The NSE Nifty 50's immediate support level stands at 24,000, with further support near 23,800, while the key resistance is positioned around 24,430, followed by a stronger resistance at 24,540, according to analysts.

Technically, on a daily basis, the index formed a doji-like candle, indicating uncertainty, according to Hrishikesh Yedve, assistant vice president of technical and derivatives research at Asit C Mehta Investment Intermediates Ltd.

On the higher side, the 100-day exponential-moving-average hurdle is placed near 24,430, followed by 24,540, which was last week's high. On the downside, the 150-DEMA stands near 24,990, acting as short-term support for the index, followed by 23,800, where the recent swing support is placed, Yedve said.

"In the immediate term, we expect the index will consolidate in the range of 23,800 to 24,500," Yedve said. "A decisive breakout on either side will determine the next direction of the index. Until then, traders should aim to buy near support and sell near resistance."

The current market texture is volatile and non-directional. Hence, level-based trading will be the ideal strategy for traders, according to Shrikant Chouhan, head of equity research at Kotak Securities. "Now, 24,000/79,000 would act as a crucial support zone for day traders. Above 24,000/79,000, the market could retest the level of 24,300–24,400/79,700–80,000."

On the flip side, if the index dips below 24,000/79,000, selling pressure can accelerate, potentially leading to levels around 23,900–23,850/78,700–78,500, Chouhan said.

The Bank Nifty displayed resilience. After opening flat and experiencing initial turbulence, the index gained positive momentum, closing at 51,876.75.

"Technically, the index on a daily scale found support near 100-DEMA and formed a green candle, indicating strength. However, the index has been consolidating in the range of 50,500 to 52,580 over the last few weeks. If it sustains above 52,580, a fresh up-move could be possible; otherwise, the index will likely continue consolidating," Yedve said.

FII/DII Activity

Overseas investors remained net sellers of Indian equities for the 31st consecutive session on Monday, while domestic institutional investors stayed net buyers.

Foreign portfolio investors sold stocks worth Rs 2,306.88 crore, and DIIs mopped up stocks worth approximately Rs 2,026.63 crore, according to provisional data from the National Stock Exchange.

F&O Cues

Nifty November futures are down by 0.35% to 24,226 at a premium of 85 points, with the open interest down by 0.35%.

Nifty Bank November futures were up by 0.52% to 52,082 at a premium of 206 points, while its open interest was down 2.3%.

The open interest distribution for the Nifty 50 Nov. 14 expiry series indicated most activity at 26,900 and maximum put open interest at 22,250.

For the Bank Nifty options expiry on Nov. 13, the maximum call open interest was at 53,000 and the maximum put open interest was at 49,000.

Market Recap

The NSE Nifty 50 and the BSE Sensex ended the choppy session little changed on Monday. Asian Paints Ltd. and Reliance Industries Ltd. share prices dragged the indices, while HDFC Bank Ltd. and ICICI Bank Ltd. supported the benchmarks.

The Nifty 50 ended 6.90 points, or 0.03%, lower at 24,141.30, and the Sensex ended 9.83 points, or 0.01%, higher at 79,496.15. During the session, the Nifty 50 rose as much as 0.78% to 24,336.80, and the Sensex rose 0.77% to 79,001.34.

Stocks In The News

Ashapuri Gold Ornament: The company entered into a pact with Titan for supply of gold jewellery.

L&T Technology: The company signed a definitive pact to acquire Silicon Valley-based Intelliswift for $110 million.

Welspun Corp.: The company's arm, Welspun Mauritius Holdings, divested a 5% stake in Saudi Arabia-based East Pipes Integrated for $58 million.

RVNL: The company emerged as the lowest bidder from South Central Railway for an EPC contract worth Rs 295 crore.

Orient Technology: The company appointed Shrihari Bhat as CEO effective January 1, 2025.

Indiamart Intermesh: The company arm Tradezeal Online entered a pact to disinvest a 26% stake in Shipway Technology.

Indian Oil: The company reported fire in a benzene storage tank (1000 KL capacity) at Gujarat Refinery. The cause of the fire is yet to be ascertained.

Windsor Machines: The company acquired Global CNC for Rs 343 crore.

Global Cues

Stocks in the Asia-Pacific region opened mixed on Tuesday as disappointing stimulus in China overshadowed Wall Street's yet another record closing driven by 'Trump Stocks'. Bitcoin surged past the $89,000 mark.

Equity benchmarks in South Korea and Australia declined while that of Japan rose in early trade. The Nikkei was 225 points, or 0.55%, higher at 39,754, while the Kospi was down 5 points, or 0.2%, at 2,526 as of 5:35 a.m.

Stocks in China will continue to be in focus after the latest data pointed out that the credit expansion slowed more than forecasted in October. Investors were underwhelmed and expended further stimulus aside of the 10 trillion yuan ($1.4 trillion) in a debt swap program to improve the finances of local governments.

