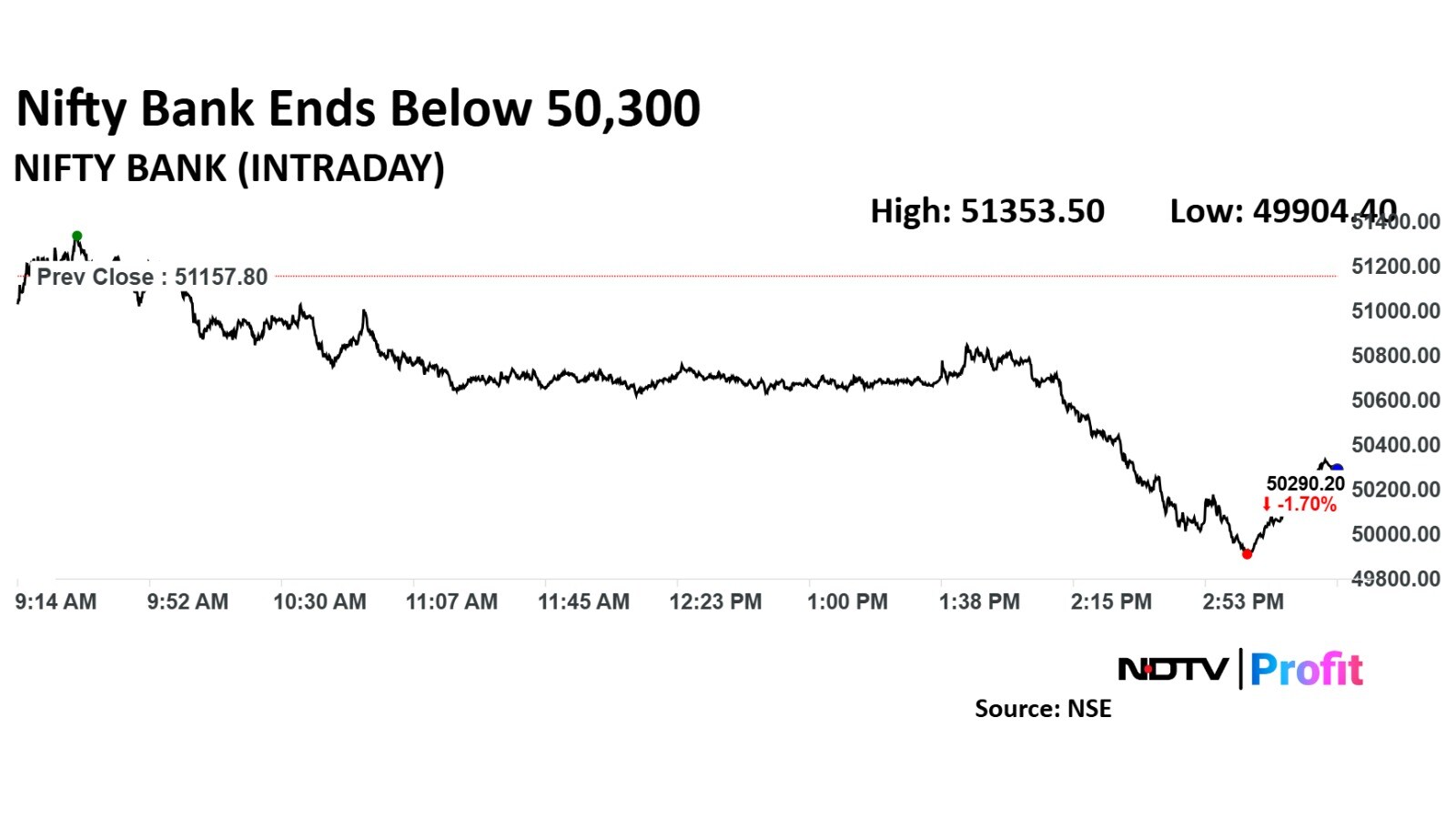

The Nifty Bank declined as much as 2.45% during the day to 49,904.40, the lowest since Aug. 16. The index ended 2.09% down at 50,088.35.

