The NSE Nifty 50 and BSE Sensex erased weekly gains as global political and economic events caused volatility in the domestic markets. The benchmark indices ended lower for second day in a row on Friday, as ICICI Bank Ltd. and Reliance Industries Ltd. share prices dragged.

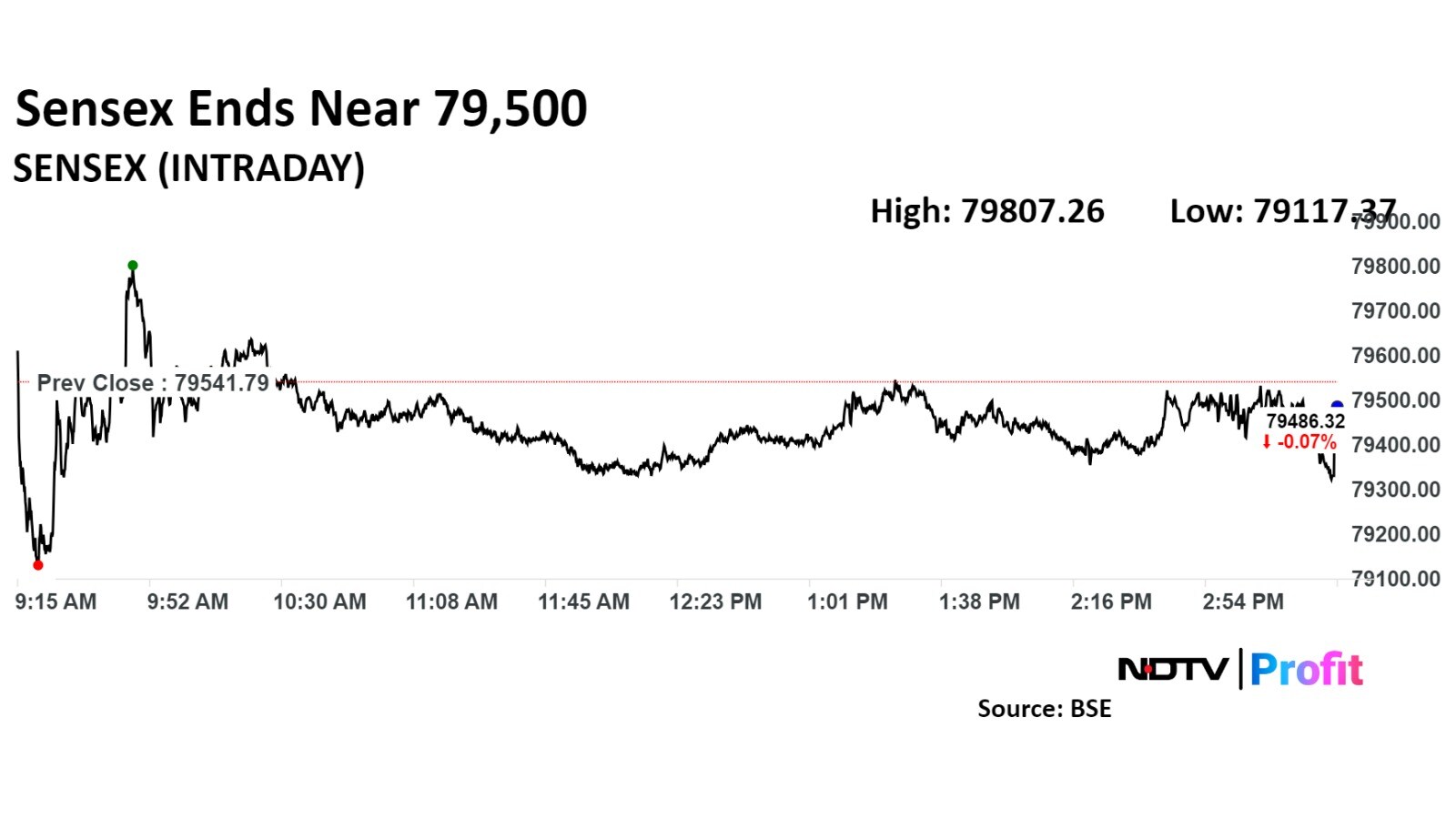

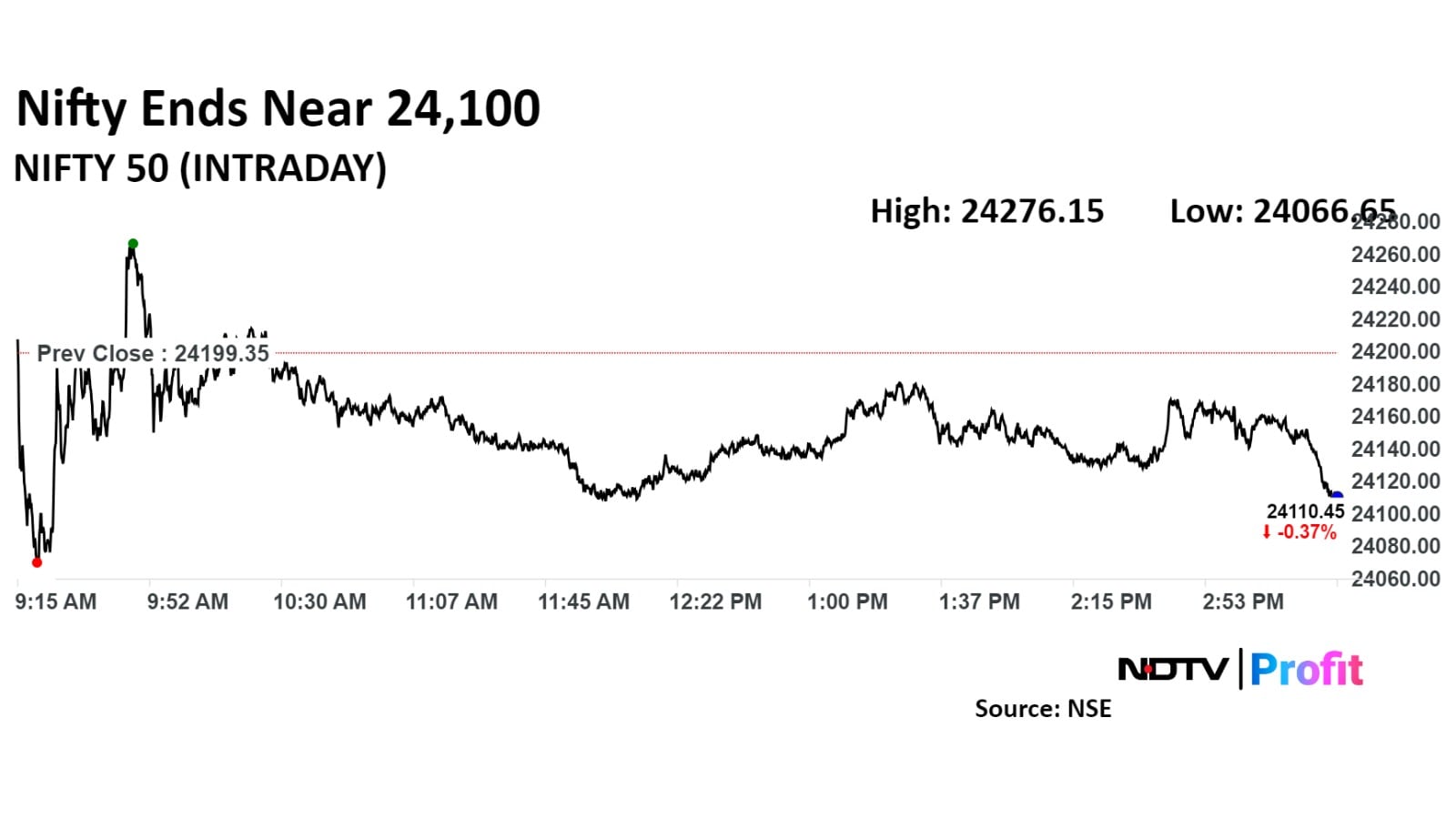

The Nifty 50 ended 51.15 points, or 0.21% down at 24,148.20, and the Sensex ended 55.47 points, or 0.07% lower at 79,486.32.

During the day, the Nifty 50 declined as much as 0.55% to 24,066.65, and the Sensex fell 0.53% to 79,117.37.

The NSE India Volatility Index rose 5.25% to 15.73 on Friday. The index ended 3.15% lower at 14.47.

