NTPC Ltd. share price surged to a fresh record high on Monday after top brokerages maintained their bullish outlook, as its green arm—due to hit the exchanges soon via an IPO—is likely to add more value to the company.

Jefferies maintained a 'buy' on the state-owned power generation company with a target price of Rs 485 per share, implying an upside of 12% from the previous close. NTPC Green Ltd.'s initial public offering could potentially add 5-11% upside for NTPC, the brokerage said.

The IPO-bound company's capacity can grow 4.6 times by fiscal 2027–28, and it is yet to make a meaningful foray into energy storage, it said.

Morgan Stanley maintained 'overweight' on the company with a target price of Rs 496 per share, implying an upside of 14%. In a bull case scenario, the brokerage values NTPC's renewable energy portfolio at Rs 1.3 lakh crore.

Faster capacity addition, stronger power demand, and value unlocking in subsidiaries could be upside risks for the company, the brokerage said.

State-run NTPC's green energy arm, NTPC Green Energy Ltd., filed its initial public offering draft papers to raise Rs 10,000 crore. As per NDTV Profit's calculations, this subsidiary could have a market capitalisation of around Rs 75,000 crore.

The IPO will comprise an entirely fresh issue with no offer-for-sale component. The company will use proceeds of the offering for repayment of debt and general corporate purposes.

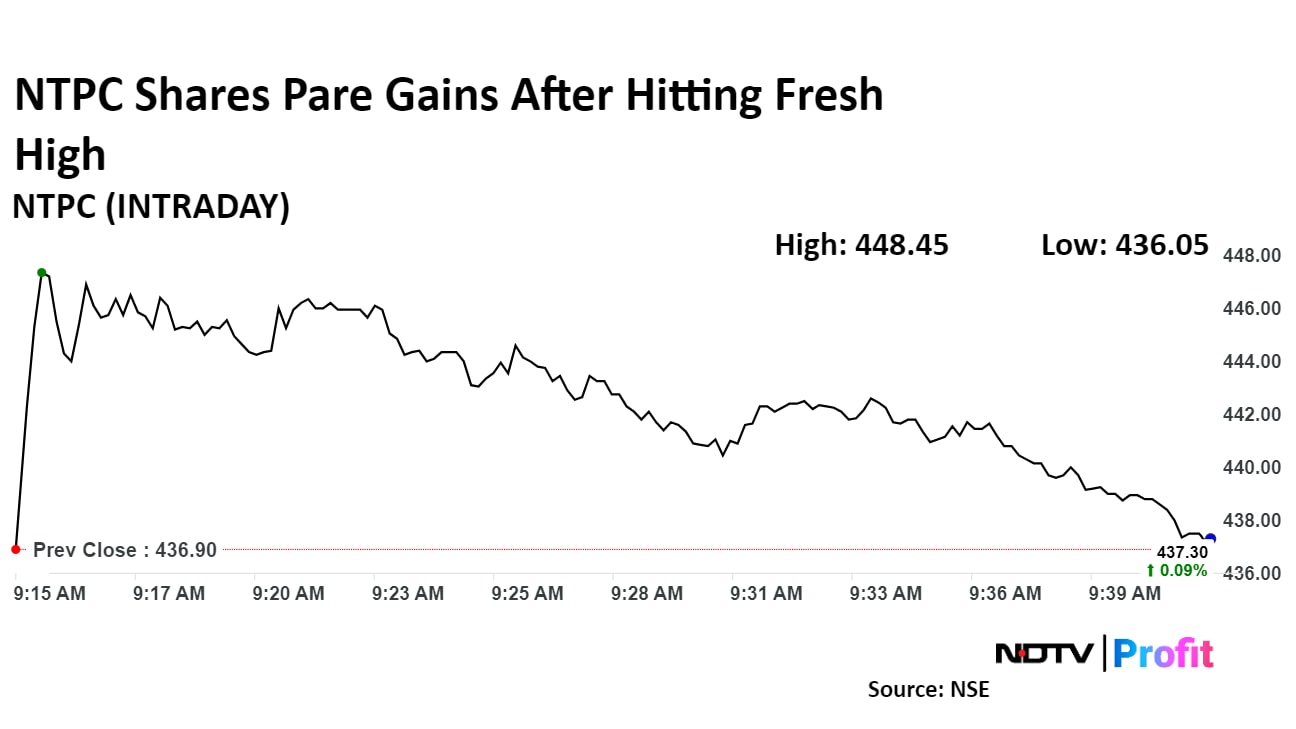

Shares of NTPC rose as much as 2.6% to hit fresh lifetime high of Rs 448.4 apiece on the NSE. It was trading 0.09% higher at Rs 437.3 apiece, compared to a 0.6% decline in the benchmark Nifty 50 as of 9:43 a.m.

The stock has risen 81% during the last 12 months and has advanced by 40% on a year-to-date basis. The total traded volume so far in the day stood at 2.3 times its 30-day average. The relative strength index was at 68.

Nineteen out of the 24 analysts tracking the company have a 'buy' rating on the stock, two suggest a 'hold', and three recommend a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.