India's benchmark stock indices declined on Friday, weighed down by Reliance Industries Ltd. and Tata Steel Ltd. However, shortly after opening, the NSE Nifty 50 had risen 0.22% to a life high of 24,854.80., led by gains in Tata Consultancy Services Ltd. and Infosys Ltd.

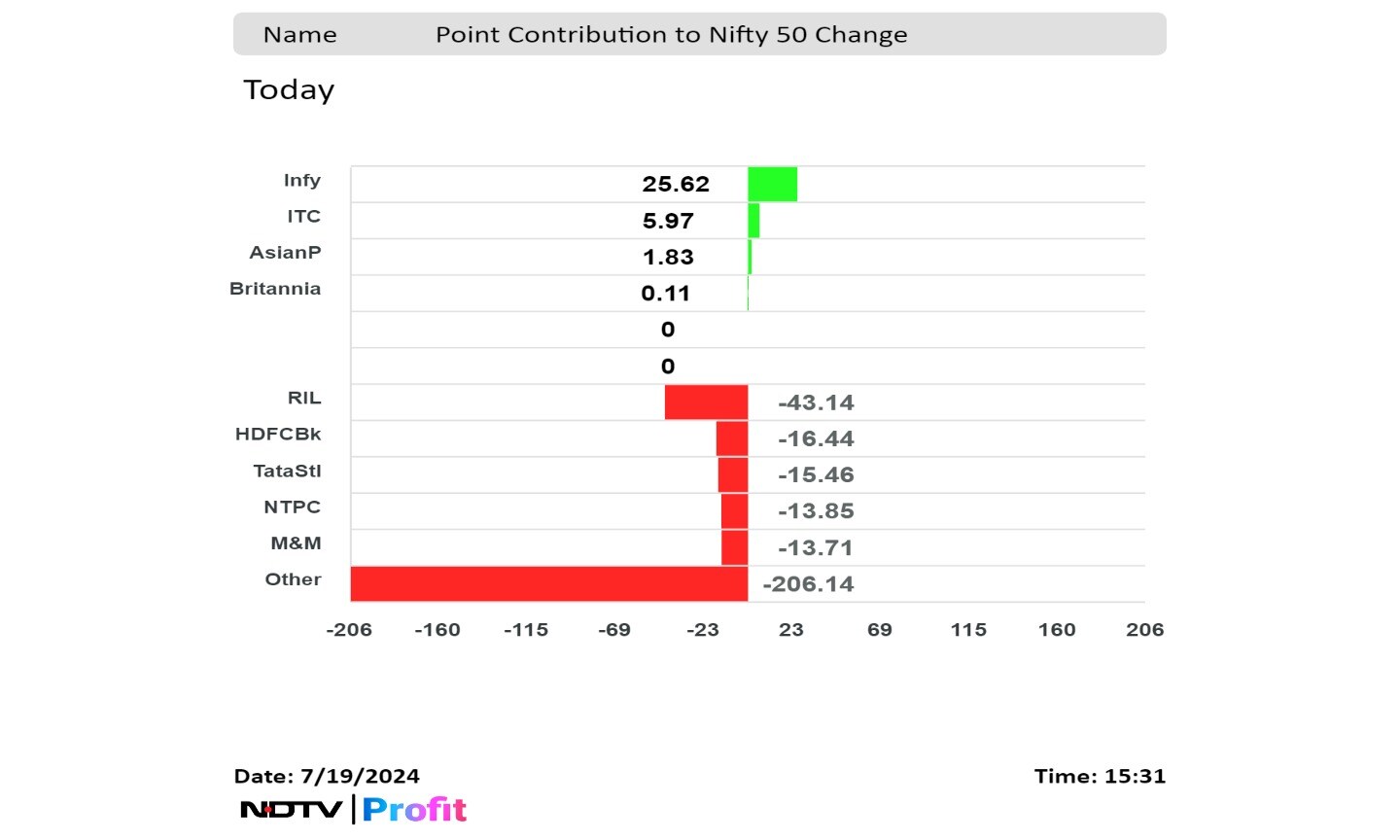

Gains in the Nifty 50 and BSE Sensex were led by Infosys Ltd. and ITC Ltd. on Friday.

The NSE Nifty 50 ended 275.25 points, or 1.11% lower at 24,800.85, and the S&P BSE Sensex settled down 738.81 points, or 0.91%, to 81,343.46.

Intraday, Nifty declined 1.18% to 24,508.15, and Sensex fell 1.04% to 80,499.10.

India's benchmark stock indices rallied for seven straight weeks for the second consecutive session since Dec. 11, 2023.

