Missed the chance to capitalise on Bajaj Housing Finance Ltd.'s initial public offering? One share of NTPC Ltd. worth Rs 428 could widen your chances to gain from what could potentially be the biggest offer of the year.

State-run NTPC's green energy arm, NTPC Green Energy Ltd., filed its initial public offering draft papers to raise Rs 10,000 crore. As per NDTV Profit's calculations, this subsidiary could have a market capitalisation of around Rs 75,000 crore.

The IPO will comprise an entirely fresh issue with no offer-for-sale component. The company will use proceeds of the offering for repayment of debt and general corporate purposes.

Retail investors could at most bid up to Rs 2 lakh in the maiden offering. However, a shareholder of its parent NTPC would be able to bid under the shareholders' reservation portion of Rs 2 lakh, upping the maximum limit to Rs 4 lakh crore.

An employee of NTPC Green Energy holding a share of its parent stands to gain further. They would be able to bid under the shareholders' reservation portion, eligible employee portion and in the retail portion taking the sum to Rs 6 lakh crore.

However, individuals must be shareholder in the books of NTPC before its arm files its red hearing prospectus to the market regulator.

The Rs 10,000-crore issue is being launched at a time when India is looking to ramp up its renewable energy sector. The government has set a target to increase renewables capacity to 500 GW by 2030, from around 200 GW at present.

In April-June quarter, NTPC Green's net profit was Rs 138.6 crore on total revenue from operations of Rs 578.4 crore. In fiscal 2024, net profit was Rs 344.7 crore on revenue from operations of Rs 1,962.6 crore.

NTPC Greens' renewable energy capacity, including NTPC and NTPC Renewable Energy, stands at 3.34 GW of solar and 0.21 GW of wind. While 8.13 GW is under construction, the company has a pipeline of 10.57 GW of renewable capacity.

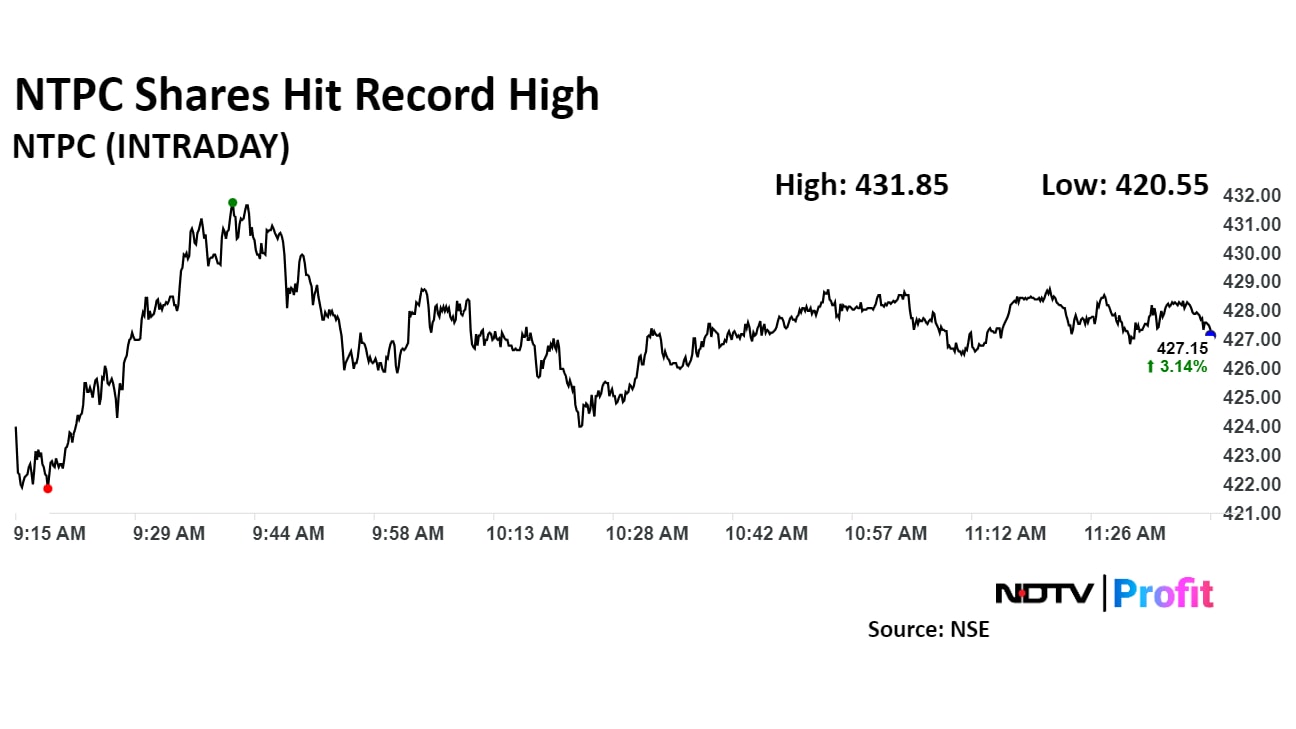

Shares of NTPC rose as much as 4.27%, the highest level since listing, before paring gains to trade 3.2% higher at Rs 427.6 apiece, as of 11:40 a.m. This compares to a 0.13 advance in the NSE Nifty 50.

The stock has risen 37.28% year-to-date. Total traded volume so far in the day stood at two times its 30-day average. The relative strength index was at 63.97.

Out of 23 analysts tracking the company, 19 maintain a 'buy' rating, one recommends a 'hold' and three suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 0.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.