The benchmark equity indices snapped two sessions of gains and ended lower on Wednesday amid caution as markets await the much-anticipated interest rate cut in the US by the Federal Reserve after keeping it unchanged in eight consecutive meetings.

This will be the first rate cut since 2020. India VIX, an indicator of volatility, closed 6.2% higher at 13.37. Shares of information technology stocks dragged the indices, while finance stocks limited the downside.

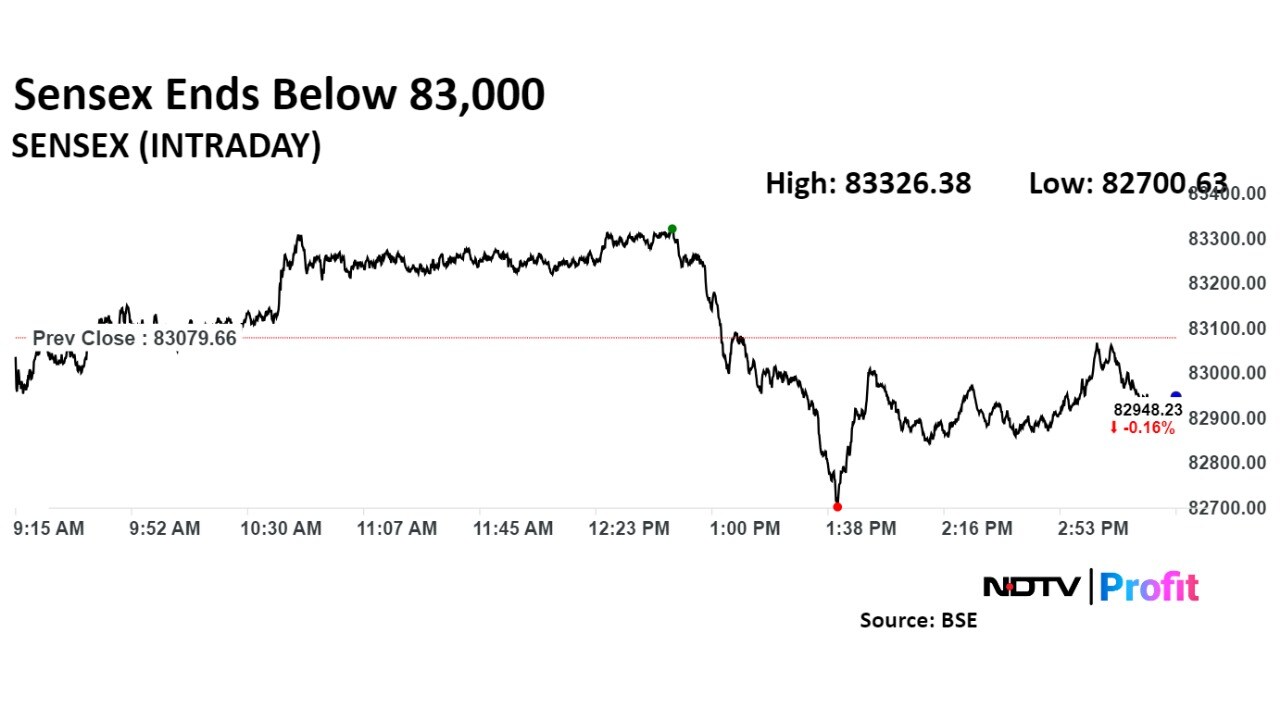

The NSE Nifty 50 ended 41 points or 0.16% lower at 25,377.55, and the S&P BSE Sensex ended 131.43 points or 0.16% lower at 82,948.23. Intraday, both the Nifty and the Sensex rose as much as 0.3% to hit their new record highs of 25,482.20 and 83,326.38 respectively.

"Considering an overnight event (outcome of FOMC on rate cut), big swings can be expected on either side for the index, where 25,580 will be considered as a hurdle, while 25,250 will serve as support," Aditya Gaggar, director of Progressive Share Brokers, said.

