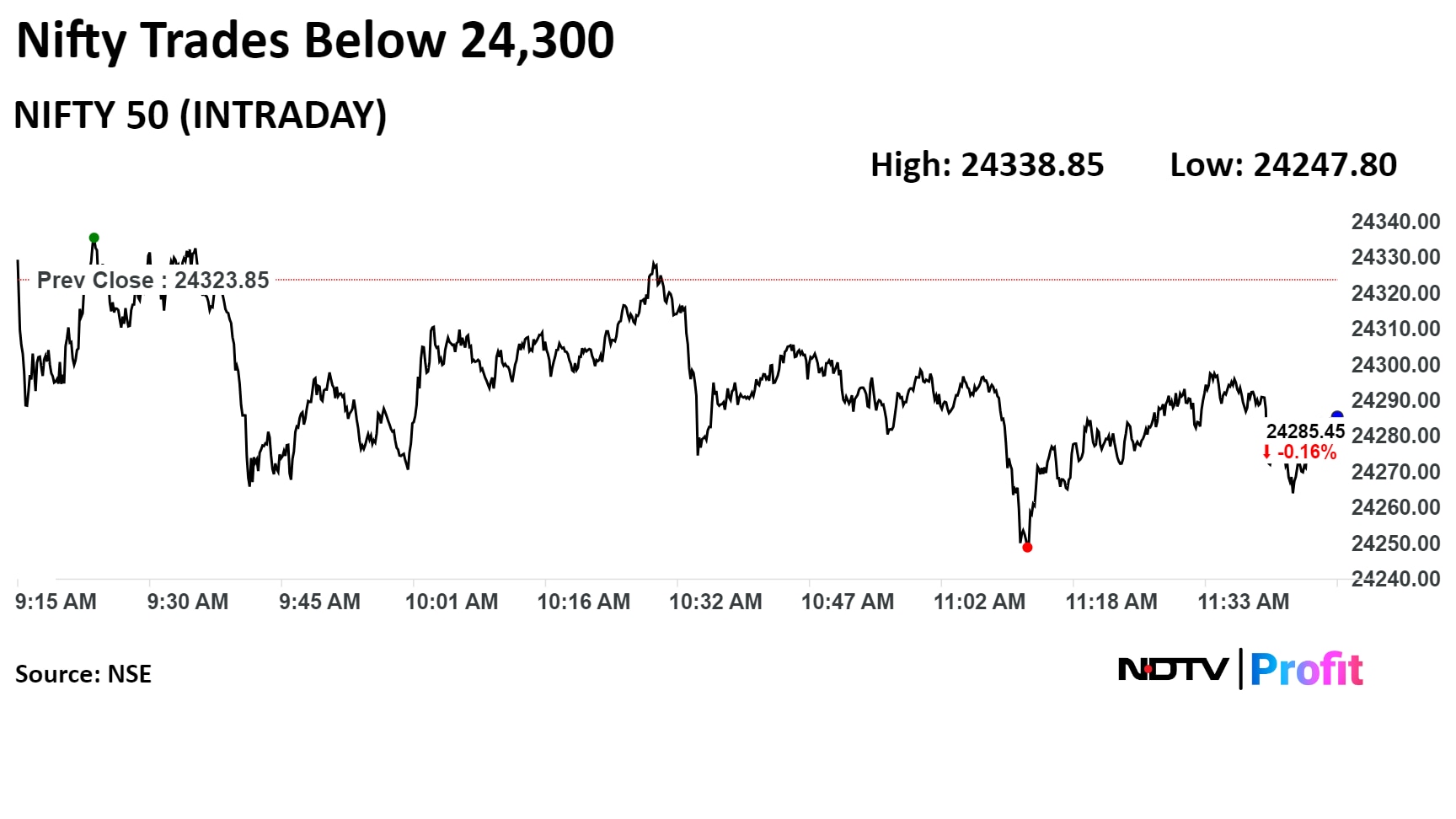

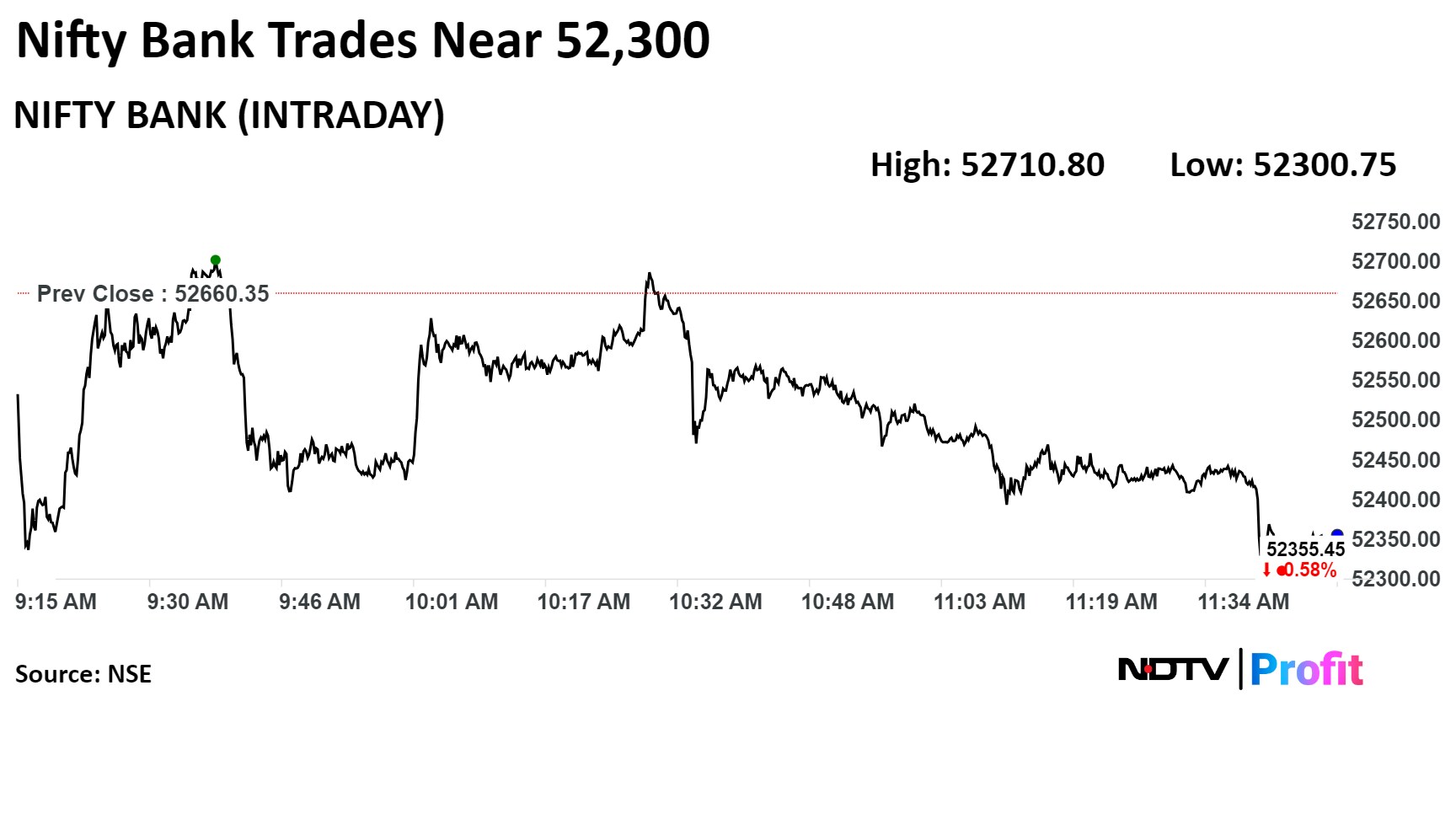

The NSE Nifty 50 snapped its three-session winning streak and traded near day's low through midday on Monday as HDFC Bank and Titan Co. dragged. The volatility index surged over 7% after falling for four consecutive sessions.

