Traders sent India's benchmark indices sliding, tracking global cues on Wednesday, to end the record winning streak as information technology and financial stocks weighed.

The NSE Nifty 50 and the S&P BSE Sensex slipped as much as 0.78% and 0.87%, respectively, during the day. This comes a day after Nifty posted a 14-day winning streak, the highest since the index's formal launch in 1996.

As of 12:15 p.m., the 50-stock blue-chip index was 145 points, or 0.57% lower at 25,133, and the 30-stock Sensex was down 384 points, or 0.46%, at 82,172.

Notably, scrips of oil marketing companies Hindustan Petroleum Corp., Bharat Petroleum Corp., and Indian Oil Corp. gained after the international benchmark Brent crude oil price tumbled to a nine-month low, slipping below the $75 per barrel mark.

A direct fall below 25,070 could usher in downsides aiming for 24,440 as the first downside objective, with 24,800 offering to slow down proceedings, according to Anand James, chief market strategist, Geojit Financial Services Ltd.

"Retention of 25,200 will, however, keep upside hopes alive, but will continue to insist on an hour's close above 25,280 to play the 25,365-800 trajectory."

India's bull run is only past the halfway mark, but a mix of fundamental and technical factors have Asia's third-largest market poised for a temporary correction, according to Morgan Stanley analysts.

The buy-on-dips strategy that has been working well in this bull run may play out this time too, said V K Vijayakumar, chief investment strategist, Geojit Financial Services Ltd. Retail investors waiting for a correction are likely to jump in on dips, he said. "In the present stage of the market where there is no valuation comfort in the broader market, quality large-caps offer safety to long-term investors."

Asian stocks plunged on Wednesday tracking the overnight rout in the US markets, led by weak economic data and easing oil prices on weak global demand. The benchmarks in Japan and Taiwan fell over 4% while the MSCI Asia Pacific index, excluding Japan, declined by 1.91% to 684.95 through midday on Wednesday.

The first week of August saw global stocks plummet as traders unwound their carry-trade bets on the Japanese yen after it rose against the US dollar.