The Nifty Metal declined 3.04% during the day to 8,802.20, the lowest since Aug. 14. The index closed 2.66% down at 8,836.75.

The Sensex ended 1.25% down at 77,690.95.

The Nifty 50 ended 1.18% down at 23,600.65.

Technically, after weak open throughout the day, the market registered selling pressure at higher levels. In addition, bearish candle on daily charts indicates further weakness from the current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that the current market texture is weak but oversold. Hence, we could expect one quick intraday pullback rally from the current levels."

The Nifty has tested its 200–day–moving–average level, which is at 23,545. The market seems slightly oversold and a bounce is warranted, according to Aditya Gaggar, director of Progressive Share Brokers. "But if the index breaches its 200–day–moving–average due to excessively pessimistic sentiments, then the next critical support is at 23,000, while on the flip side, the higher level is capped at 23,800."

The Nifty Bank ended 1.70% down at 50,290.20.

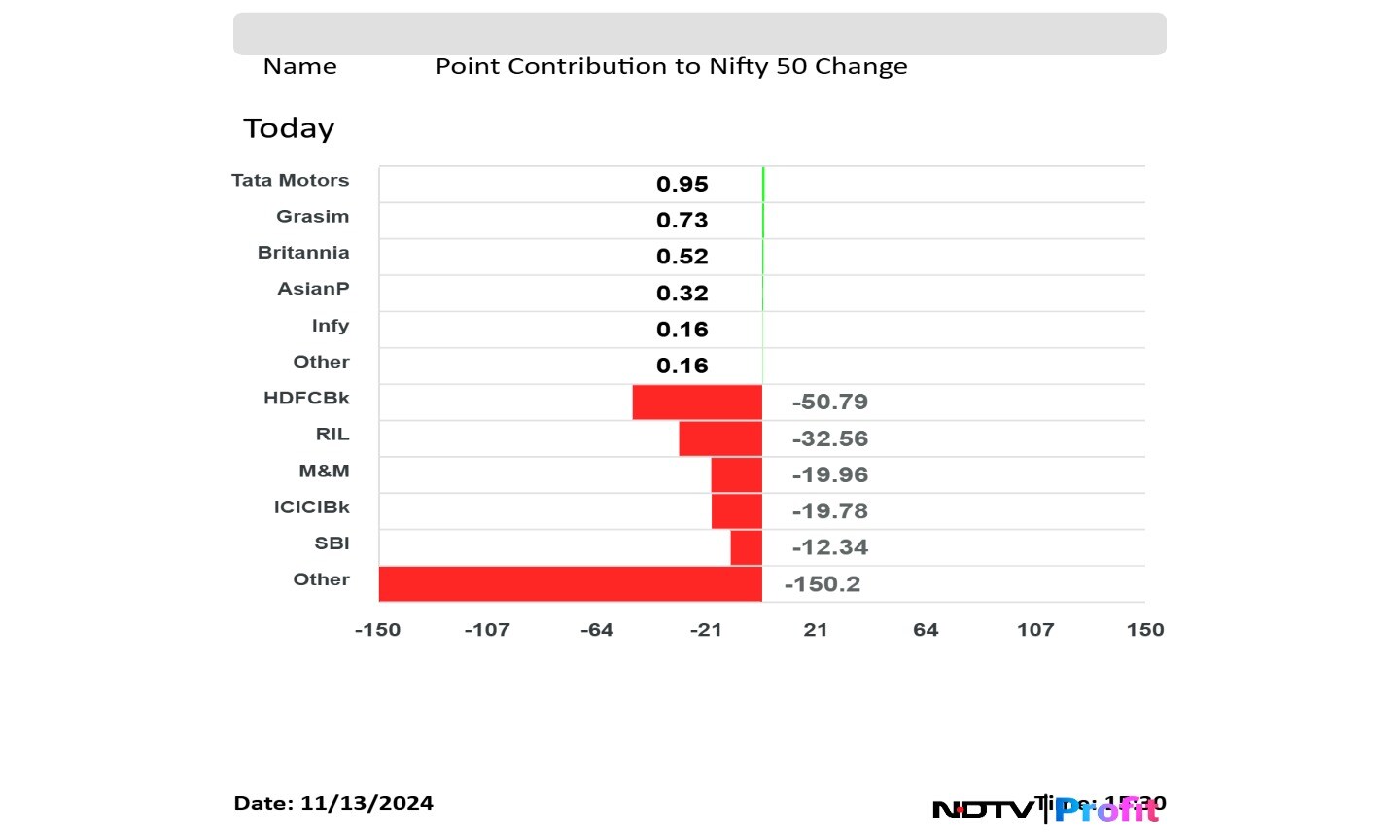

HDFC Bank Ltd., Reliance Industries Ltd., Mahindra & Mahindra Ltd., ICICI Bank Ltd. and State Bank of India weighed on the Nifty 50 the most.

Tata Motors Ltd., Grasim Industries Ltd., Britannia Industries Ltd., Asian Paints Ltd. and Infosys Ltd. added to the index.

Top contribution to the Nifty 50 index on Nov 13.

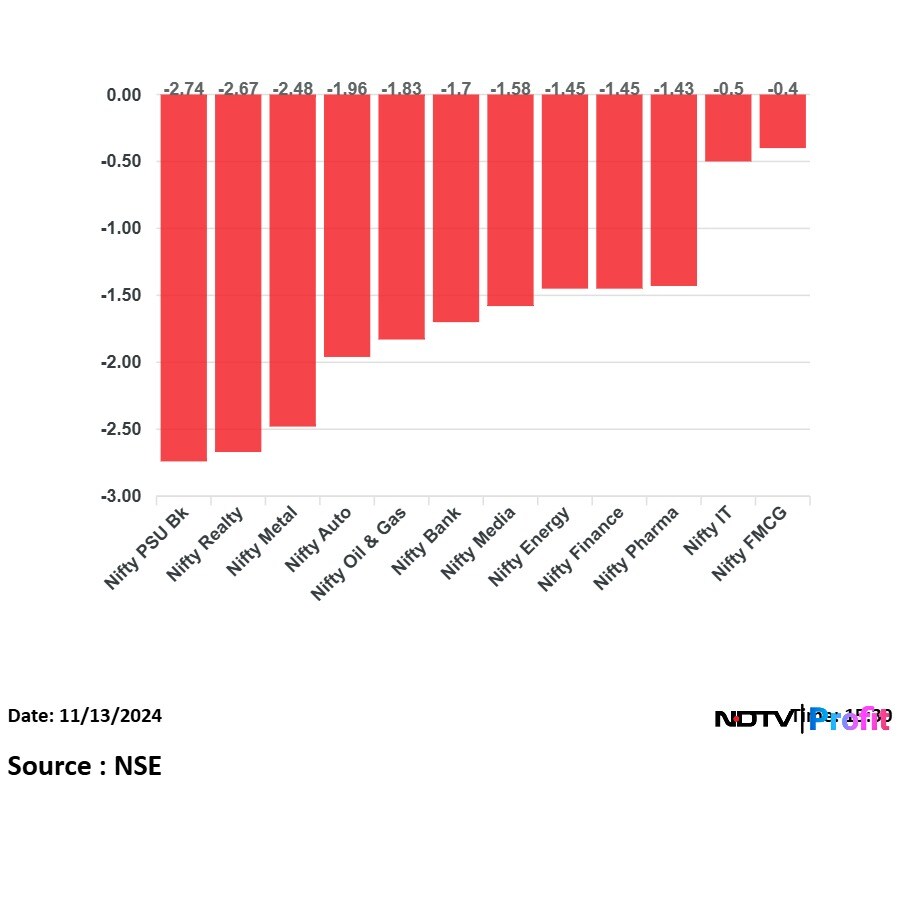

All the 12 sectoral indices on the NSE ended lower, with the Nifty PSU Bank and Realty declining the most.

Most sectoral indices ended lower on Nov 13.

The broader markets underperformed the benchmark indices as the BSE MidCap and SmallCap ended 2.56% and 3.08% lower respectively.

On the BSE, 21 sectors ended lower, with Realty declining the most.

The market breadth was skewed in favour of the sellers as 3,292 stocks declined, 679 advanced and 96 remained unchanged on the BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.