The National Stock Exchange Ltd. and BSE Ltd. on Friday announced a revision of their transaction fees for cash, equity futures and options as well as currency derivatives, following a directive from the Securities and Exchange Board of India. These changes will take effect from Oct. 1.

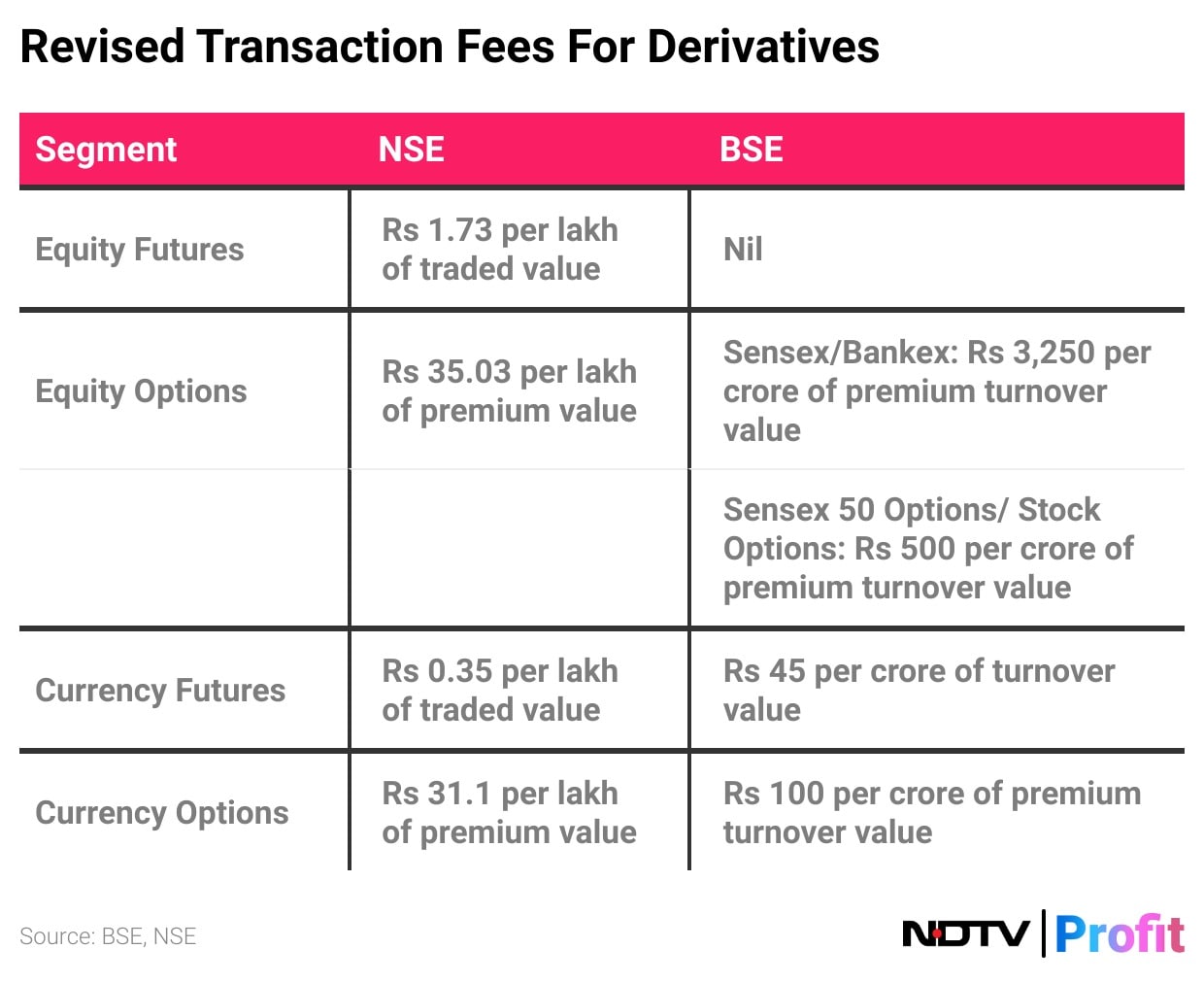

For the cash market, the transaction fee will be Rs 2.97 per lakh of traded value. In the equity derivatives segment, futures will carry a transaction fee of Rs 1.73 per lakh of traded value, and options will incur a fee of Rs 35.03 per lakh of premium value, according to the NSE, which is preparing for an IPO.

In the currency derivatives segment, NSE has set the transaction fee for futures at Rs 0.35 per lakh of traded value, while options and interest rate options will carry a fee of Rs 31.1 per lakh of premium value.

The BSE has also revised its transaction fees. In the currency derivatives segment, futures contracts, including cross-currency futures, will be charged Rs 45 per crore of turnover value.

The fee for options, including cross-currency options, will remain at Rs 100 per crore of premium turnover value. For the equity derivatives segment, the revised fees apply to Sensex and Bankex options contracts.

NSE Supportive Of SEBI

The revision in derivatives transaction fees are a part of SEBI's actions on reforming India's capital markets, NSE Managing Director and Chief Executive Officer Chief Ashish Chauhan told NDTV Profit.

He said the market regulator is trying to ensure that small investors invest more, and don't go into speculative instruments of like derivatives.

"Overall impact of SEBI directives remain to be seen. NSE is fully supportive of all actions SEBI wants to take. Exchanges are there for helping capital formation and not for small investors to indulge in speculation," he said.

These revisions in transaction fees followed SEBI's mandate issued in July, which requires stock exchanges to adopt a uniform flat fee structure for all members of market infrastructure institutions.

The directive aims to replace the varied slab-wise fees based on volume or activity that are currently charged by different stock exchanges. This change will remove any advantages based on size or activity level among members and ensure transparency for end clients.

Earlier this week, the Multi Commodity Exchange of India Ltd. also revised its transaction fees for futures and options contracts, effective from 1st October. MCX has set the transaction fee for futures contracts at Rs 2.1 per lakh of turnover value, while the fee for options contracts has been revised to Rs 41.8 per lakh of premium turnover value.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.