The truncated trading week in India will result in the headline Nifty 50 being rangebound in a consolidated set-up, while the mid and small caps will witness bullish momentum, according to market analyst Kunal Shah.

"No big movement is coming in this truncated week for the Nifty and Bank Nifty indexes. It will be sideways, but mid and small caps will gain traction," said Shah, senior technical and derivative analyst at LKP Securities Ltd.

The range for the Nifty is 21,850–22,200, he said. For the Bank Nifty, Shah pegged 47,000 as the resistance level, a breach of which will lead to short covering towards 48,000.

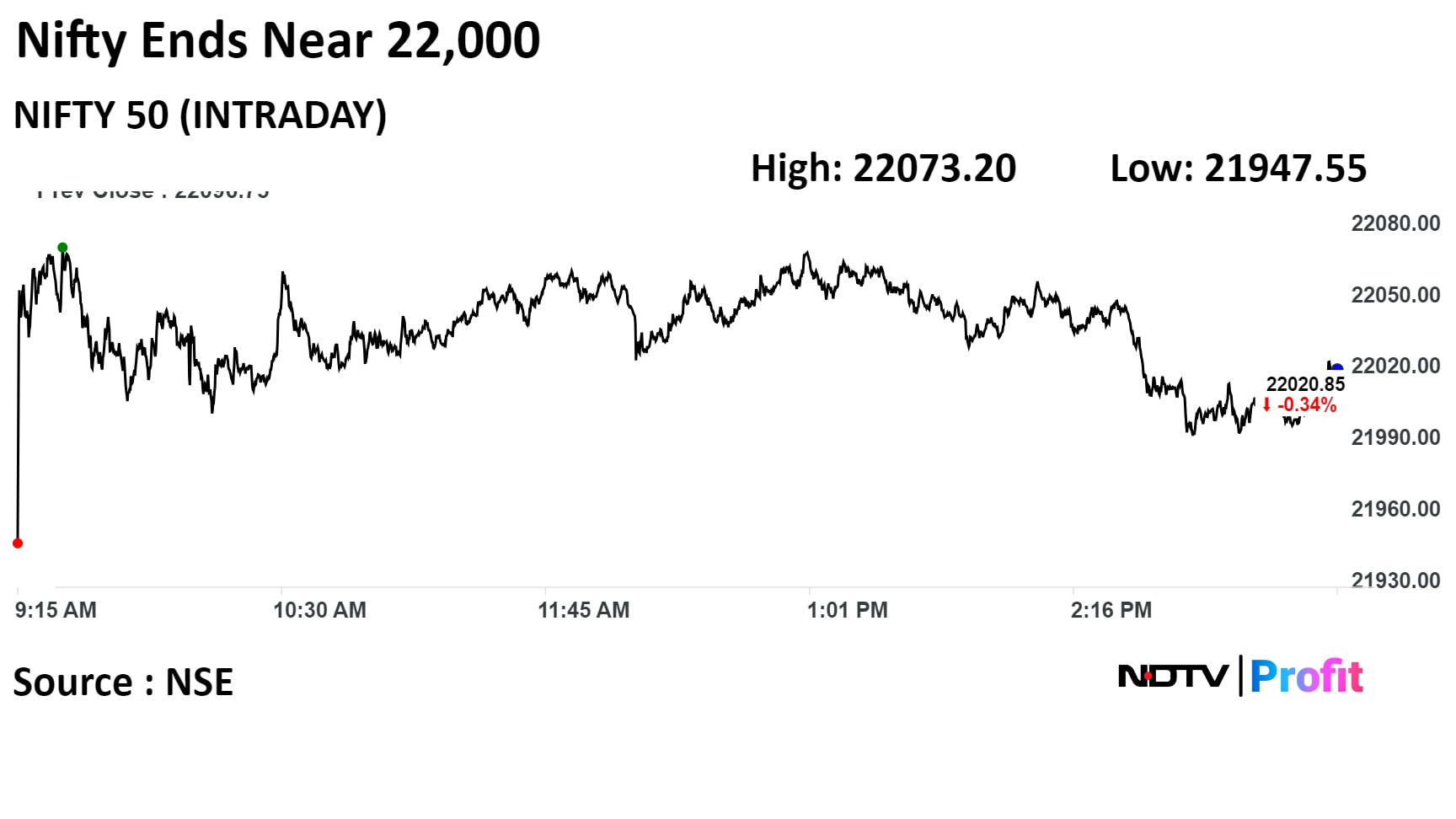

Benchmark equity indices snapped their three-day rally and ended lower on Tuesday as losses in heavyweights dragged them, while broader indices ended higher.

The NSE Nifty 50 fell 75.90 points, or 0.34%, to close at 22,020.85, while the S&P BSE Sensex declined 357.98 points, or 0.49%, to end at 72,473.96.

Shah expects real estate stocks to consolidate after a near-two-year outperformance, with the investing approach being company-specific.

The Nifty Realty rose nearly 2% intraday.

DLF Ltd. and Prestige Estates Projects Ltd. are his top picks in the space.

Companies engaged in trading and transportation of liquified natural gas will be in a "sweet spot," as global LNG prices are low and the outlook is benign, benefiting India with a huge latent demand, according to Harshvardhan Dole, vice president, IIFL Securities Ltd.

Between Gujarat State Petroleum Corp. and GAIL Ltd., the latter is more poised to gain on the back of its trading activity in LNG, he said.

Watch The Full Conversation Here:

The views and opinions expressed by the investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.