(Bloomberg) -- A rally in megacaps spurred a rebound in stocks on speculation the artificial-intelligence boom will continue fueling market gains.

The Nasdaq 100 outperformed as Alphabet Inc. jumped 5% a day after Google released Gemini, the “largest and most capable AI model” the company has ever built. The S&P 500 halted a three-day drop, though gains were mild as traders refrained from committing to strong positions ahead of Friday's jobs report that will be key in shaping Federal Reserve bets.

The catalyst for more substantial rate cuts to bring policy into accommodative territory would be job losses — usually associated with a recession taking hold, according to Jeff Schulze at ClearBridge Investments. Historically, the S&P 500 has rallied 5.1% on average during the Fed's pause, suggesting there could be upside, he noted.

“Regardless of when the first cut occurs, the pause is typically a favorable period for equities,” Schulze said. “With no obvious risks on the horizon and third-quarter earnings season coming in solid, the Santa Claus rally could continue.”

Treasury yields rose on speculation that bets on rate cuts by major central banks have gone too far, with hawkish signals from the Bank of Japan rattling global bonds. The BOJ indication drove the Japanese yen up almost 2%, while sending yields higher around the globe.

“Japan looks like an outlier in tightening policy, with most other major central banks moving toward easing as economic growth slows,” said Solita Marcelli at UBS Global Wealth Management. “This backdrop supports our preference for high-quality bonds, though we do expect the pace of the recent rally to moderate.”

Signs of exhaustion have surfaced after the bond market saw one of its best months in decades. Interest-rate strategists at TD Securities recommended taking profits on long positions in 10-year Treasuries ahead of the November employment report — which puts yields “at risk of backing up sharply.”

“Both valuation and positioning would argue for exhaustion in the recent bond rally,” said Mohit Kumar at Jefferies International. “Given our view of only a mild recession and inflation still remaining sticky, we would argue that the market has run a bit ahead of itself.”

In a week jam-packed with labor-market readings, data showed continuing applications for US jobless benefits fell by the most since July in a holiday week after climbing for the past two months. Despite the decline, continuing claims are still near a two-year high amid growing evidence of a cooling labor market.

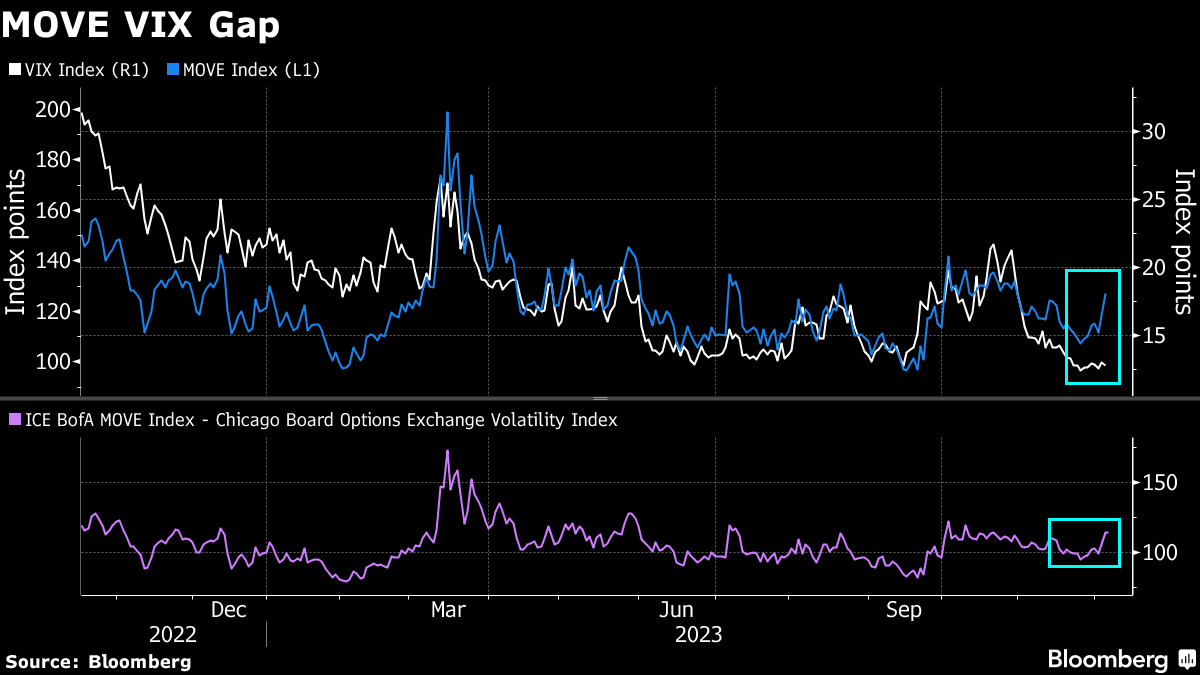

Easing rate expectations played a big part in November's stocks rally, yet a reading of cross-asset volatility shows risks aren't as muted as they may appear. The gap between the MOVE Index, which tracks interest-rate volatility, and the VIX gauge of stock price swings has once again widened, suggesting rate markets remain choppy and could spark stress for equities at any time.

US stocks are already reflecting an optimistic outlook on economic growth, leaving them “vulnerable” to any macro shocks, according to Goldman Sachs strategists including Ryan Hammond and David Kostin.

“We believe much of the optimistic scenario is already reflected in US equity prices today,” they wrote.

Bank of America Corp.'s quant strategists say that after the big tech-fueled rally in 2023, the S&P 500 has the potential to rise next year — even without their support. Concerns about narrow market breadth are “misplaced” as bull markets in the past four decades — outside of the dotcom bubble — have always ended with far better breadth, they noted.

