.jpeg?downsize=773:435)

India's benchmark stock indices extended losses through midday on Thursday after a gap-down opening, with most of the largecaps trading lower, spooked by rising geo-political tensions between Iran and Israel and SEBI's new norms on the futures and options segment.

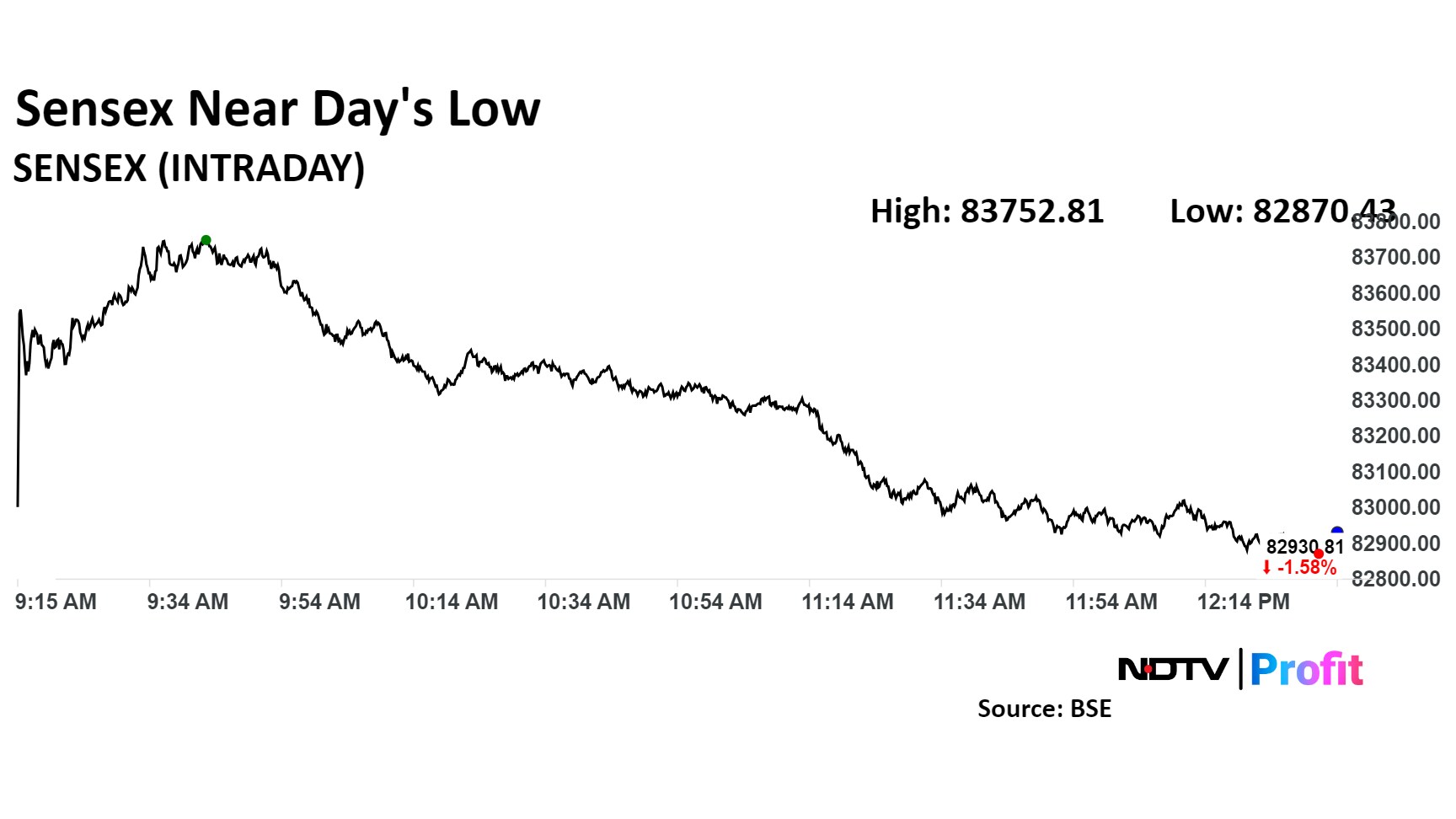

At 12:37 p.m., the Nifty was at 25,402.55, down 1.53% or 394.35 points, and the Sensex was at 82,978.34, lower by 1.53% or 1,287.95 points. Only 9 of the Nifty 50 stocks traded higher.

