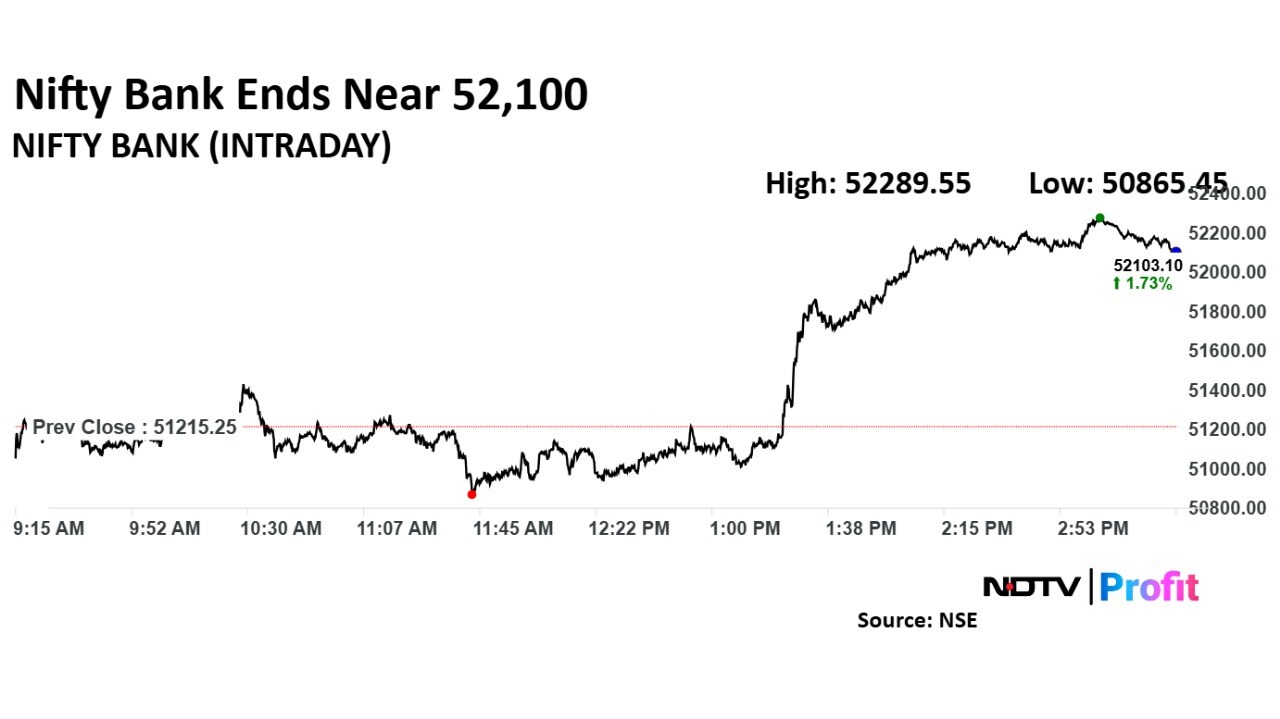

India's benchmark stock indices recovered during the last two hours of trade on Tuesday, recording their best session since Sept. 20, supported by rising banking stocks, even as global market participants await the outcome of the US election.