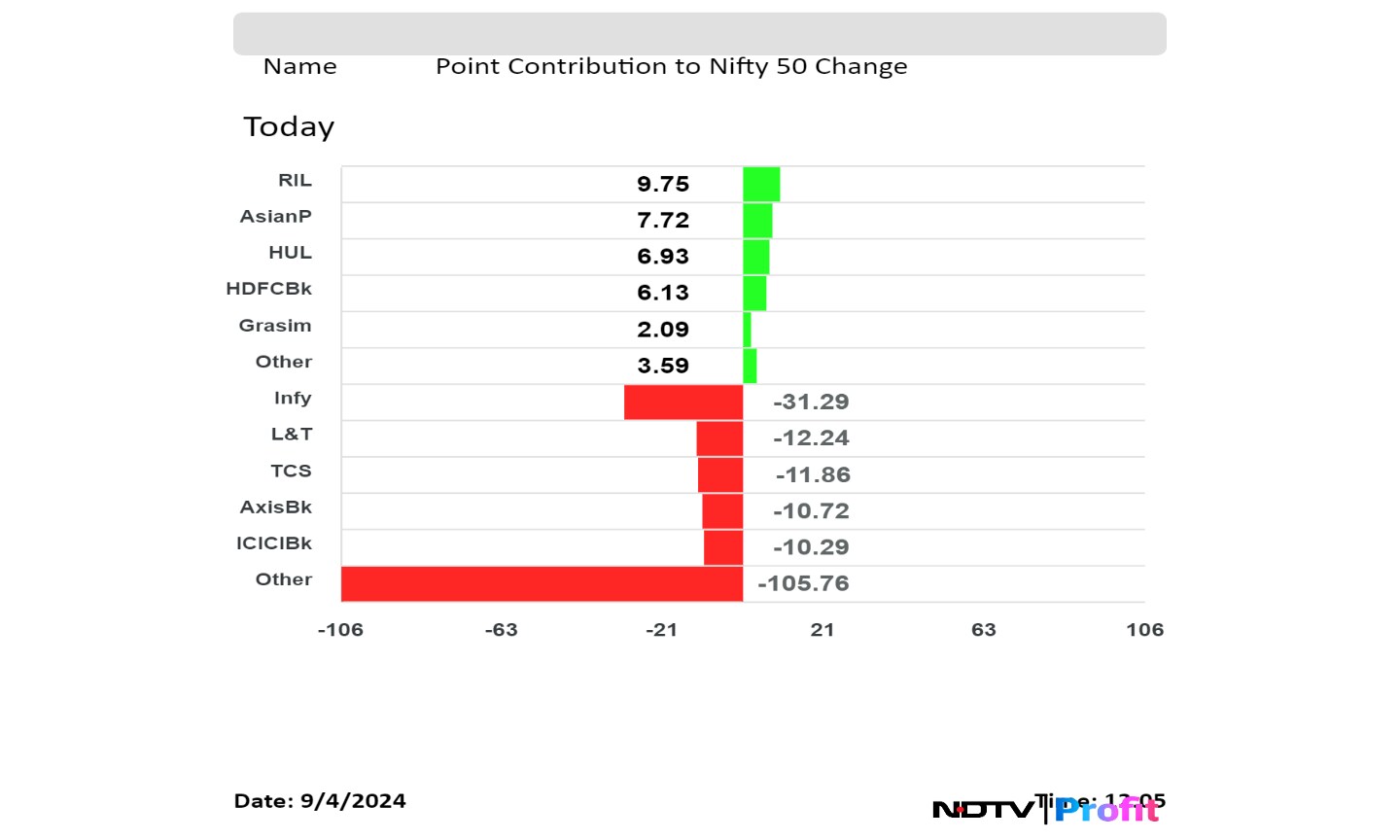

Shares of Reliance Industries Ltd., Asian Paints Ltd., Hindustan Unilever Ltd., HDFC Bank Ltd., and Grasim Ltd. cushioned the loss in the Nifty 50.

While those of Infosys Ltd., Larsen & Toubro Ltd., Tata Consultancy Services Ltd., Axis Bank Ltd., and ICICI Bank Ltd. weighed the index.

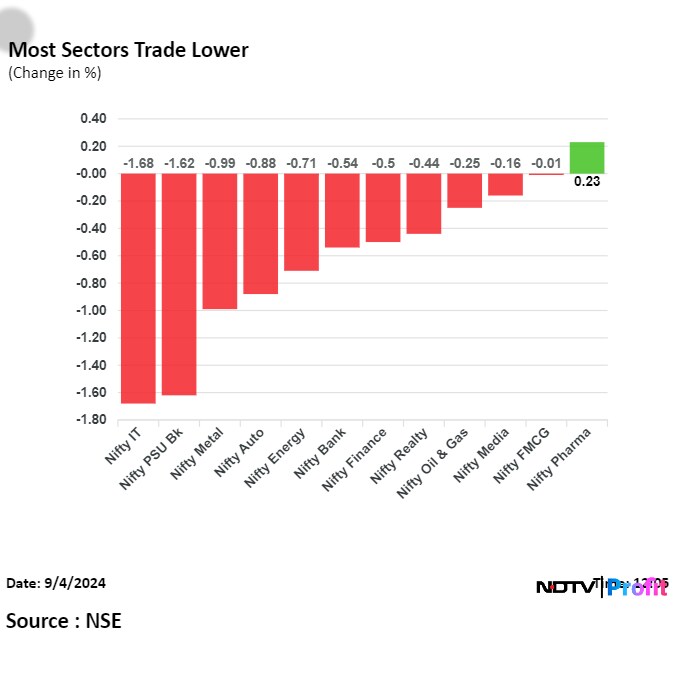

On NSE, 11 of the 12 sectors slipped, with Nifty IT and PSU Banks falling the most during the session. The Nifty Pharma was the only sector on the rise on Wednesday.

Broader markets were mixed against the benchmark indices. The BSE Midcap was down 0.41%, while Smallcap was trading 0.18% higher.

On BSE, 18 of the 20 sectors declined, with BSE IT and Metal leading the fall.

