Emkay Global Research hiked One 97 Communications Ltd. or Paytm's target price and upgraded the stock rating as cost optimisation drive is likely to help the company turn operating profit positive. Further, the brokerage said, expected ease in regulatory stance will pave the way for Paytm to get authorities' approval.

Emkay Global Research upgraded the One 97 Communications Ltd.'s stock rating to 'Add' from 'Reduce'. It has also hiked the target price to Rs 750 apiece from Rs 350 apiece. The current target price implies 15.36% upside from Monday's close of Rs 650.15 per share.

Paytm has protected its merchant base and transitioned user base to partnered merchant banks, which Emkay Research believes will help get the approval from National Payment Corp of India, it said in a note on Tuesday.

The recent approval from Foreign Investment Promotion board is expected to get long-pending Payment Aggregator license from the Reserve Bank of India, Emkay Global Research said. This will help the company protect the merchant business.

The merchant lending business is doing well, and is likely to be a growth driver till Paytm introduces new product, Emkay Global Research said.

One 97 Communications has taken a long cost optimisation drive via voluntary or involuntary attrition. It has also limited marketing expenses now that a bulk of payment business is shifting to UPI, Emkay Global Research said.

Paytm is expecting to save Rs 400-500 crore from employee expenses, coupled with relatively lower loan distribution business, Emkay Global Research said.

Emkay Global Research upgraded the stock based on discounted cash flow, implying 3.6 times and 3 times for financial year 2025-26 and FY27 operating revenue, it said in a note.

"This (hope of regulatory approval), coupled with its cost optimization measures, should put Paytm on the early path to profitability," Emkay Global Research said.

At present, Paytm shares trade at a premium to profitable global payment platform providers like Paypal and Paysafe on the back of India's growth premium and differentiated loan distribution business, the brokerage said,

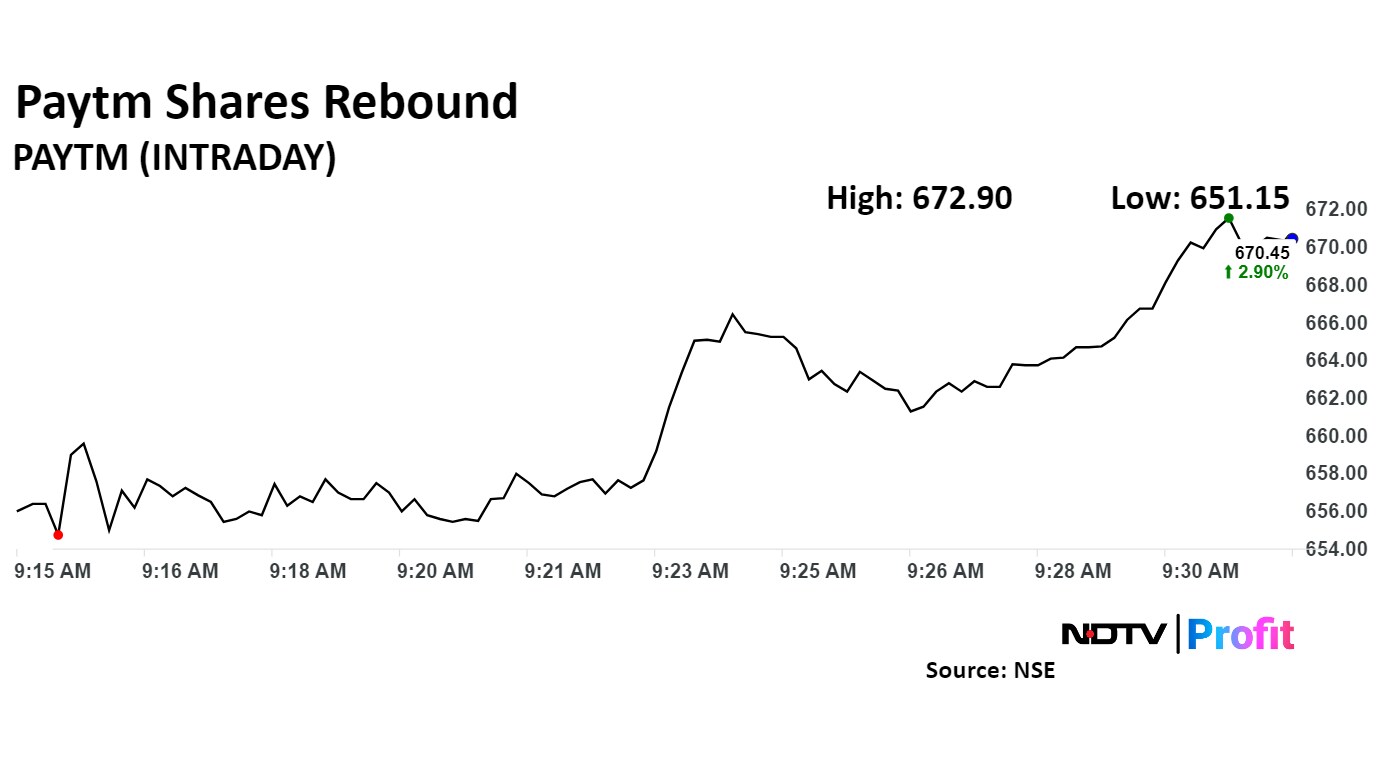

Paytm share price rose as much as 2.35% to Rs 666.85 apiece. It was trading 1.67% higher at Rs 662.40 apiece as of 09:26 a.m., as compared to 0.07% decline in the NSE Nifty 50 index.

The stock declined 21.93% in 12 months, and 4.22% on year-to-date basis. The relative strength index was at 62.1.

Out of 18 analysts tracking the company, six maintain a 'buy' rating, six recommend a 'hold,' and six suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an downside of 40.7%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.