At 11:53 a.m., the Nifty was at 24,299.30, down 0.10% or 24.55 points, and the S&P BSE Sensex was at 79,905.77, down 0.11% or 100 points.

There are signs of fatigue at higher levels, according to Milan Vaishnav, founder of Gemstone Equity Research. But in the near-term, he has a neutral to bullish view.

Vaishnav has pegged near-term support at 24,000, which continues to have maximum put open interest. On the upside, the index may go to 24,500–24,800 levels, which has the highest call open interest.

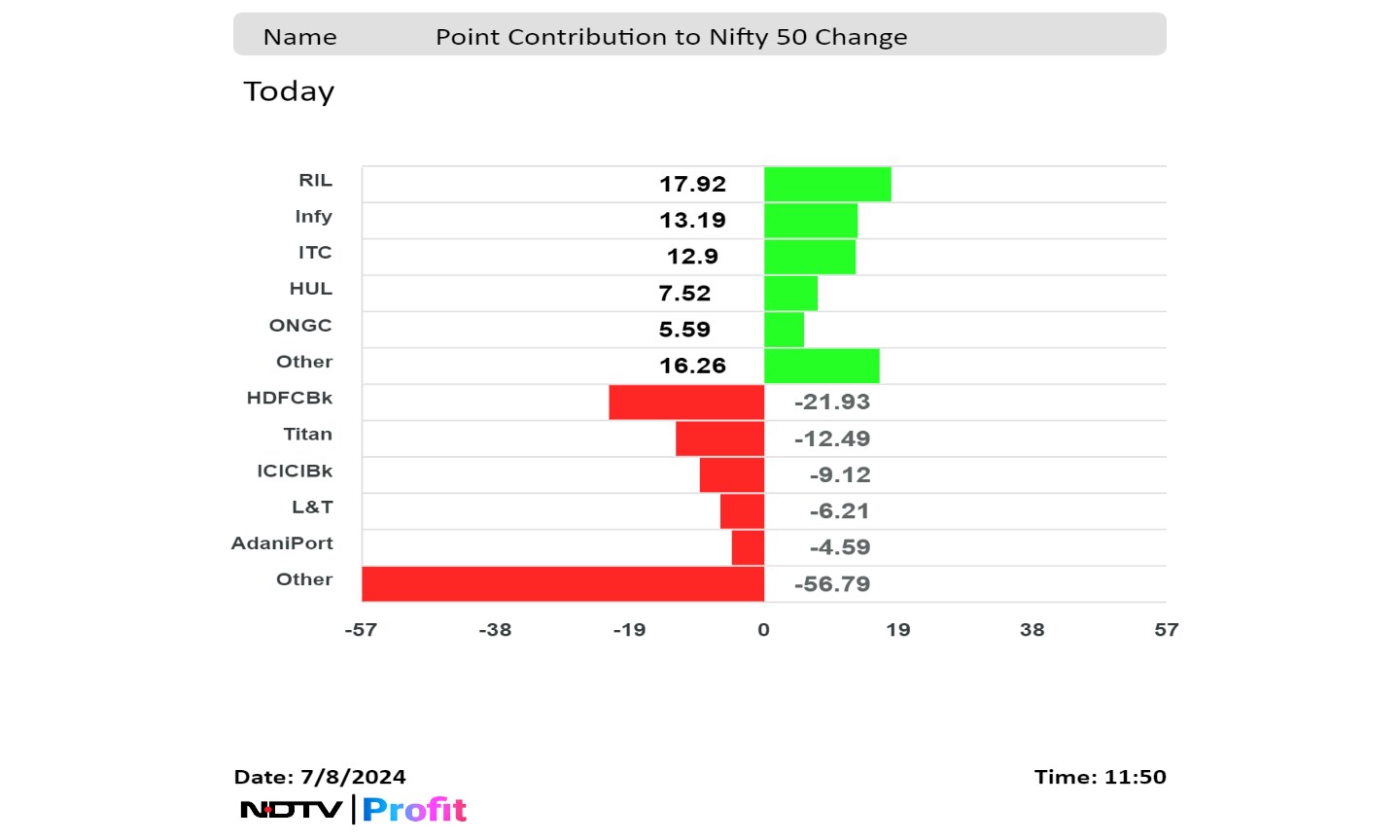

Shares of HDFC Bank Ltd., Titan Co., ICICI Bank Ltd., Larsen & Toubro Ltd. and Adani Ports & Special Economic Zone Ltd. dragged the Nifty the most.

