.png?downsize=773:435)

India's benchmark indices plunged to the lowest level since the Yen carry trade rout in August, tracking global stocks on concerns of US payroll data due on Friday.

This decline will set the stage for the domestic gauges to record a weekly fall after three gains. The NSE Nifty 50 and the S&P BSE Sensex slipped as much as 1.06% and 1.09%, respectively, so far in the day.

At 11:37 a.m., the 50-stock NSE Nifty was trading 233 points, or 0.93%, lower at 24,909, and the 30-stock Sensex was down 816 points, or 0.99%, at 81,369.

All eyes will be on the upcoming US jobs data for August due Friday, a key indicator of whether the Federal Reserve will initiate a half-point interest cut in September. Traders are pricing in over 100 basis points of easing this year, implying a potential super-sized reduction, according to Bloomberg.

India remains at a better place to attract inflows from Fed rate cuts, compared to its peers in the overall emerging markets this time, Citi said in its latest report.

Vodafone Idea Ltd. faced another blow as its target price was cut by Goldman Sachs to Rs 2.5 apiece, implying an 83% downside to current market price. Here's why.

The near-term trend in the market will be influenced by the US jobs data to be published tonight, according to V K Vijayakumar, chief investment strategist, Geojit Financial Services Ltd. Markets might not take it positively if the August jobs numbers come lower than market expectations as the Fed may even cut by 50 bps, he said.

The Indian economy continues to do well with elevated valuations as the only concern, he said. "Investors should prioritise buying fairly valued quality stocks on declines."

A direct fall below 25,070 should, however, set up a collapse aiming 24,400 with 24,800 offering initial support, according to Anand James, chief market strategist, Geojit Financial Services.

The first week of August saw Indian stocks plummet as traders unwound their carry-trade bets on the Japanese yen after it rose against the US dollar.

Most Asian stocks were hit on Friday as traders remained cautious just ahead of the release of US payroll data, which could set the tone for the September rate cut. The Japenese Nikkei 225 was 0.74% lower while the South Korean benchmark was down 1.16% as of 11:39 a.m. IST.

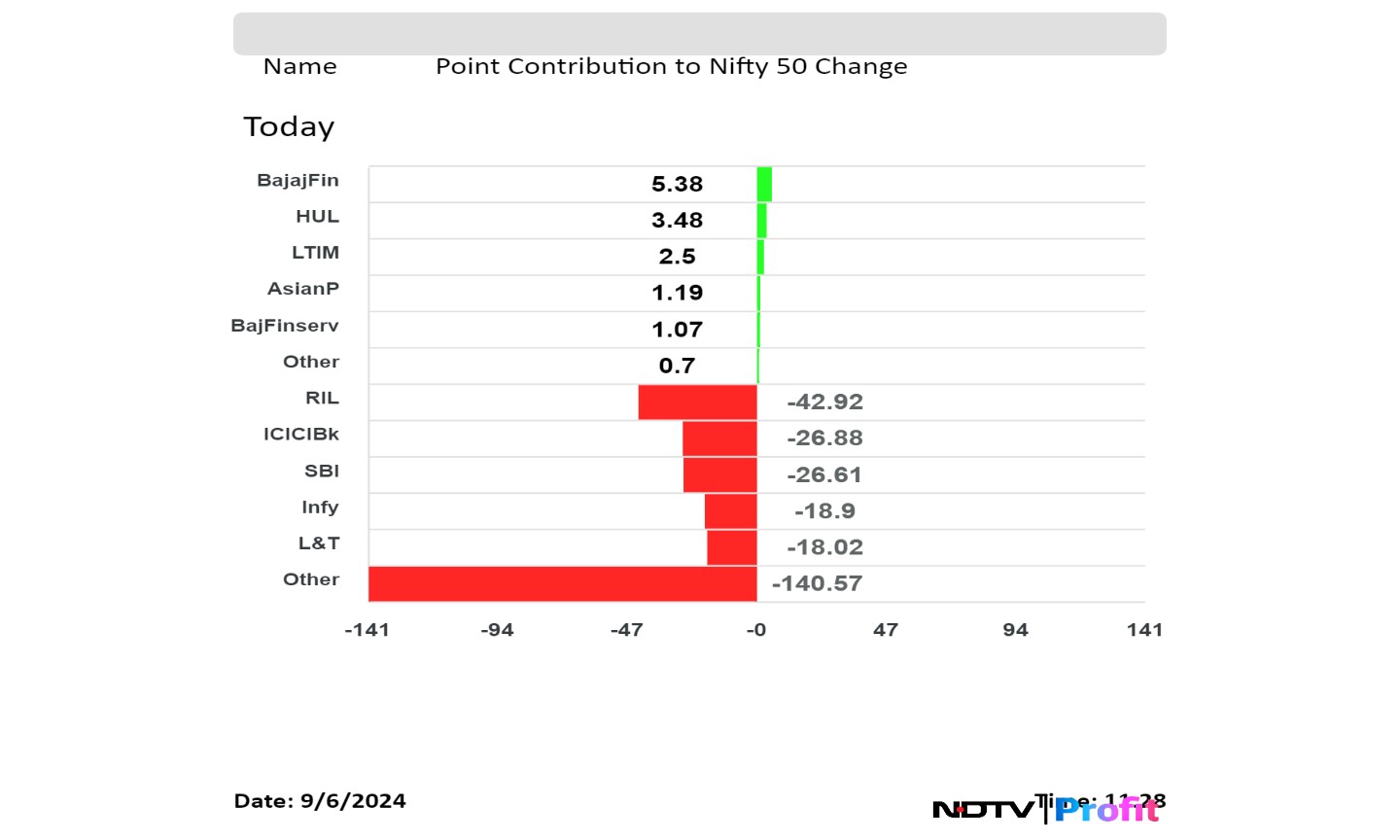

Shares of Bajaj Finance Ltd., Hindustan Unilever Ltd., LTIMindtree Ltd., Bajaj Finserv Ltd., and Asian Paints Ltd. cushioned the loss in the Nifty 50.