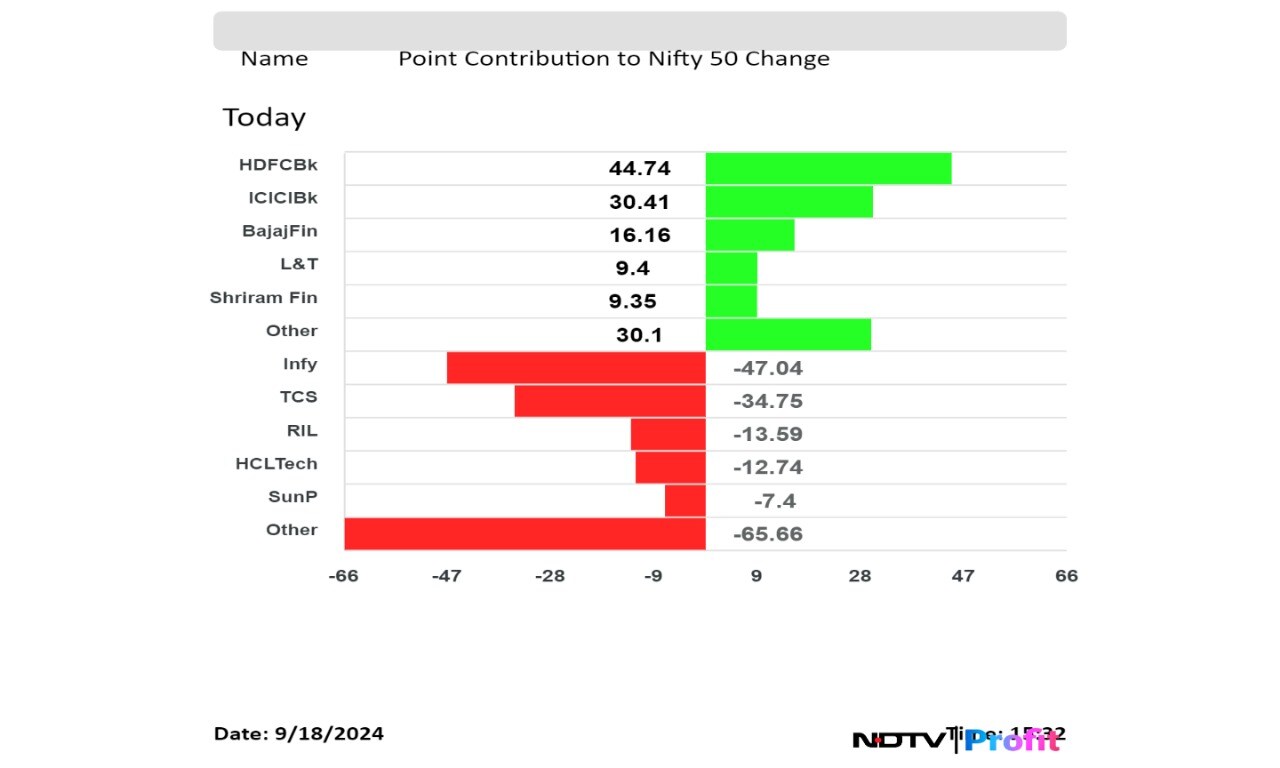

Shares of Infosys Ltd., Tata Consultancy Services Ltd., Reliance Industries Ltd., HCL Technologies Ltd. and Sun Pharmaceutical Industries Ltd. dragged the Nifty the most.

HDFC Bank Ltd., ICICI Bank Ltd., Bajaj Finance Ltd., Larsen & Toubro Ltd. and Shriram Finance Ltd. cushioned the fall the most.

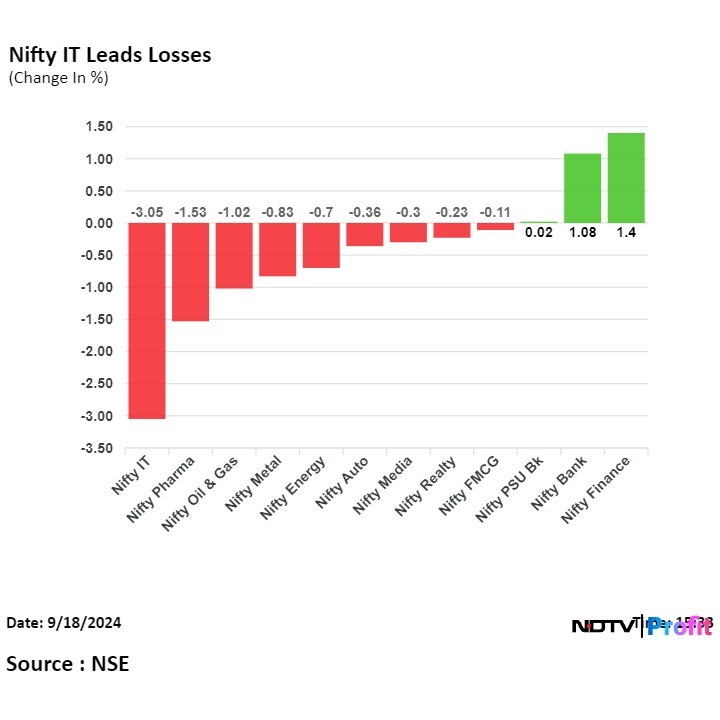

Most sectoral indices on the NSE ended lower, with the Nifty IT falling the most.

On the BSE, 18 sectors declined and two advanced out of 20. IT emerged as the top loser with a 3% decline, while the BSE Financial Services rose the most.

The broader markets underperformed the benchmark indices as the BSE MidCap and the SmallCap ended 0.71% and 0.52% lower respectively.

The market breadth was skewed in favour of the sellers as 2,437 stocks declined, 1,527 rose and 106 remained unchanged on the BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.