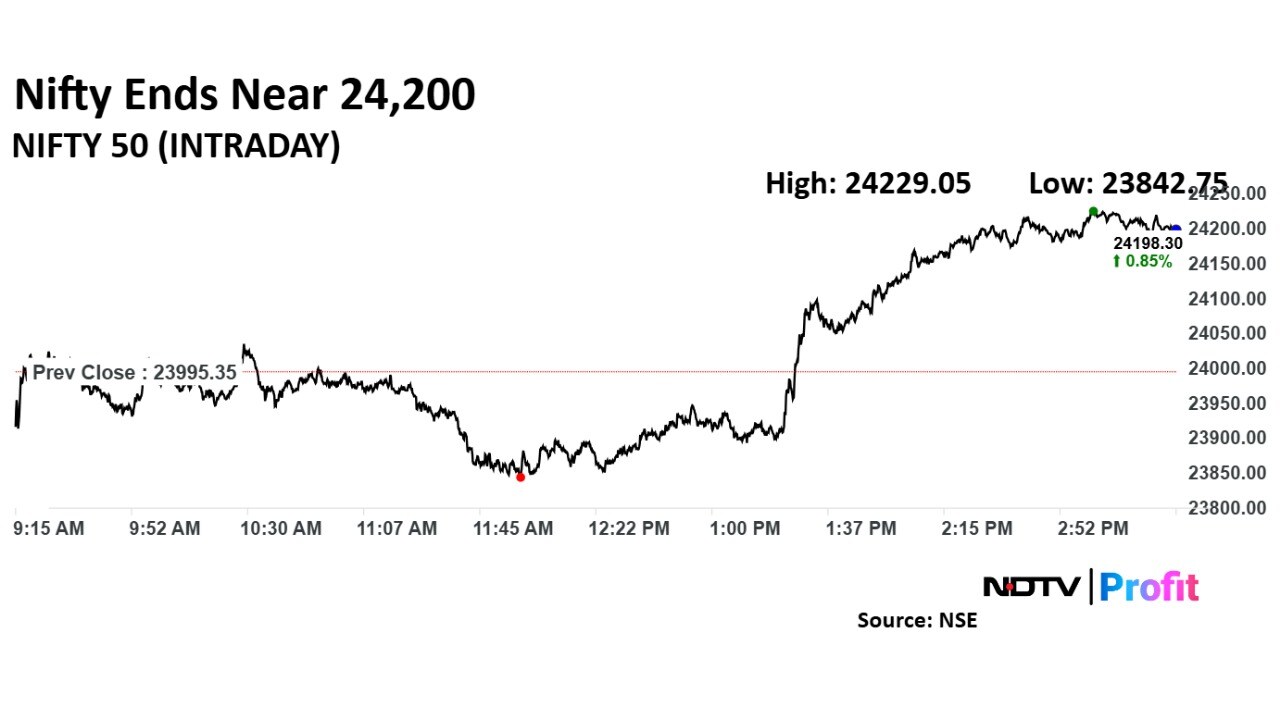

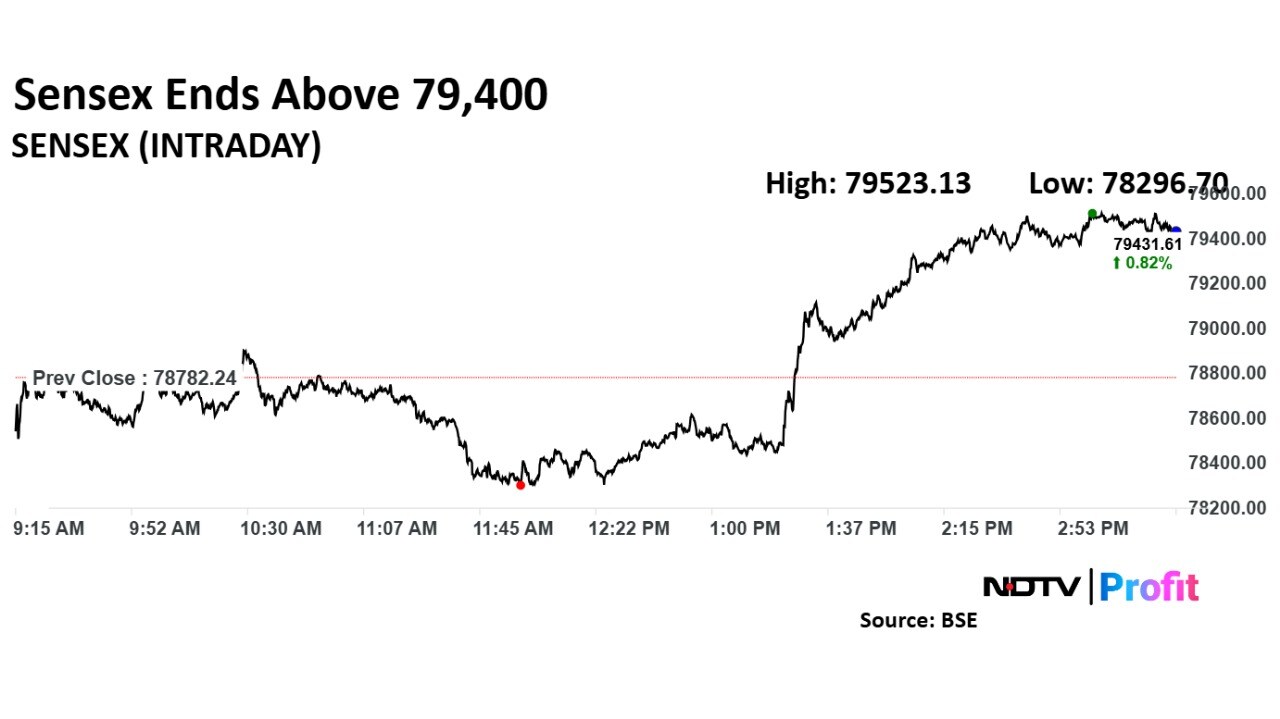

The NSE Nifty 50 ended 0.91%, or 217.95 points, higher at 24213.30, and Sensex ended 0.88%, or 694.39 points, higher at 79476.63. Intraday, both Nifty and Sensex fell as much as 0.6% each.

Market participants now look forward to the US election outcome due tonight, according to Shrisha Acharya, vice president at Anand Rathi Global Finance. The Trump card, coupled with potential Republican control, could shoot US yields higher due to anticipated increases in deficit spending, inflation risks, and potential tax cuts, Acharya said.

On the other hand, Harris' rise has been met with a stock market rally glued on expectations of economic stability and controlled inflation, with more predictable fiscal policy likely to help in a soft landing, he said. "In any case, a contested election, which remains probable, could extend market uncertainty, magnifying volatility across the equity and bond market until the winner stands tall," Acharya said.

"Nifty 50 has formed a Piercing Candlestick pattern coupled with a positive divergence in the RSI and 150DMA support," said Aditya Gaggar, director of Progressive Shares. "As indicated yesterday also, the level of 23,800 will serve as immediate support for Nifty while on the higher side, and the resistance level is shifted higher to 24,370."