While those of Reliance Industries Ltd., State Bank of India Ltd., ICICI Bank Ltd., Infosys Ltd. and Larsen & Toubro Ltd. weighed on the index.

On NSE, all 12 sectors plunged, with Nifty PSU Bank falling nearly 3% during the day. Nifty Oil and Gas and Energy slipped nearly 2%.

Broader markets fell along with the benchmark indices. The BSE Midcap and Smallcap were down 0.92% and 0.59%, respectively.

On BSE, all 20 sectors declined, led by BSE Telecommunication and Oil and Gas and Energy.

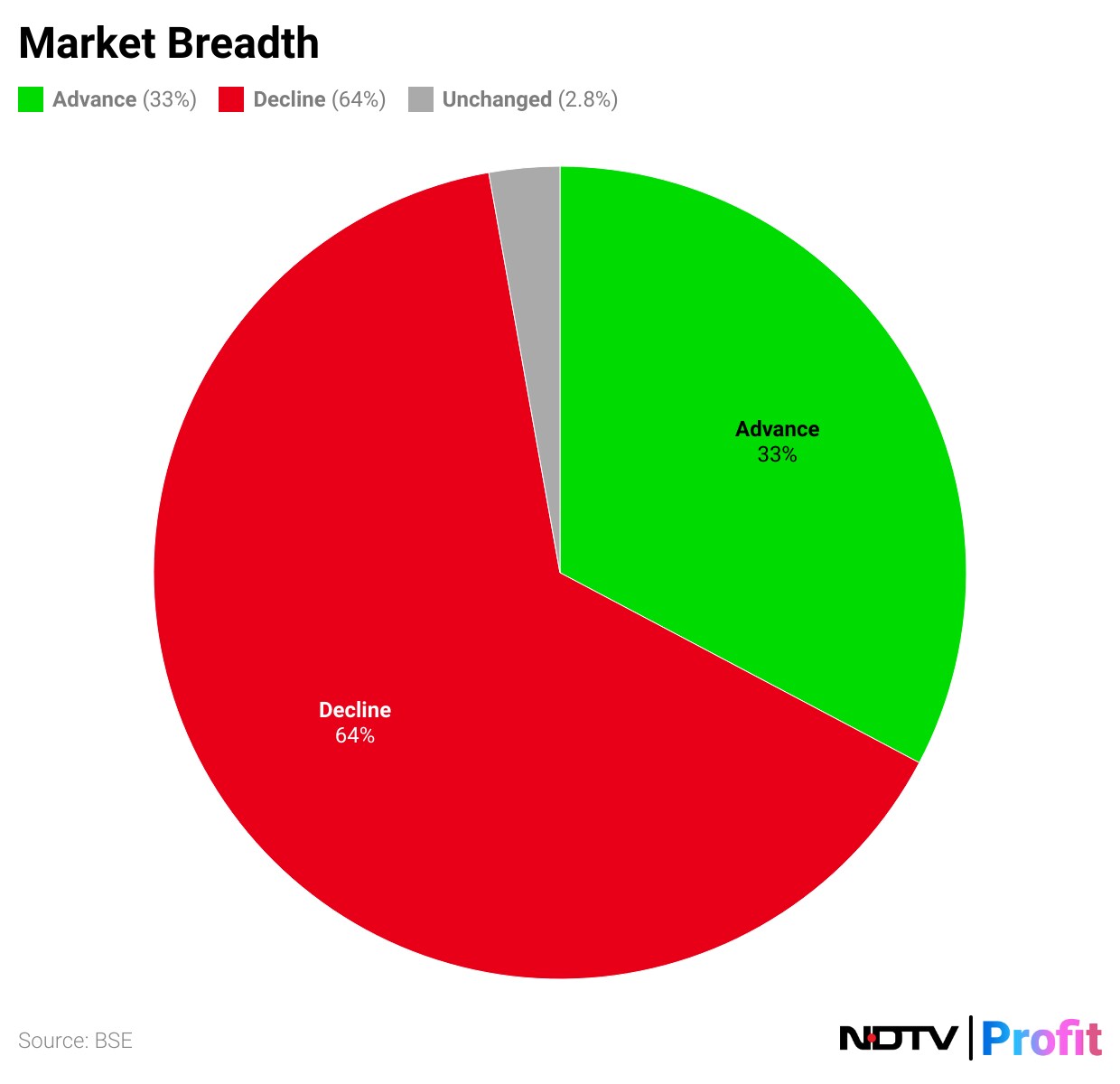

Market breadth was skewed in the favour of the sellers. Around 1,272 stocks rose, 2,504 stocks declined, and 109 stocks remained unchanged on the BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.