This week, the Indian markets reacted to Donald Trump winning US election, which pushed the dollar index, and US Treasury yield to four–month high. The domestic currency hit fresh lows against the US dollar every day this week, which also weighed on the Indian equities.

The Sensex settled 0.07% down at 79,486.32 on November 8.

The Nifty 50 ended 0.37% down at 24,110.45.

“After gyrating nearly 700 points in early trades, markets moved in a range-bound manner thereafter and ended marginally lower on selective selling in banking, telecom, metal, oil and gas and realty stocks," said Prashanth Tapse, a senior vice president, Mehta Equities Ltd.

Despite recovery in global indices, Indian markets continue to bear the brunt of FII fund outflows. The US Fed rate cut failed to enthuse local investors as the undertone remained caution with a negative bias, he said.

The Nifty Bank ended 0.68% down at 51,561.20 on November 8

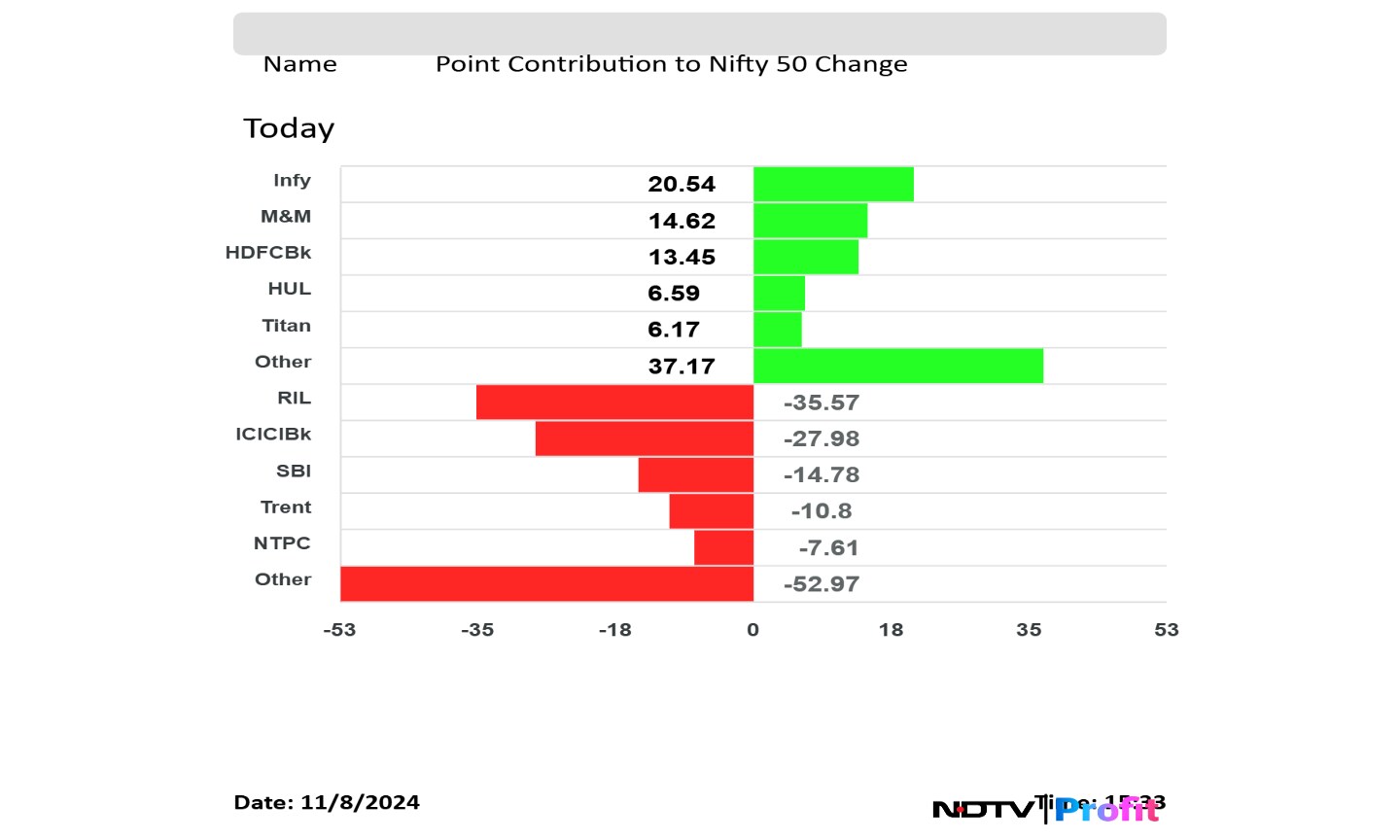

Shares of Infosys Ltd., Mahindra & Mahindra Ltd., HDFC Bank Ltd., Hindustan Unilever Ltd., and Titan Co. limited losses in the Nifty 50.