Reliance Industries Ltd., Infosys Ltd., ITC Ltd., Hindustan Unilever Ltd. and Oil & Natural Gas Corp. cushioned the fall.

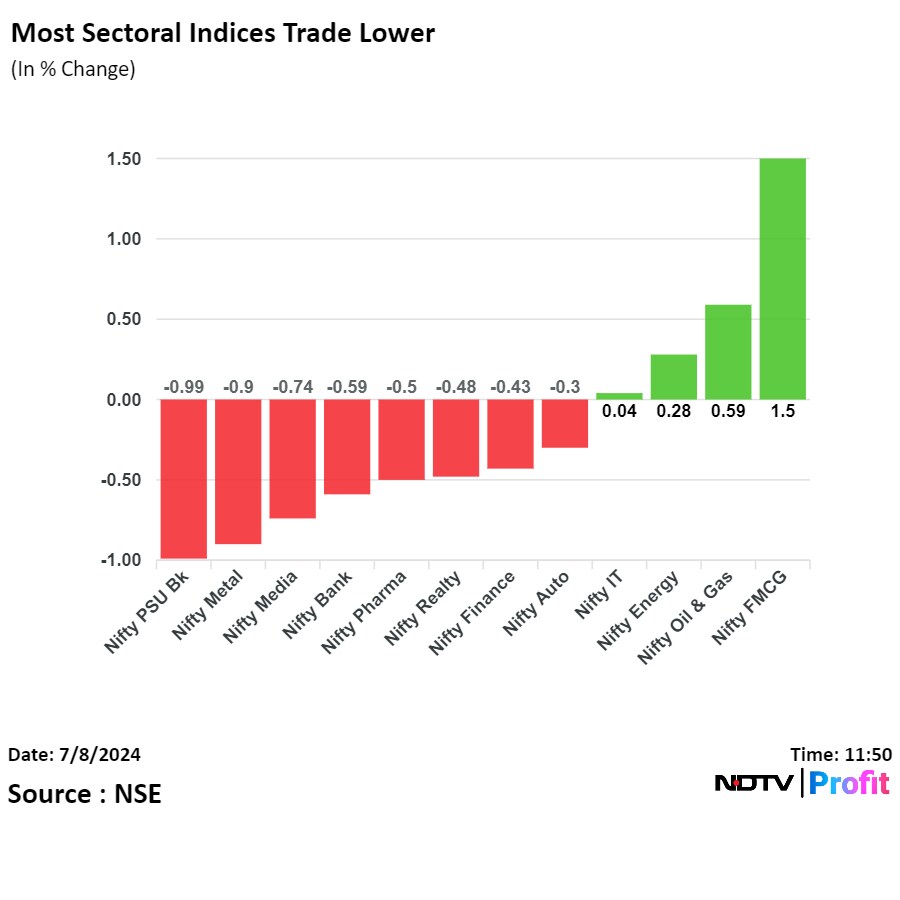

The Nifty FMCG was the top sectoral gainer and among the four indices that rose on the NSE.

The broader indices underperformed as the BSE MidCap and the SmallCap fell 0.3% each.

Sixteen out of the 20 sectoral indices on the BSE declined, with Consumer Durables falling the most.

The market breadth was skewed in the favour of the sellers as 2,219 stocks fell, 1,669 rose and 159 remained unchanged on the BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.