The benchmark equity indices closed lower on Thursday as the FMCG sector dragged the most, followed by banks after the RBI failed to announce any measures to ease tight liquidity.

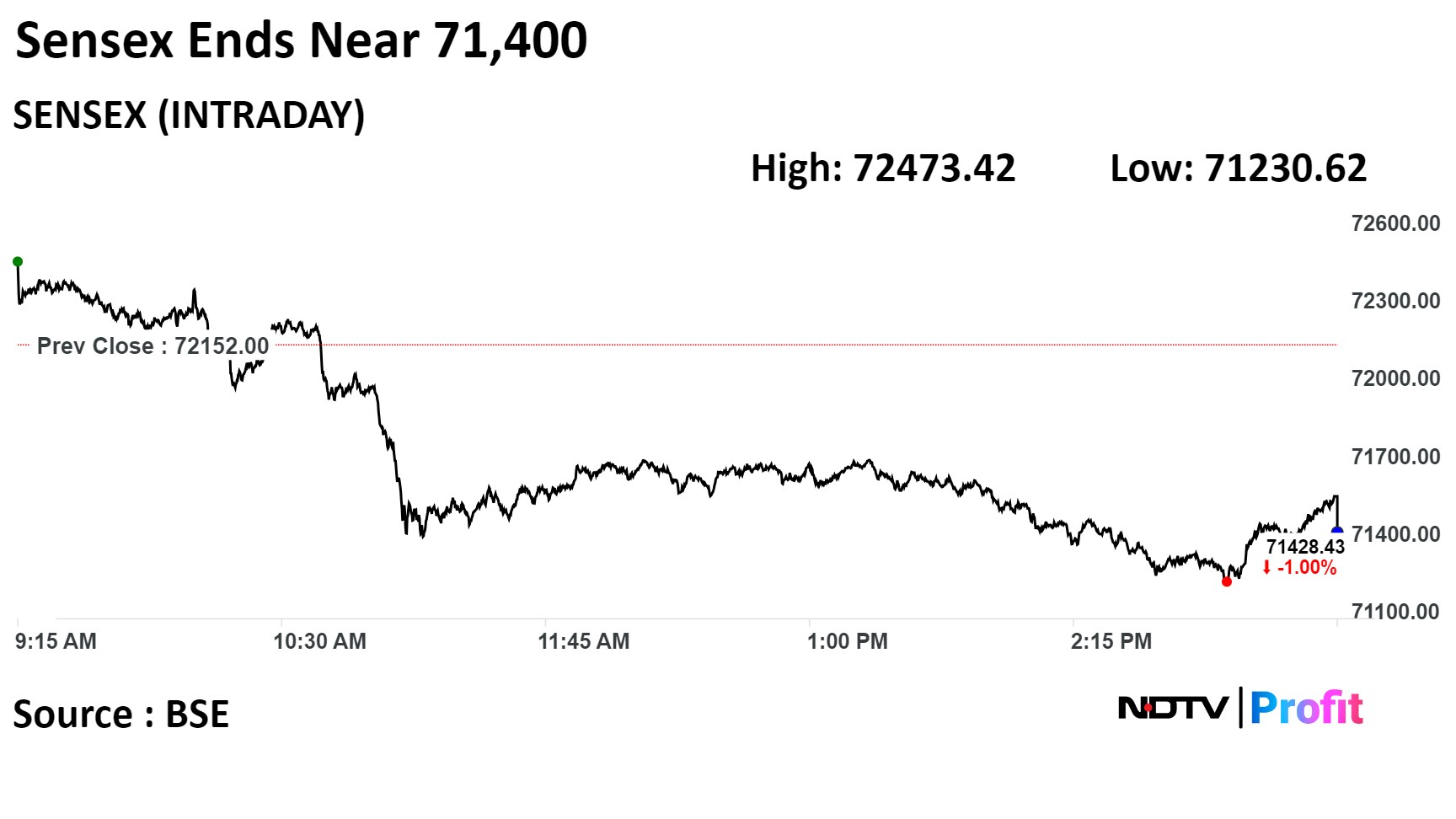

The NSE Nifty 50 was 212.55 points or 0.97% lower at 21,717.95 and the Sensex ended 723.57 points or 1% lower at 71,428.43.

During the day, the Nifty fell as much as 1.21% to 21,665.30, while the Sensex declined 1.28%. to 71,230.62.

"Once again, the level of 22,000 worked well for the bears, as after the status quo decision by the MPC committee, a steep fall was seen in the private banking and FMCG stocks, which led to a sharp correction in the index as well," Aditya Gaggar of Progressive Share Brokers Pvt.

On the daily chart, the index has made a big negative candle but defended the level of 21,700, which can be considered immediate support. The upside seems to be capped at 21,900, according to Gaggar.

