Competitive prices against petrol-burning scooters in near future and a possible success in its battery venture make Ola Electric Mobility Ltd. "worth investing in", said HSBC Global Research, initiating coverage on the Bhavish Agarwal-led EV maker.

HSBC has assigned a 'buy' rating to Ola Electric with a target price of Rs 140, marking an upside potential of 26.2%. The Ola-S1 maker is the market leader in electric scooters despite slower EV adoption and potential battery plant challenges, the brokerage noted.

EV production costs currently exceed Rs 1.1 lakh, around 2.5 times that of a scooter with internal combustion engine. Regulatory support is expected dwindle to Rs 10,000 over the next two to three years. Following this manufacturing costs have to come down to Rs 70,000 to keep EVs viable for buyers.

HSBC anticipates that improved costs of ownership and increased consumer awareness will drive further growth. The report highlighted a growing acceptance of EVs, particularly in Karnataka, Maharashtra, Tamil Nadu and Gujarat. These states account for a substantial portion of both overall two-wheeler and electric two-wheeler sales, indicating an upward trend in EV adoption.

Ola Electric is aiming to build an in-house battery manufacturing plant in Tamil Nadu, with a 20 GWh capacity by mid-2026, which is considered a critical factor. If successful, this venture could allow the company to produce batteries at a lower cost compared to imports, potentially reducing overall vehicle costs and bolstering profitability.

Despite the optimistic outlook, HSBC identifies several risks for Ola Electric. These include the possibility of electric two-wheelers' slower-than-expected adoption and market penetration. The company may face hurdles with its battery manufacturing unit, including challenges in expanding capacity and adapting to new technologies, the report said.

Additionally, the company faces intensifying competition from other manufacturers and new entrants in the electric vehicle sector. The volatility in battery prices and the potential removal of government incentives could further impact the affordability and profitability of EVs, posing additional risks to the company's growth trajectory.

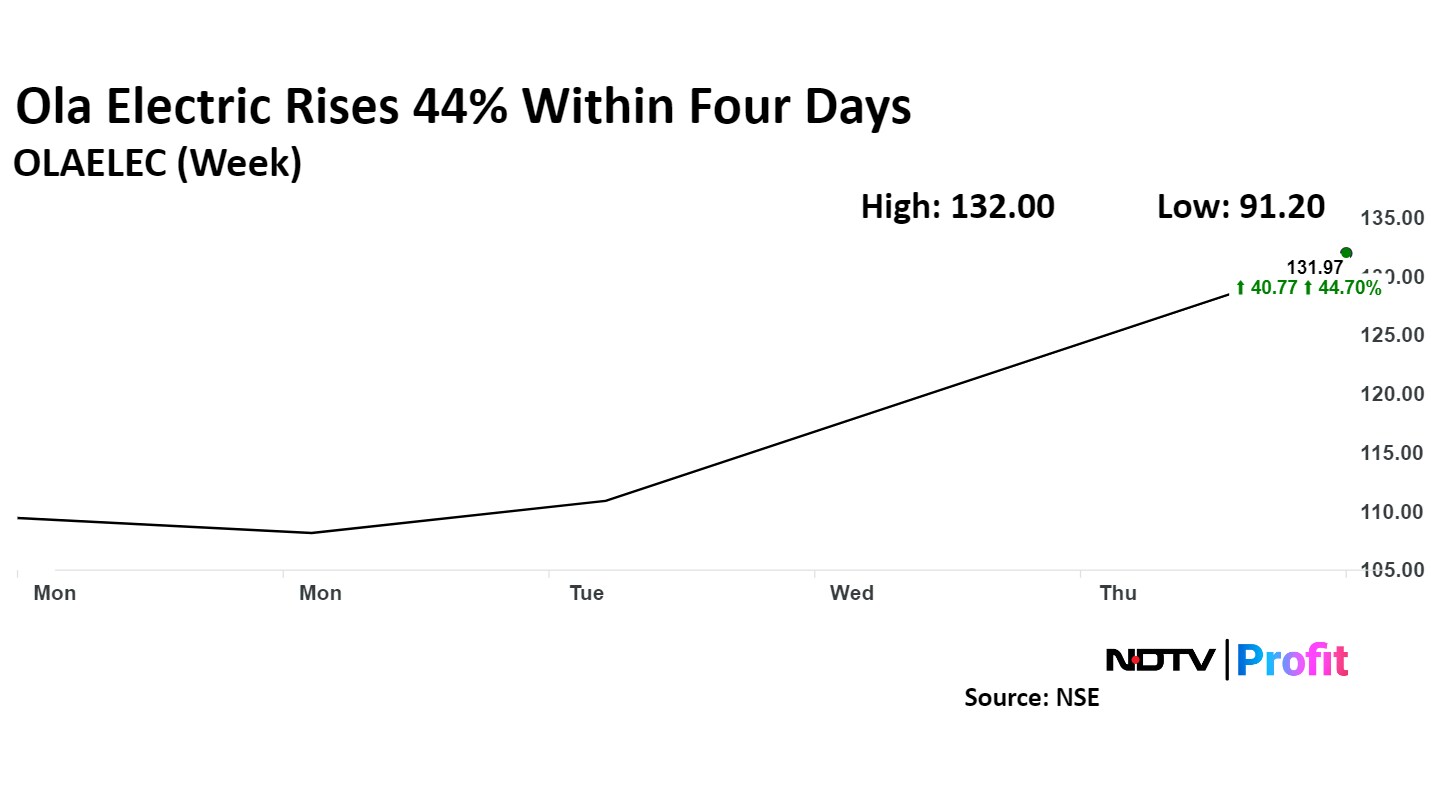

Shares of Ola Electric hit an upper circuit of 20% in trade today, rising to 133.08. It pared gains to trade 18.76% higher at Rs 131.71 apiece as of 12:28 p.m. This compares to a 1.11% advance in the NSE Nifty 50 Index.

The stock has risen more than 44% since listing. Total traded volume so far today was 0.96 times its 30-day average. The relative strength index was at 89.2.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.