Snapping a three-day winning streak, India's benchmark indices ended lower, weighed by losses in shares of heavyweights HDFC Bank Ltd. and Tata Motors Ltd.

The NSE Nifty 50 ended 17.30 points, or 0.08%, lower at 22,200.55, and the S&P BSE Sensex closed 117.58 points, or 0.16%, down at 72,987.03. Intraday, the Nifty rose 0.36% to 22,297.55, and the Sensex gained 0.27% to 73,301.47.

Market participants await the US CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core US CPI, which excludes volatile food and energy costs, is expected to come in at 0.3% month-on-month in April from 0.4%, according to a Bloomberg survey.

.jpeg)

"Range-bound trade comes to an end on a negative note at 22,200.55. With a gain of more than 1%, PSU Banking and Energy were the top performers, and on the flip side, FMCG was the major laggard, followed by Auto," said Aditya Gaggar, director, Progressive Shares.

"Despite a range-bound trade in the Nifty 50, Mid and Small Caps continued to showcase strong outperformance by advancing over 0.50%. After a steep rally in the preceding days, the index found resistance around its crucial hurdle of 22,240–22,330. A convincing move above the mentioned levels will push the index further higher to 22,400, while on the lower side, 22,100 will be considered a strong support," he said.

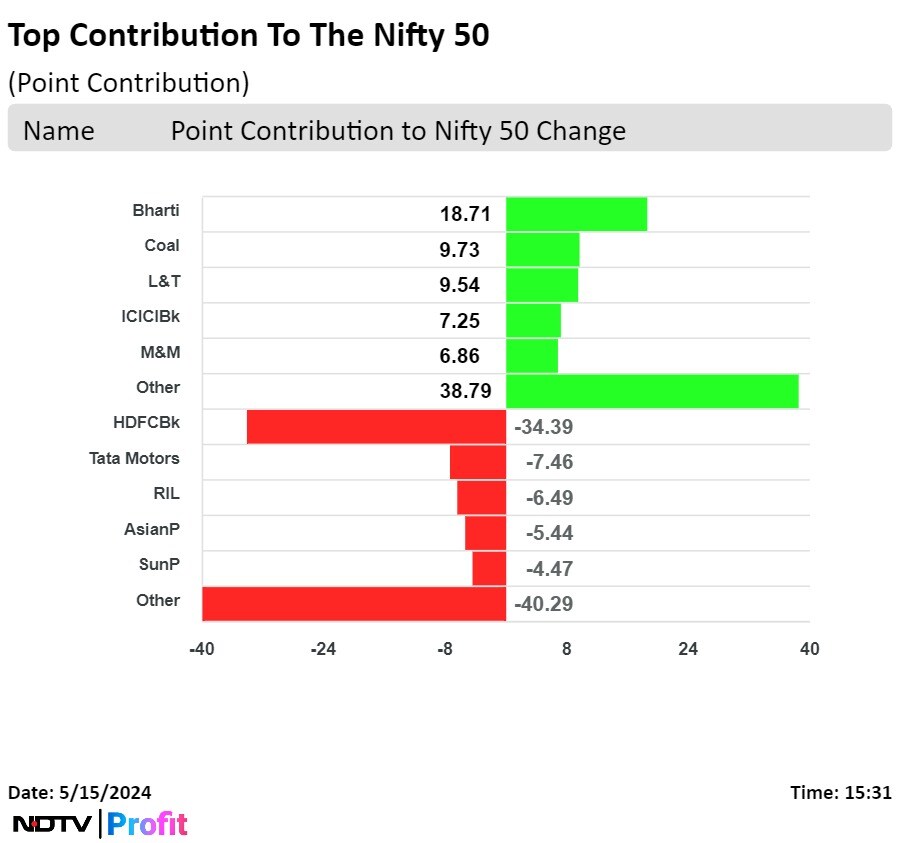

Bharti Airtel Ltd., Coal India Ltd., Larsen and Toubro Ltd., ICICI Bank Ltd., and Mahindra & Mahindra Ltd. contributed to the gains in the index.

HDFC Bank Ltd., Tata Motors Ltd., Reliance Industries Ltd., Asian Paints Ltd., and Sun Pharmaceutical Industries Ltd. weighed on the index.

On the NSE, five sectors declined, five advanced, while two remained flat out of 12.

The NSE Nifty FMCG index was the top loser among peers, and the NSE Nifty PSU Bank was the top gainer.

.jpeg)

Broader markets outperformed the benchmark indices. The S&P BSE Midcap ended 0.60% higher, and the S&P BSE Smallcap settled 0.96% up.

On BSE, 16 sectors advanced, and four declined out of 20. The S&P BSE FMCG was the worst performing sector. S&P BSE Capital goods gained the most.

Market breadth was skewed in favour of buyers. Around 2,214 stocks rose, 1,577 stocks declined, and 144 stocks remained unchanged on the BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.