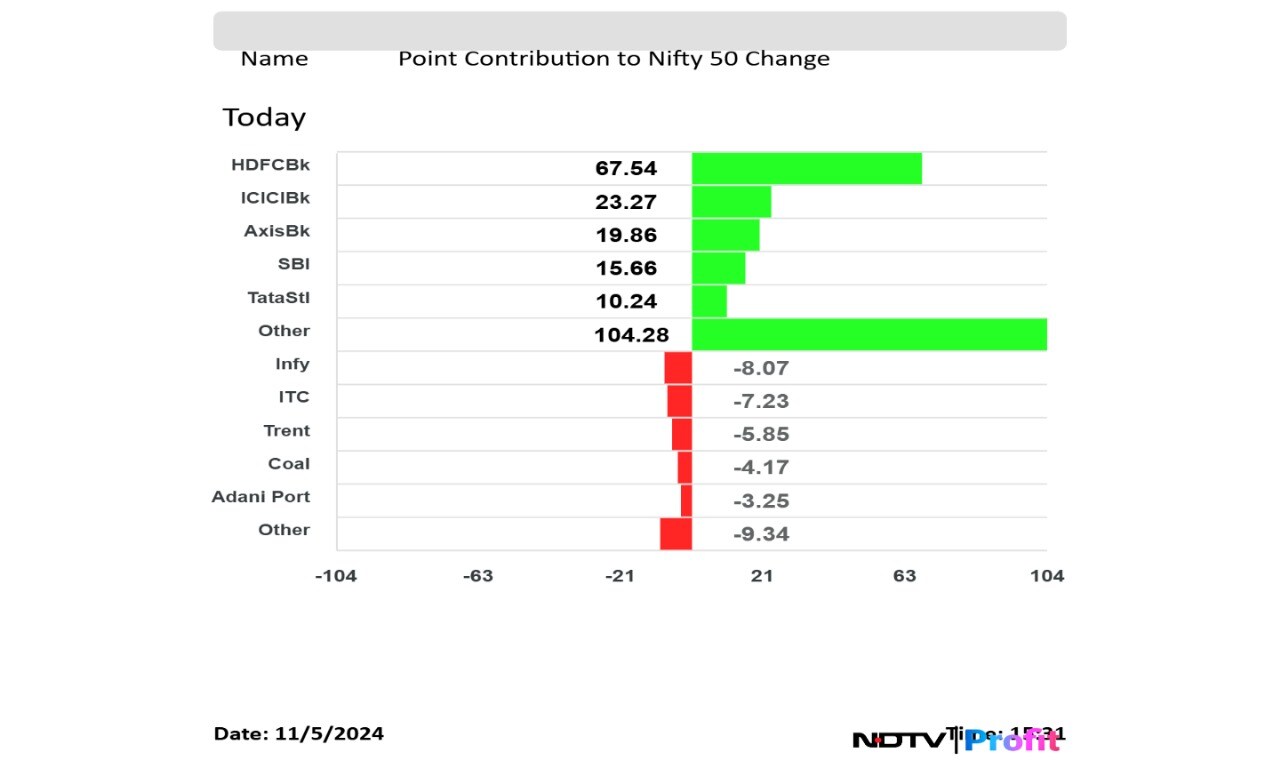

Share prices of HDFC Bank Ltd., ICICI Bank Ltd., Axis Bank Ltd., State Bank Of India, and Tata Steel Ltd. contributed the most to the gains in Nifty.

While those of Infosys Ltd., ITC Ltd., Trent Ltd., Coal India Ltd., and Adani Ports & Special Economic Zone Ltd capped the upside.

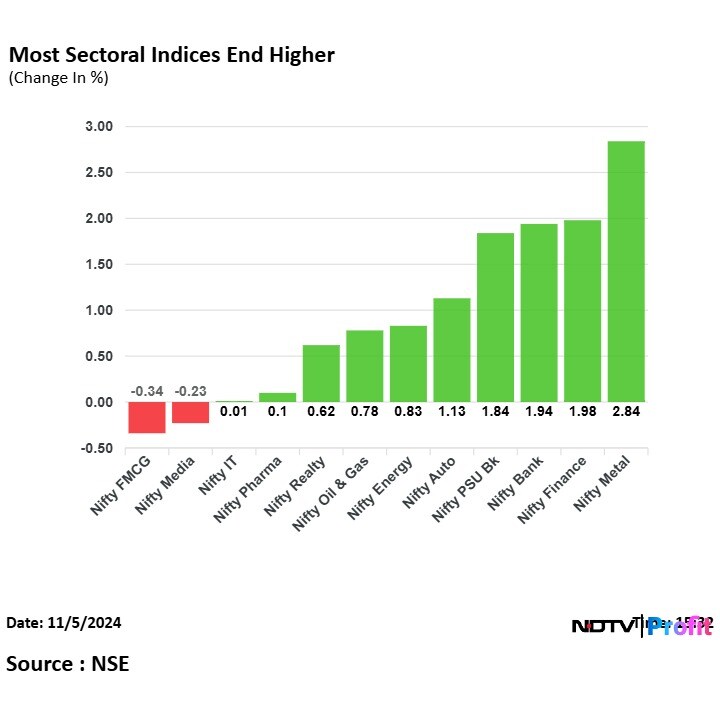

Most sectoral indices ended higher with Nifty Metal rising the most tracking China stimulus.

Broader markets underperformed benchmark indices. The BSE Midcap and Smallcap indices ended 0.48% and 0.41% higher, respectively.

Out of 21 sectors complied by BSE, 16 advanced and five declined. The BSE Metal rose the most, while the BSE Services declined the most.

Market breadth was skewed in favour of buyers. Around 2,472 stocks advanced, 1,478 stocks declined, and 108 stocks remained unchanged on BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.