Shares of NTPC Ltd. surged more than 4% to hit an all-time high after NTPC Green Energy Ltd., an arm of the state-run company, filed the draft red herring prospectus for an initial public offering to raise Rs 10,000 crore on Wednesday.

The IPO comes at a time when India aims to boost its renewable energy sector, targeting an increase in capacity to 500 GW by 2030 from the current 200 GW.

The offer is likely to attract significant investor interest, as green energy continues to be a priority, according to Kranthi Bathini, director of equity strategy at WealthMills Securities. NTPC is seeking to diversify its earnings by exploring new energy avenues, he said.

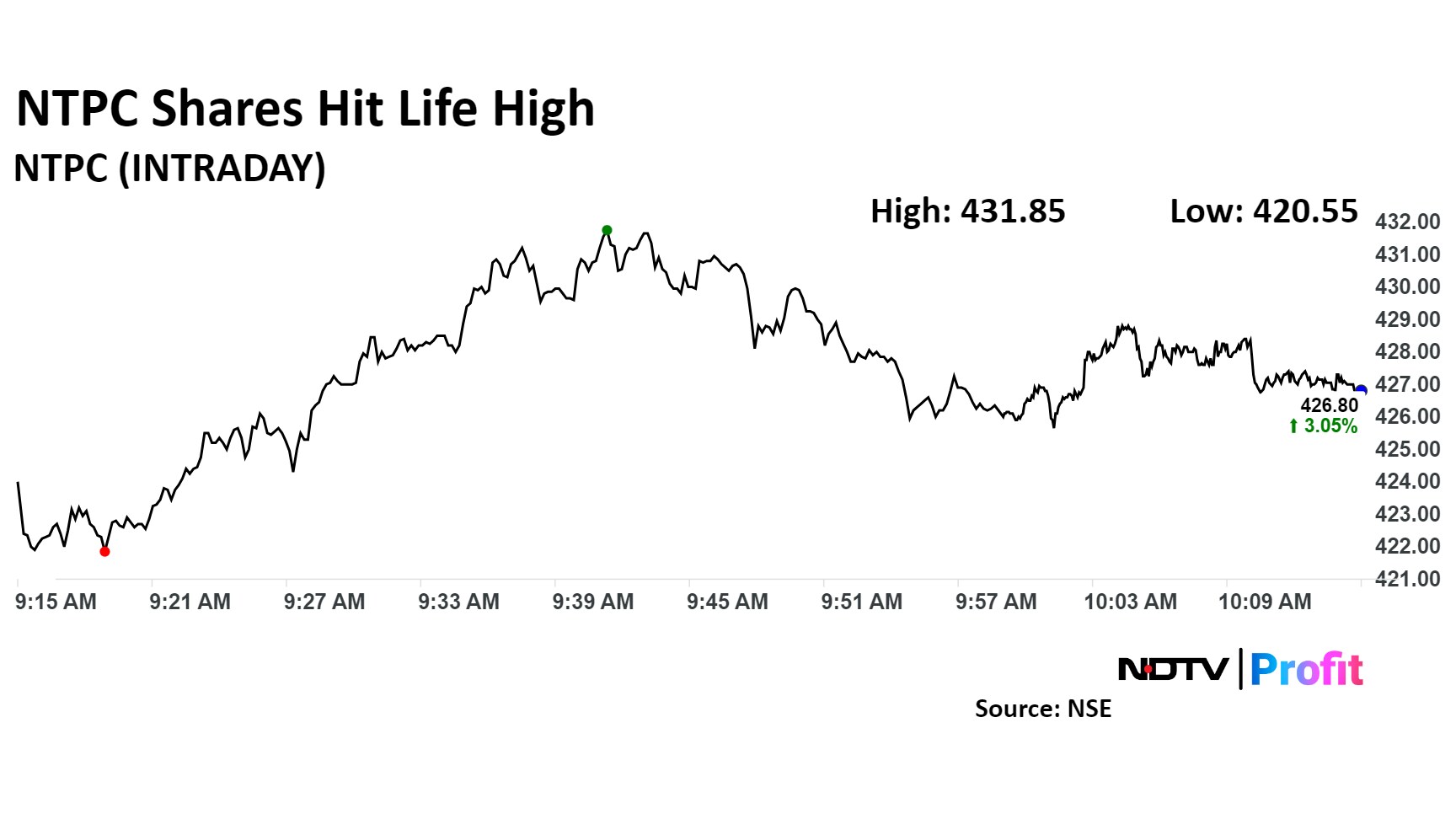

Shares of the company rose as much as 4.27%, the highest level since listing, before paring gains to trade 3.04% higher at Rs 426.75 apiece, as of 10:12 a.m. This compares to a 0.58 advance in the NSE Nifty 50.

The stock has risen 37.28% year-to-date. Total traded volume so far in the day stood at two times its 30-day average. The relative strength index was at 63.97.

Out of 23 analysts tracking the company, 19 maintain a 'buy' rating, one recommends a 'hold' and three suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 0.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.