While those of Reliance Industries Ltd., ICICI Bank Ltd., State Bank of India, Trent Ltd., and NTPC Ltd. weighed on the index.

Top contribution to the Nifty 50 index.

Broader indices underperformed. BSE Midcap ended 1.2% lower and BSE Midcap closed 1.5% lower.

Six of the 21 sectoral indices on the BSE rose and 15 declined. The BSE Realty fell the most.

Market breadth was skewed in the favour of sellers. As many as 2,575 stocks declined, 1,394 rose, and 95 remained unchanged on the BSE.

The Nifty 50 and Sensex erased weekly gains. The benchmark indices ended 0.64% and 0.30% down, respectively in the week ended Nov. 8.

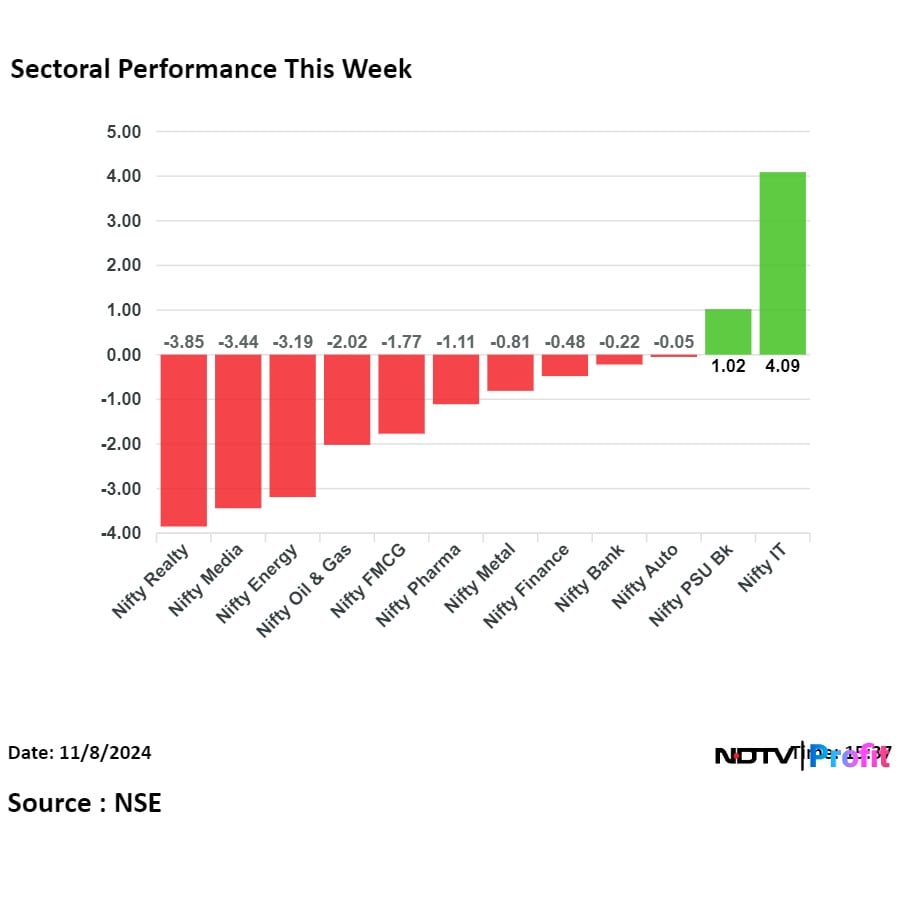

This week, on NSE, 10 sectors declined and two advanced out of 12. The NSE Nifty Realty declined the most, while the NSE Nifty IT rose the most.

Sectoral indices performance in the week ended on Nov 8.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.