(Bloomberg) -- The rally in Indian stocks that saw benchmark indexes climb to records this month may be poised for a pullback if derivatives positioning is any guide.

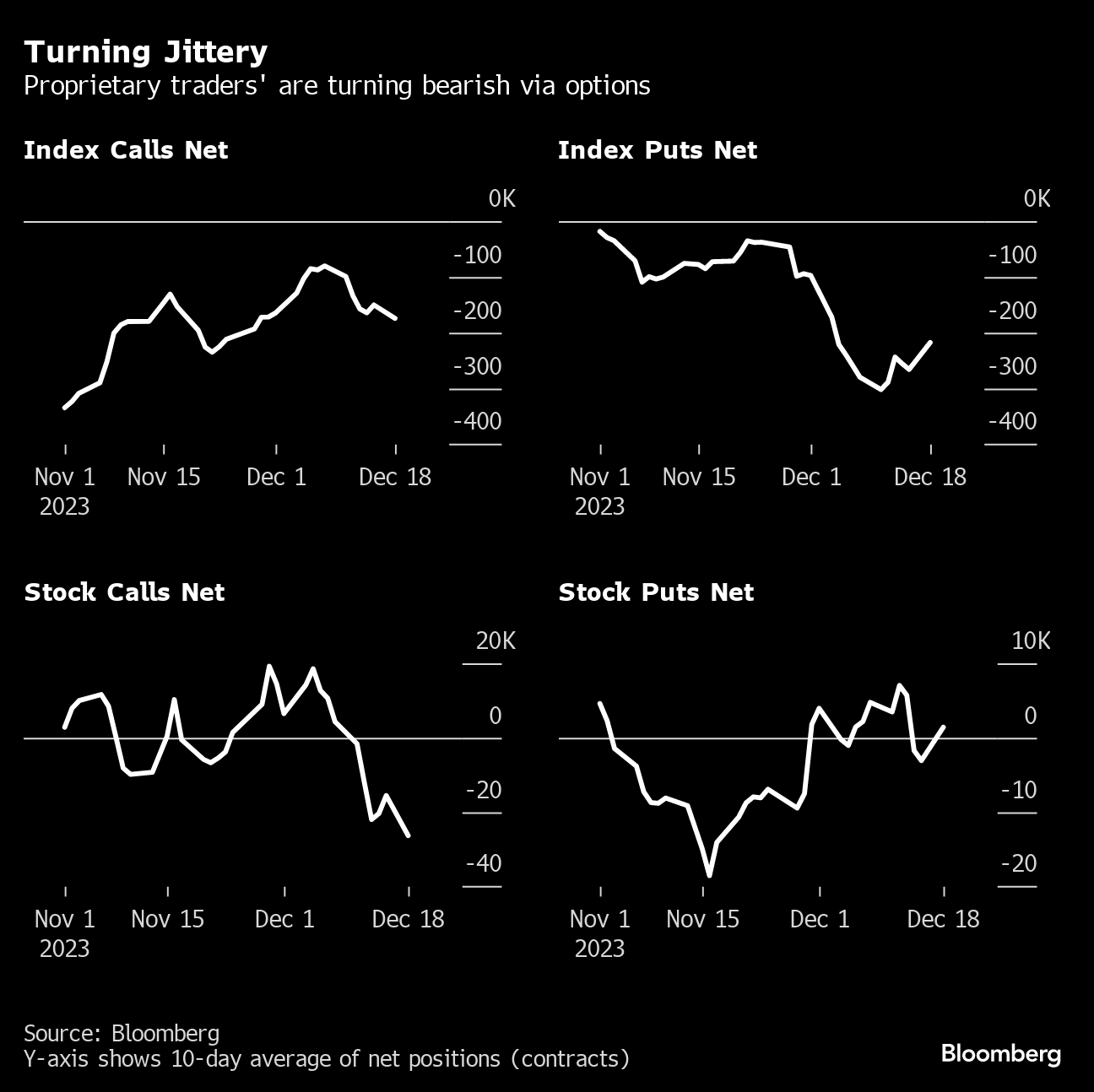

Proprietary traders have boosted net short positions in index calls, while trimming their net shorts in index-based puts, according to data compiled by Bloomberg. At the same time, their stock options activity — increasing net shorts in calls and rising net longs in puts — also indicates increasing caution.

Prop traders — who take on market exposure for themselves rather than their clients — account for the largest single share of the total derivatives volume in India, so monitoring their positioning comes with extra significance.

India's benchmark S&P BSE SENSEX Index slid 1.3% on Wednesday, the biggest one-day drop since October, after hitting a series of record highs earlier this month, The gauge has still gained 16% this year, while the MSCI AC Asia Pacific Index has risen just 5.6%.

“Prop traders tend to be much better informed in terms of developing trends given their scale of operations,” said Alok Agarwal, head quant and portfolio manager at Alchemy Capital Management. If they are no longer as confident selling puts after having participated in the bulk of the post-October advance, then it surely warrants attention, he said.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.