"In case of a decisive breakdown, the correction may extend to 21,500, while on the higher side, a convincing close above 22,100 is a must for resuming its uptrend," he said.

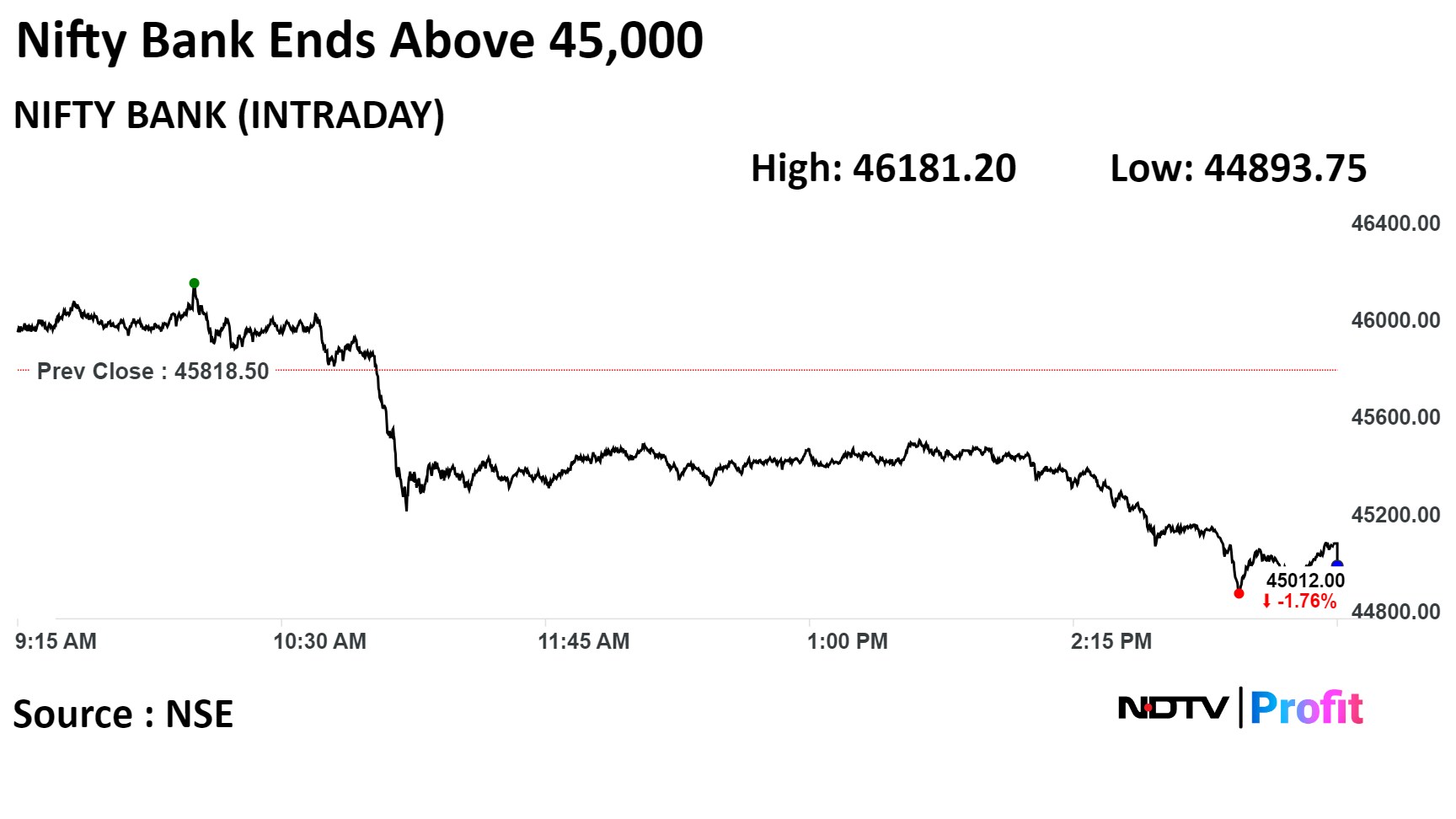

Shares of HDFC Bank Ltd., ICICI Bank Ltd., ITC Ltd., Kotak Mahindra Bank Ltd. and Axis Bank Ltd. dragged the Nifty the most.

Reliance Industries Ltd., State Bank of India, Tata Consultancy Services Ltd., Power Grid Corp. and Bharat Petroleum Corp. led the gains.

Sectoral indices on the NSE ended mixed, with the Nifty PSU Bank and Media gaining 2% while FMCG and Financial Services falling the most.

The broader markets ended on a mixed note as the BSE midcap rose 0.08% and the smallcap fell 0.44%.

Twelve out of the 20 sectors on the BSE fell, with fast-moving consumer goods falling the most.

The market breadth was skewed in favour of the sellers as 2,176 stocks rose, 1,666 fell and 103 remained unchanged on the BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.