India's equity benchmark, the NSE Nifty 50, crossed another milestone by scaling past the 24,000 mark on Thursday. The index hit a fresh record for the 36th time this year, and it marked the fastest 1,000-point rally since 2021.

During the session, the Nifty 50 companies' market capitalisation rose by Rs 1.25 lakh crore.

The index's 1,000-point journey lasted 23 sessions starting May 24. The benchmark took 89 trading sessions to reach the 23,000 mark, while it took 63 sessions more than it took to touch the 22,000 mark.

The S&P BSE Sensex also surged 0.65% to another record of 79,186.9 on Thursday. As of 12:17 p.m., Sensex was 502.1 points, or 0.62% higher at 79,176.4. Nifty Bank scaled past the 53,000 mark to a fresh high, led by Kotak Mahindra Bank Ltd. and Axis Bank Ltd.

The market will remain bullish in the near term despite the valuation concerns, and the ongoing momentum has the potential to take the Sensex to 80,000 levels, according to VK Vijayakumar, chief investment strategist at Geojit Financial Services. "A healthy trend in the market is that now the upmove is being led by fundamentally strong large caps in sectors like banking and telecom."

With Reliance Industries Ltd., which had not participated in the rally till Wednesday, joining the bull bandwagon, the rally has the strength to continue, Vijayakumar said.

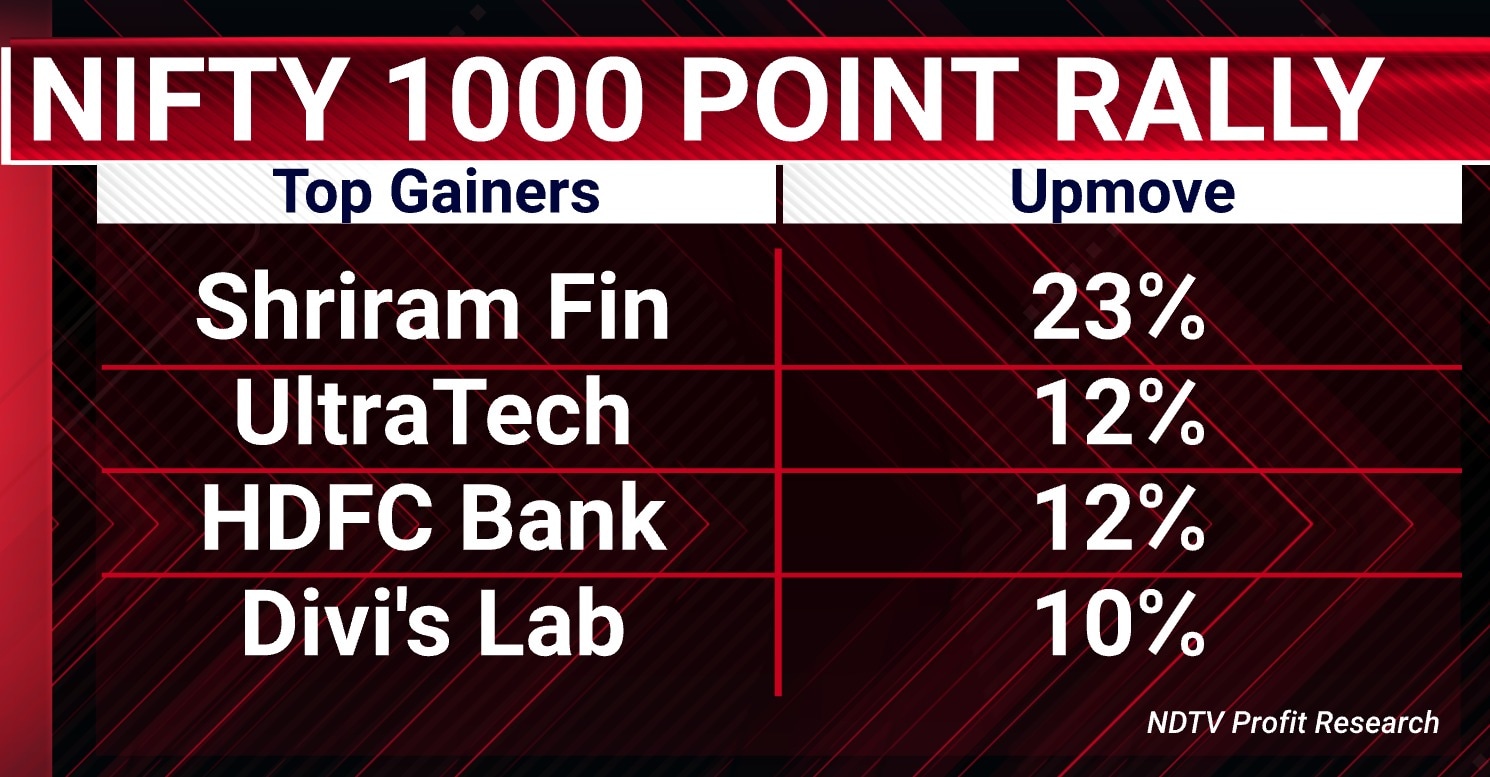

Shares of Shriram Finance Ltd., UltraTech Cements Ltd., HDFC Bank Ltd., Divis Laboratories Ltd. and Axis Bank Ltd. led gains during Nifty's 1,000-point rally. Bharat Petroleum Corp., Coal India Ltd. and Maruti Suzuki India Ltd. were the top laggards.

(Source: NDTV Profit)

However, the index has underperformed its broader peers as well as Nifty Bank during its journey. Compared to a 3.9% rise in the Nifty 50, both the Nifty Bank and the Nifty Smallcap 250 have jumped nearly 8%. The Nifty Midcap 150 has risen nearly 6% during the period.

"Despite the large upsides recently, the downside setup does not look to gain momentum today, with the key marker placed at 23,680," Geojit Financial Services Ltd. said in a note.

As the massive domestic liquidity support for the market continues, there are no potential triggers that can cause a sharp correction in the market, Vijayakumar said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.