Orient Cement Ltd.'s share price hit a lifetime high, soaring over 7%, after Ambuja Cements announced its acquisition of a 45.7% stake in OCL.

Ambuja Cements Ltd.'s stock also rose nearly 2% in early trade on Tuesday following the company's announcement of its acquisition for approximately Rs 8,100 crore. Ambuja Cements plans to fund the entire acquisition through internal accruals.

OCL has strong established presence in the South and West Indian markets and this acquisition is expected to increase Ambuja's market share across India by 2%.

OCL brings valuable assets to the table, including ready-to-execute projects totaling 8.1 million tonnes per annum and substantial high-quality limestone reserves located in Chittorgarh, Rajasthan. These resources are anticipated to drive future growth, particularly in Northern India, where demand for cement is robust.

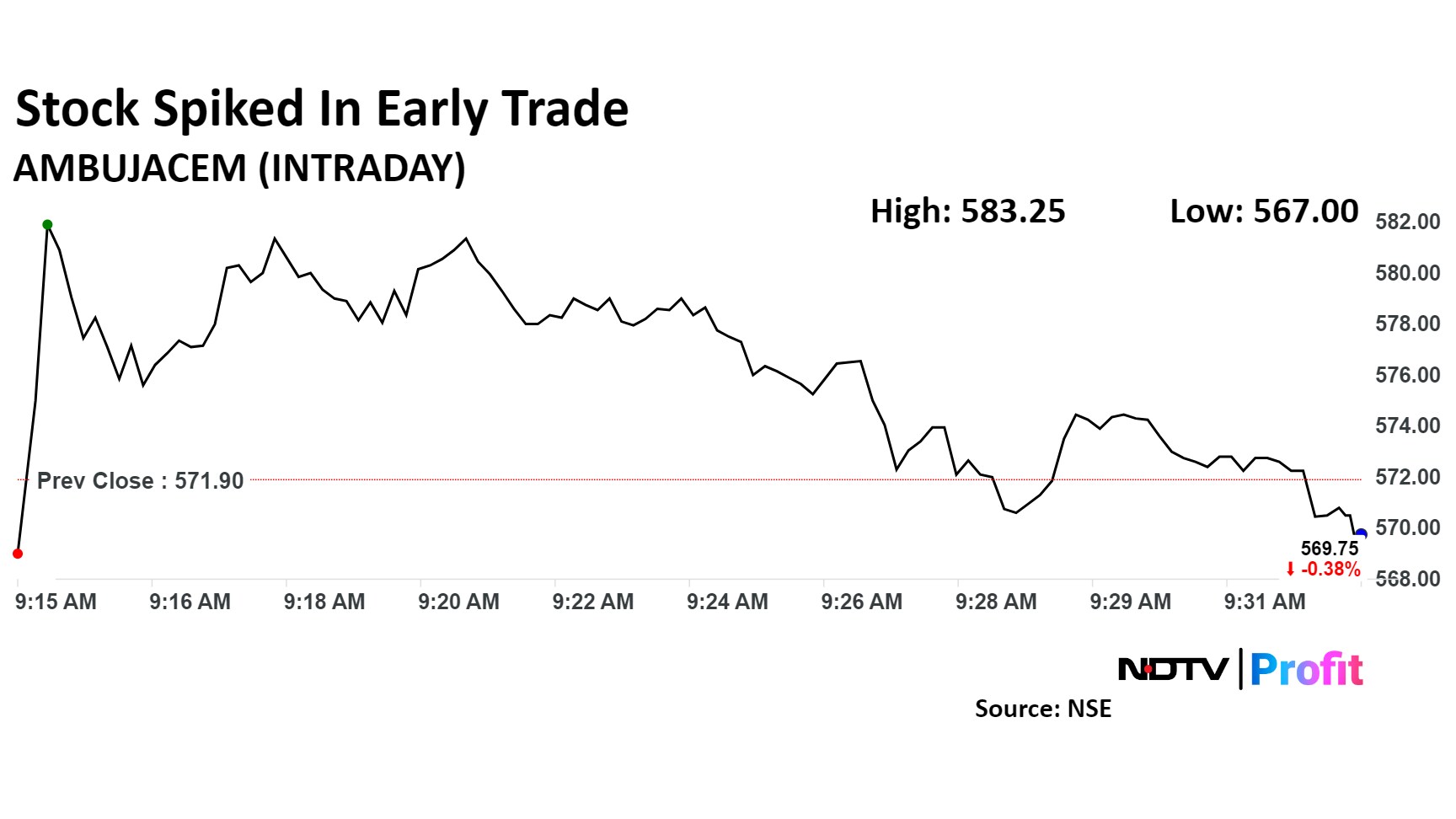

Ambuja Cements Stock Price Soars

The scrip rose as much as 1.98% to 583.25 apiece. It pared gains to trade 1.65% higher at Rs 581.35 apiece, as of 09:25 a.m. This compares to a 0.06% advance in the NSE Nifty 50 Index.