The Nifty 50 plunged amid global selloff. The broader market witnessed sharper selling pressure and fell more than 2%, said Siddhartha Khemka, head of retail research at Motilal Oswal Financial Services Ltd.

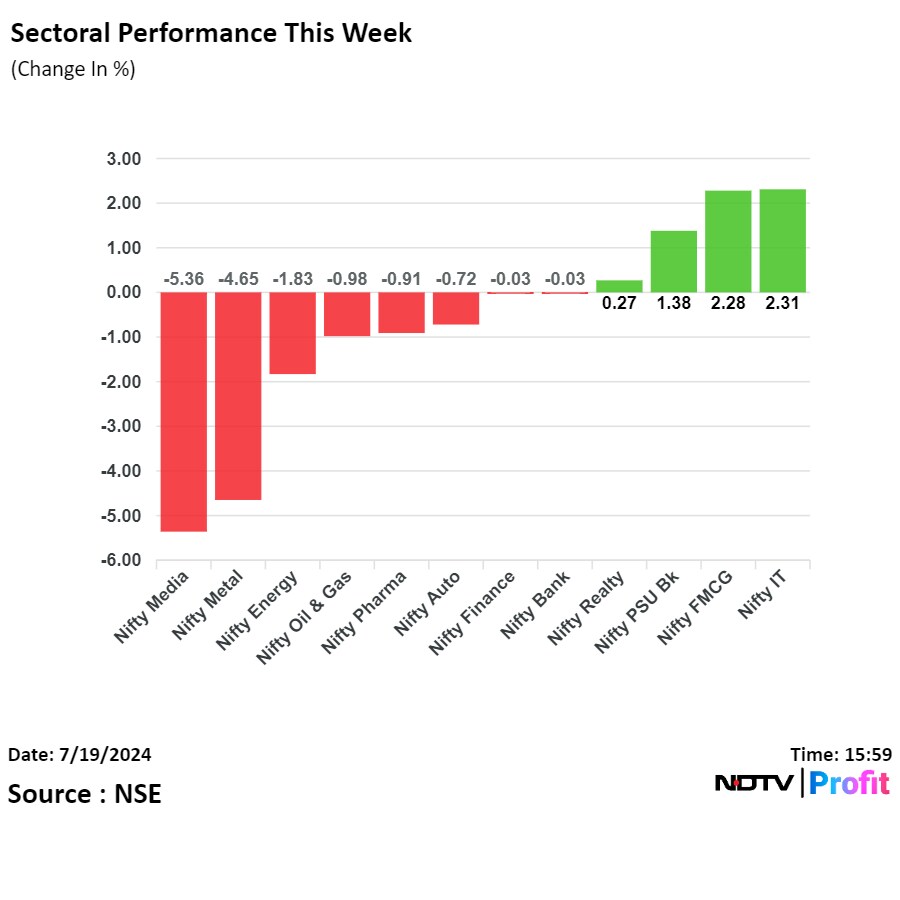

"All the sectors ended in red, with metals being the biggest loser, which fell 4%. However, the IT sector was quite resilient, posting better than expected results posted by Infosys. Investors also shifted towards defensive sector like FMCG, which is witnessing demand revival with increasing rural recovery," Khemka said.

.jpeg)

.jpeg)

Overall markets got impacted due to new tensions between the US and China, which resulted in global profit booking. In addition, Microsoft Inc.'s outage impacted a lot of large organisations, airlines, and stock exchanges globally, Khemka noted.

Investors are also cautious ahead of the Union Budget next week on July 23, which will provide the next set of directions to the market. Earnings season will also pick up pace, which will result in stock-specific actions. Apart from budget, US Core PCE data and PMI data will be key events to monitor, he said.

.jpeg)

On weekly basis, the benchmarks have held their best stretch of gains in over seven months, as they have risen for seven straight weeks. The Nifty 50 gained 0.12% and Sensex rose 0.11% in the week ended July 19.

Shares of Infosys Ltd., ITC Ltd., Asian Paints Ltd., and Britannia Industries Ltd. cushioned the fall in the Nifty.

While those of Reliance Industries Ltd., HDFC Bank Ltd., Tata Steel Ltd., NTPC Ltd., and Mahindra & Mahindra Ltd. weighed the index.

This week, six sectors out of 12 declined, four advanced, and two remained flat on the NSE. The NSE Nifty Media declined the most, and the NSE Nifty IT rose the most.

Broader markets underperformed benchmark indices. The S&P BSE Midcap and Smallcap indices were 2.31% and 2.22% lower, respectively.

On BSE, all 20 sectors ended lower, with the S&P BSE Metal emerging as the worst performing sector.

Market breadth was skewed in the favour of sellers. Around 3,005 stocks declined, 906 stocks advanced, and 90 stocks remained unchanged on BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.