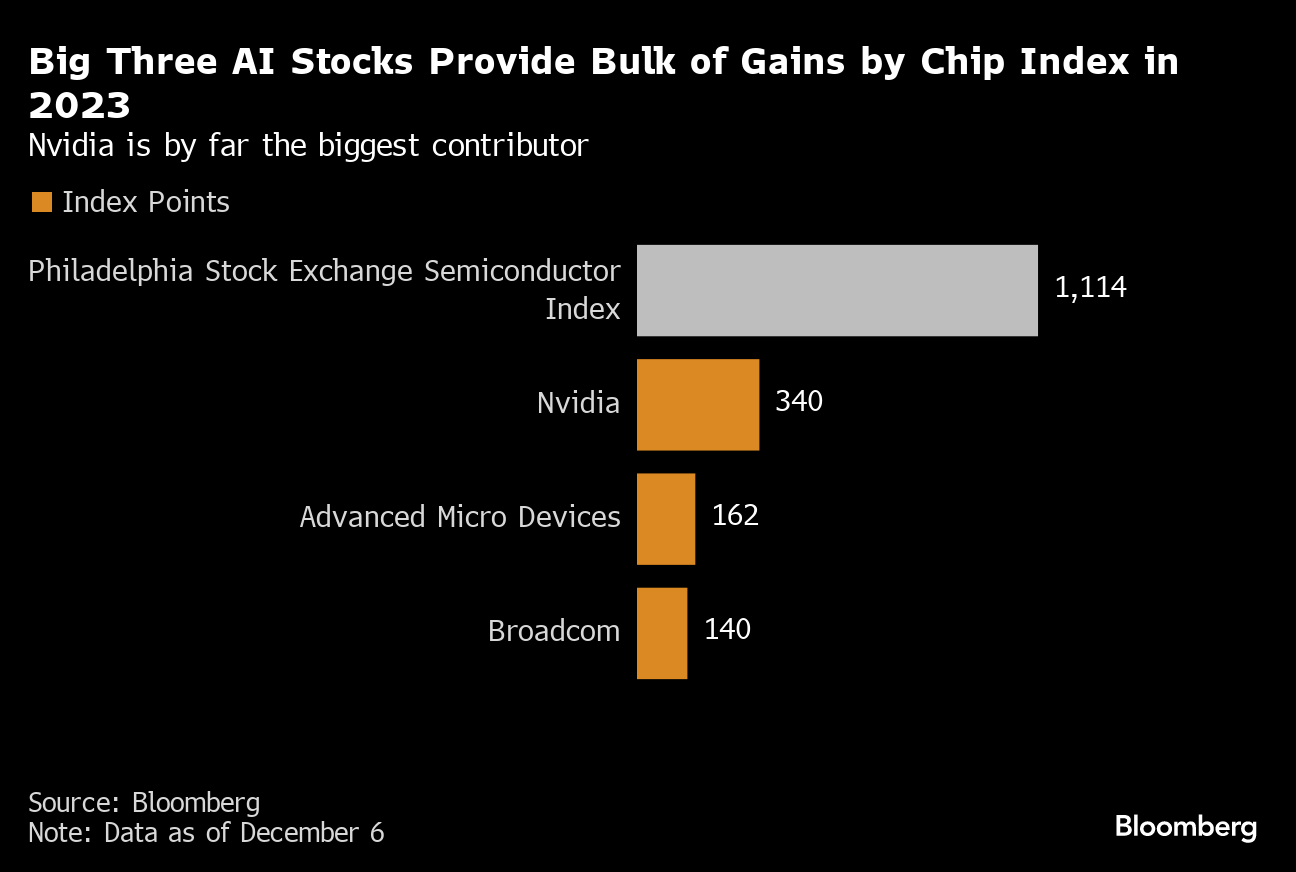

“Unlike this year during which the ‘Magnificent 7' did 70% of the work, we expect broader leadership,” said Savita Subramanian, referring to contributions from the likes of Apple, Nvidia and Microsoft to the rally.

Corporate Highlights:

- JetBlue Airways Corp. boosted its full-year financial outlook, citing better-than-expected bookings and operational performance this fall. Its shares jumped by double digits in early trading.

- Dollar General Corp. reported comparable sales that were better than the average analyst estimate, a sign that Chief Executive Officer Todd Vasos is having some early success in improving results after taking the helm for a second time in October.

- GameStop Corp., the video-game retailer, reported sales that fell short of analysts estimates.

- Elon Musk's SpaceX has initiated discussions about selling insider shares at a price that values the closely held company at $175 billion or more, according to people familiar with the matter.

Key events this week:

- Germany CPI, Friday

- Japan household spending, GDP, Friday

- Reserve Bank of Australia's head of financial stability Andrea Brischetto speaks at Sydney Banking and Financial Stability conference, Friday

- US jobs report, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.4% as of 10:10 a.m. New York time

- The Nasdaq 100 rose 0.7%

- The Dow Jones Industrial Average was little changed

- The Stoxx Europe 600 fell 0.5%

- The MSCI World index was little changed

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro was little changed at $1.0769

- The British pound was little changed at $1.2555

- The Japanese yen rose 1.8% to 144.70 per dollar

Cryptocurrencies

- Bitcoin fell 0.6% to $43,554.21

- Ether rose 1.2% to $2,275.05

Bonds

- The yield on 10-year Treasuries advanced five basis points to 4.16%

- Germany's 10-year yield was little changed at 2.20%

- Britain's 10-year yield advanced five basis points to 4.00%

Commodities

- West Texas Intermediate crude rose 1.1% to $70.17 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Jan-Patrick Barnert, Michael Msika, Ian King and Subrat Patnaik.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.