It has risen 39.76% in the last 12 months. Total traded volume so far in the day stood at 0.14 times its 30-day average. The relative strength index was at 35.

Out of 41 analysts tracking the company, 22 maintain a 'buy' rating, 11 recommend a 'hold,' and 8 suggest 'sell,' according to Bloomberg data.

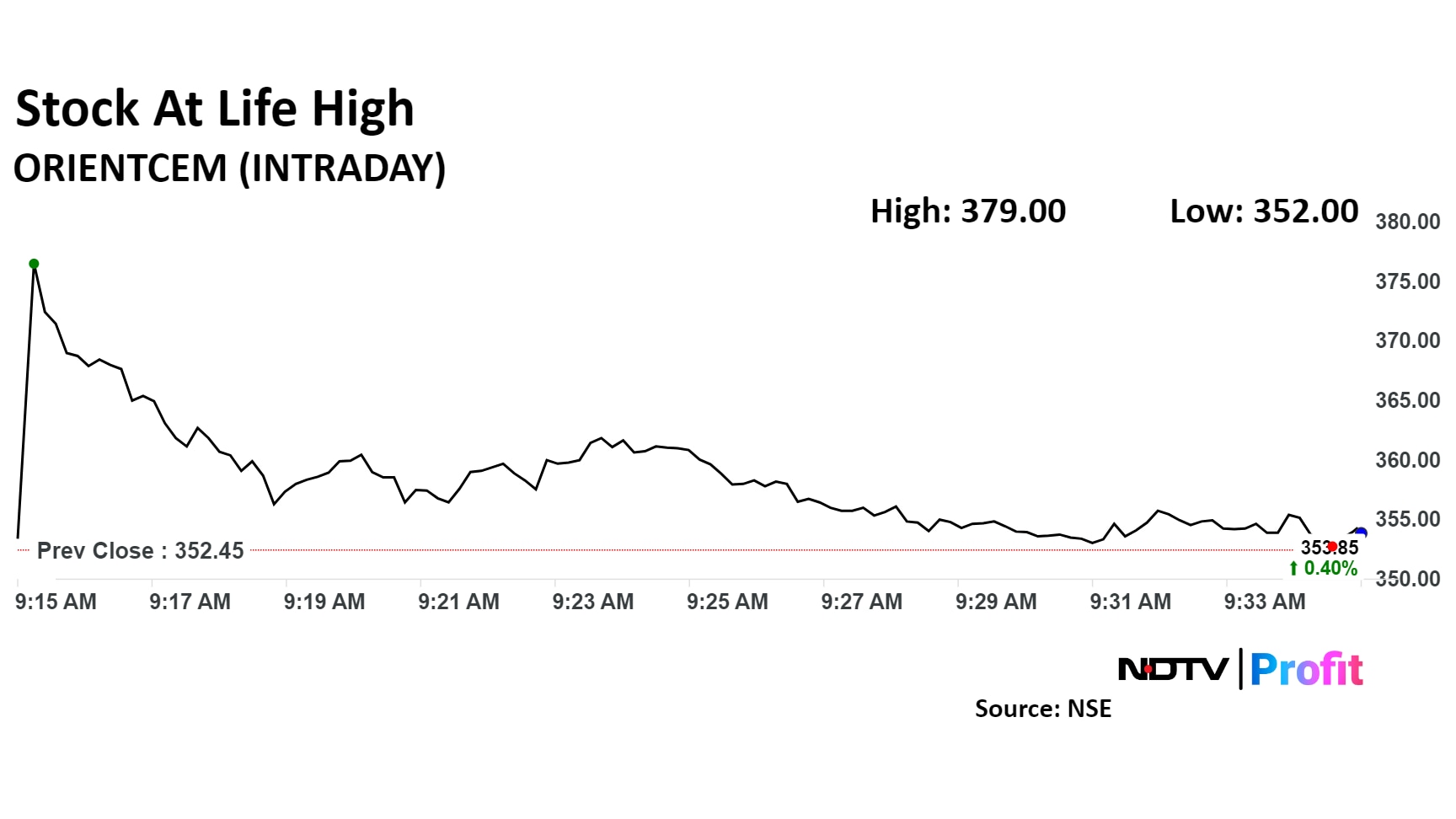

Orient Cement Stock Price Also Up

The scrip rose as much as 7.53% to 379 apiece. It pared gains to trade 1.28% higher at Rs 356.95 apiece, as of 09:28 a.m. This compares to a 0.06 advance in the NSE Nifty 50 Index.

It has risen 84.14% in the last 12 months. Total traded volume so far in the day stood at 3.7 times its 30-day average. The relative strength index was at 68.

Out of 10 analysts tracking the company, one maintains a 'buy' rating, four recommend a 'hold,' and five suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 25.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.