The consumer inflation print in India along with its industrial output print and South Korean unemployment figures will provide further cues to Asian stocks on Tuesday.

Elsewhere, the US stocks continued to gain as investors positioned themselves to stocks that would benefit from President-elect Donald Trump's economic plans.

The S&P 500 and the tech-heavy Nasdaq Composite advanced 0.10% and 0.06%, respectively, while the Dow Jones Industrial Average rose 0.69%.

Key Levels

US Dollar Index at 105.54

US 10-year bond yield at 4.33%.

Brent crude down 2.76% at $71.83 per barrel.

Bitcoin was down 0.12% at $87,907.94

Gold spot was up 0.19% at $2,623.87

Money Market

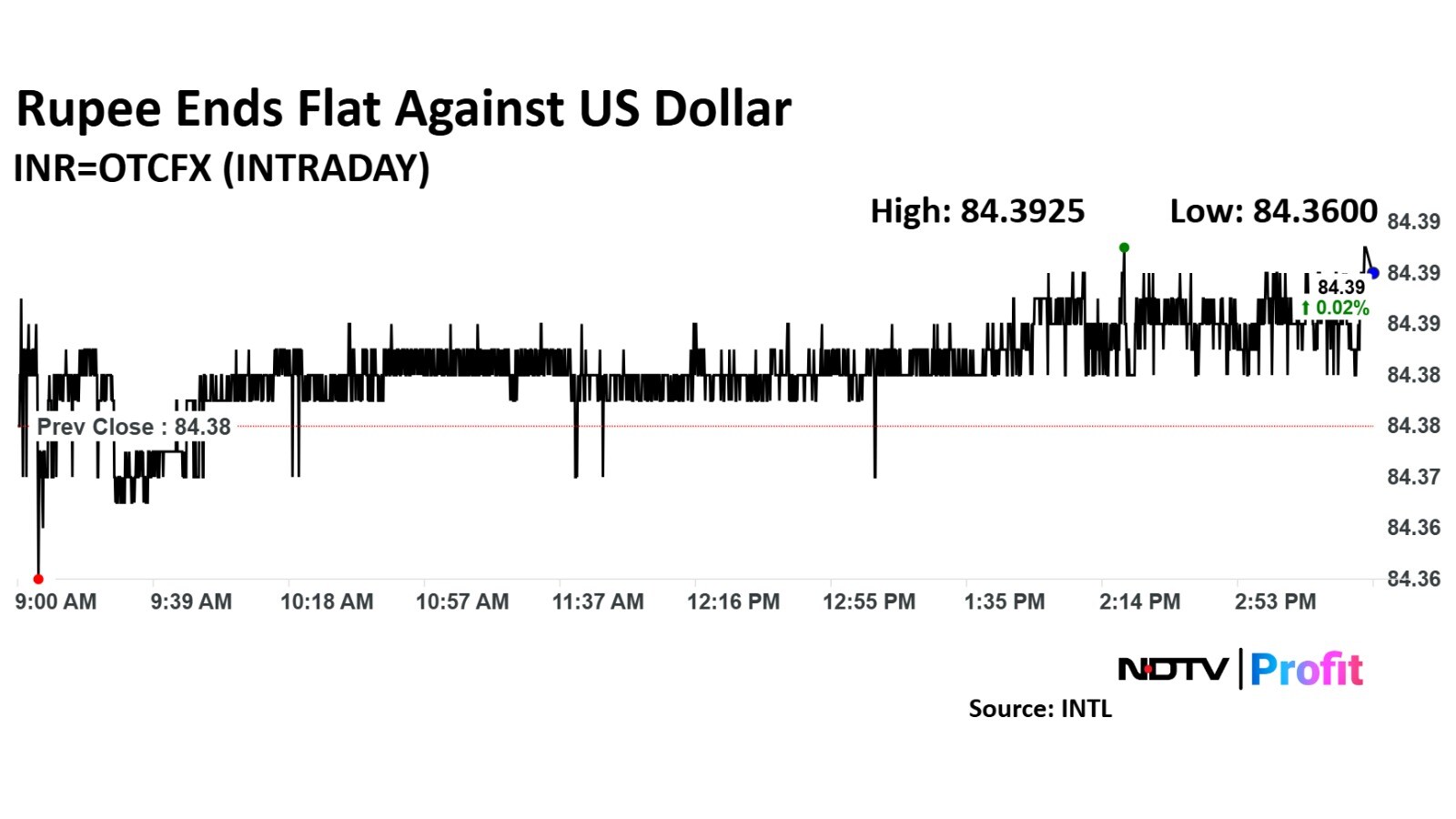

The Indian rupee closed flat against the US dollar on Monday. The domestic currency closed at Rs 84.388 against the greenback after it had opened at a new record low on Monday. It had closed at 84.375 on Friday, according to Bloomberg data.

Brent crude prices slipped to $73.61 per barrel as the threat of supply disruption from a storm in the Gulf of Mexico subsided.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.