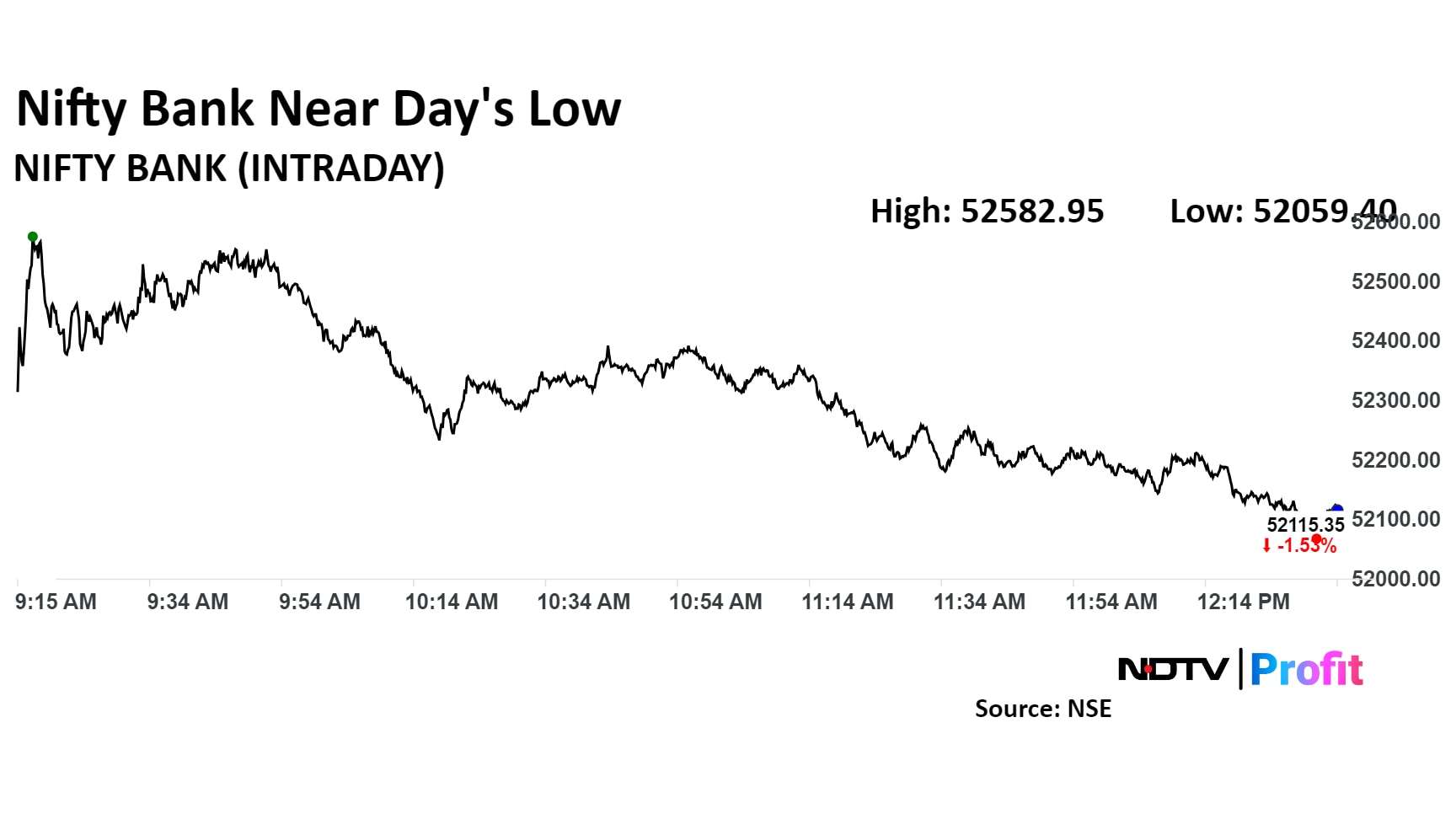

Nifty and Bank Nifty extended their fall, driven by global and domestic factors, with both indices now trading below their 20-day moving average (DMA), indicating near-term pressure, according to Kush Bohra, founder of Kushbohra.com. "Despite the significant decline, hourly charts suggest the indices are approaching oversold territories, making a technical rebound plausible," he said. "However, investors should resist creating positional long positions until the downtrend conclusively reverses."

Bohra expects support for Nifty at 23,300 and resistance at 23,800. He said that for the Bank Nifty, support is at 51,700 and resistance at 53,000, while recommending investors exercise caution and wait for a clear reversal signal before creating new positional longs.