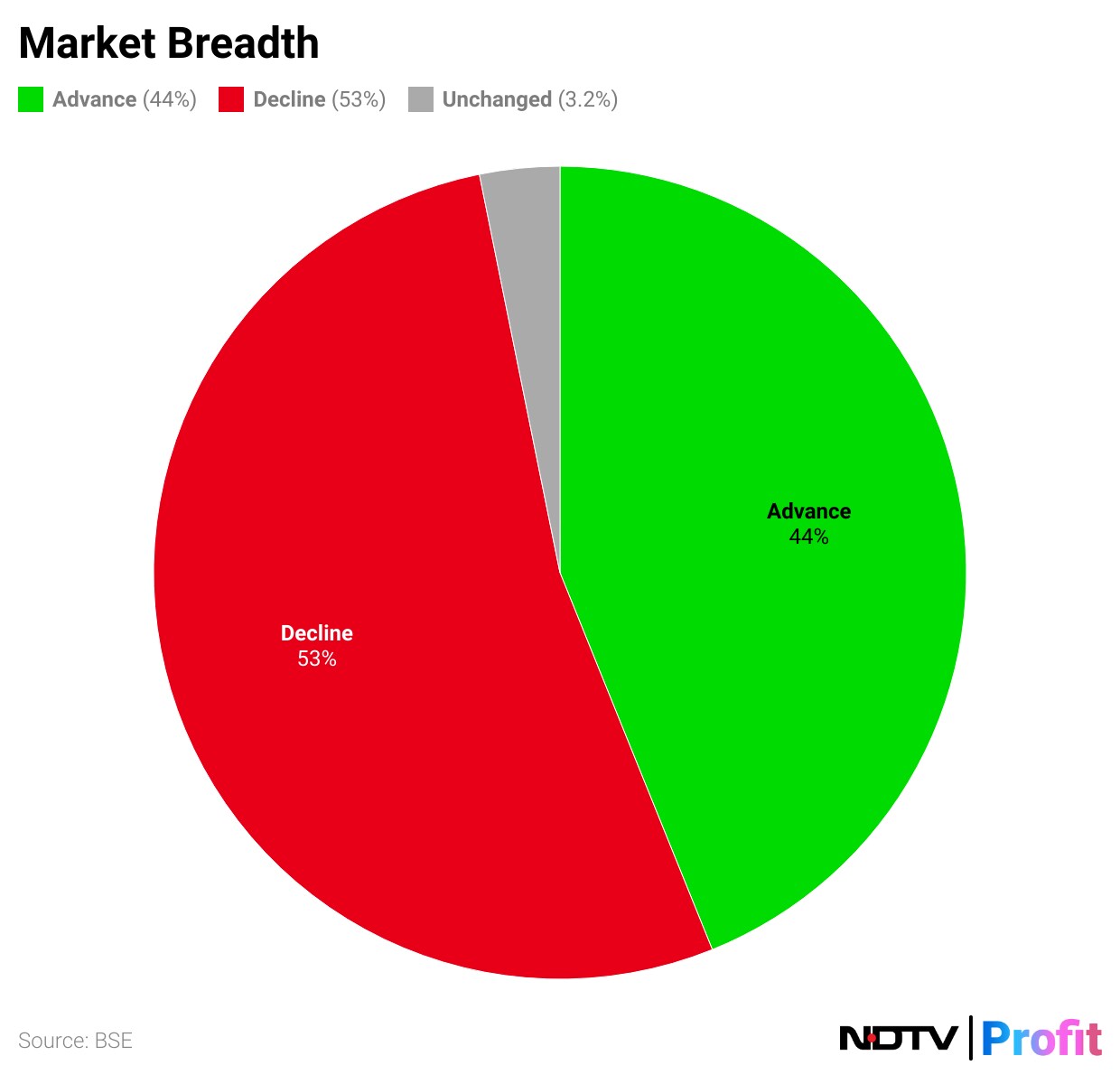

Market breadth was skewed in the favour of the sellers. Around 1,726 stocks rose, 2,082 stocks declined, and 125 stocks remained unchanged on the BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.