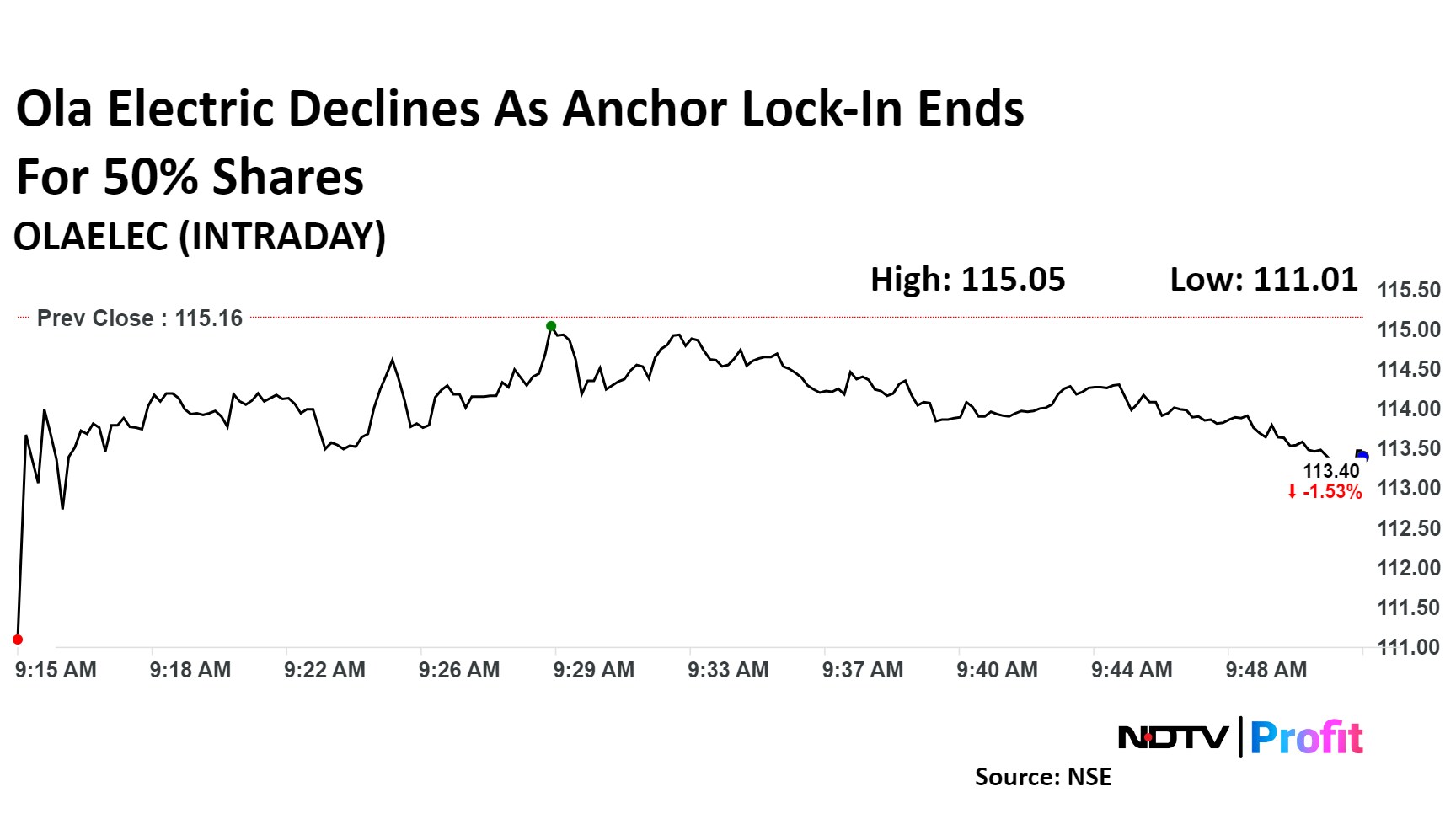

Shares of Ola Electric Mobility Ltd. declined more than 3% in early trade on Friday as the minimum lock-in period of 30 days for anchor book investors ends, freeing up around 18.17 crore shares for sale. This represents 4.1% equity.

Regulations stipulate that shares acquired by anchor investors are subject to a lock-in period of 30 days for 50% of the shares and 90 days for the remaining 50% from the grant date. This policy is designed to ensure stability in the IPO price.

The second tranche of anchor investor-owned shares will be open for sale after Nov. 4.

The anchor round was held on Aug. 1, while the IPO opened on Aug. 2. The board finalised the allocation of 36.35 crore equity shares to 84 anchor investors at the upper end of the price band of Rs 72–76 apiece, aggregating to Rs 2,763 crore.

Mutual funds—led by those managed by the State Bank of India, Nippon Life Asset Management Ltd. and HDFC Asset Management Co.—accounted for 40% of the anchor book.

Major foreign investors include Goldman Sachs, Fidelity Investments, American hedge fund Schonfeld, Societe Generale, Morgan Stanley and BNP Paribas.

Shares of Ola Electric Mobility fell as much as 3.6% to Rs 111 apiece. The scrip was trading 1.5% lower at Rs 113.4 as of 9:50 a.m. The relative strength index was at 64.

The Ola Electric stock has risen 26% since its debut on the bourses on Aug. 9.

The Bengaluru-based company specialises in electric scooters. It was founded in 2017 and apart from scooters, it also makes certain core components for electric vehicles, such as battery packs, motors, and vehicle frames at the Ola Future Factory.

Net loss of India's largest electric two-wheeler maker expanded to Rs 347 crore in the three months ended June 30, 2024, from loss of Rs 267 crore in the year-ago period. Revenue rose 32% year-on-year to Rs 1,644 crore.

While profitability may be some time away, Ola Electric claimed that its automotive business has inched closer to breakeven with an Ebitda margin of 1.97% for the quarter.

The company also claimed to have clocked highest ever quarterly revenue in April-June 2024, on the back of highest ever deliveries—1,25,198 units as against 70,575 units delivered in the same period last year.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.