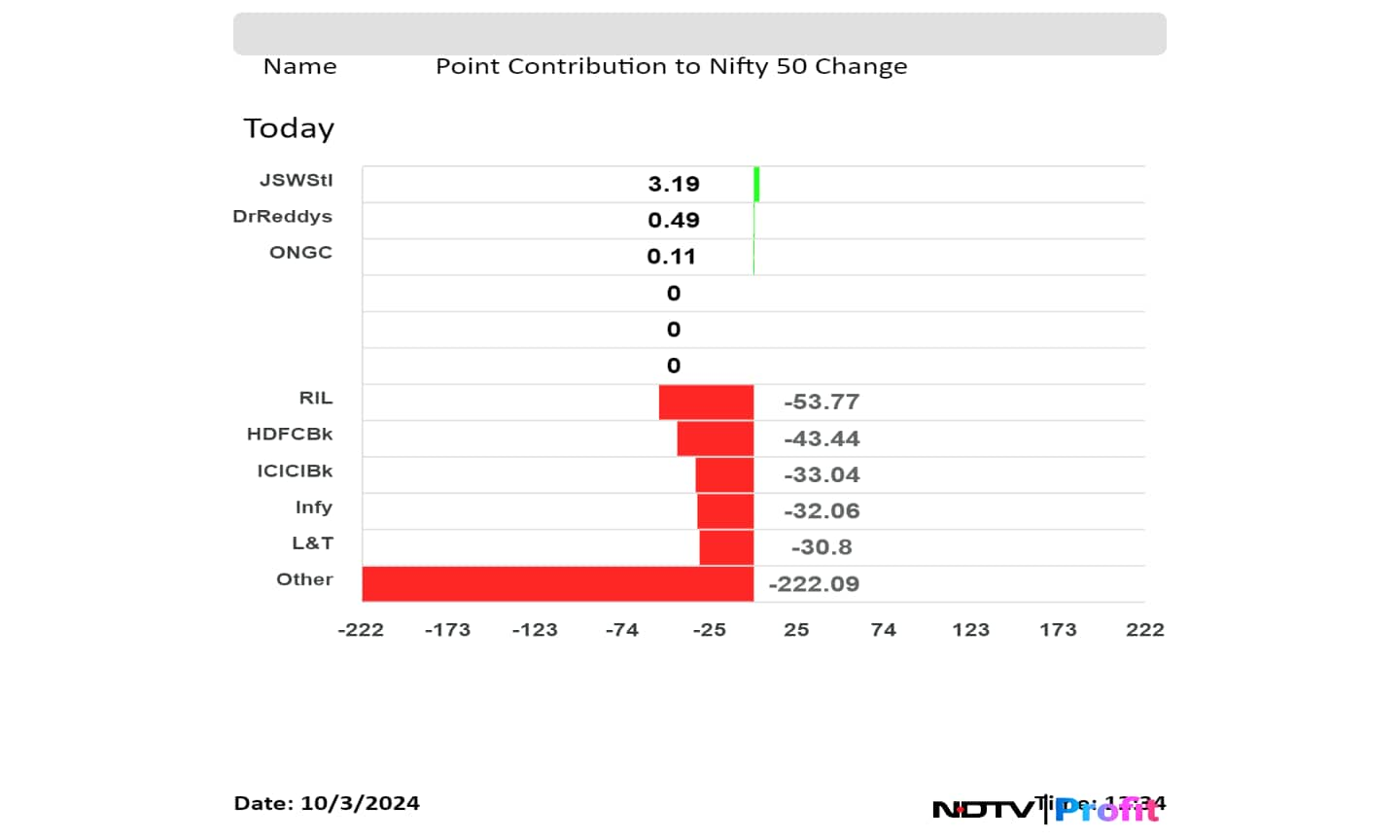

Shares of Reliance Industries Ltd., HDFC Bank Ltd., ICICI Bank Ltd., Infosys Ltd., and Larsen & Toubro Ltd. dragged the Nifty the most. While those of JSW Steel and Dr Reddy's Labs cushioned the fall.

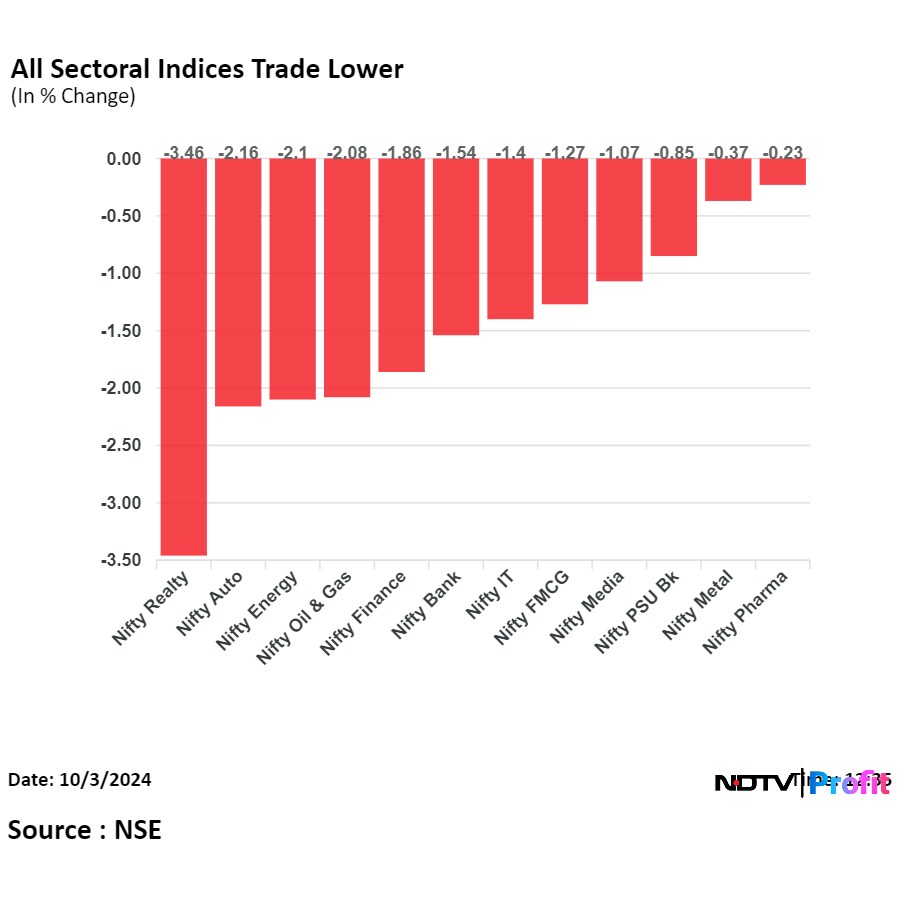

All sectoral indices on the NSE fell with Nifty Realty losing the most.

Broader indices too fell, with the BSE Midcap and Smallcap trading 1.52% 1.25% lower, respectively, during midday on Thursday.

All sectoral indices on the BSE fell with BSE Realty falling the most.

Market breadth was skewed in favour of the sellers. Around 2,773 stocks fell, 1,089 rose, and 112 remained unchanged on the BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.