The pullback in the NSE Nifty 50 on Monday after last week's selloff provides an opportunity to take long positions even as the election-related nervousness may continue to weigh on sentiments, according to analysts.

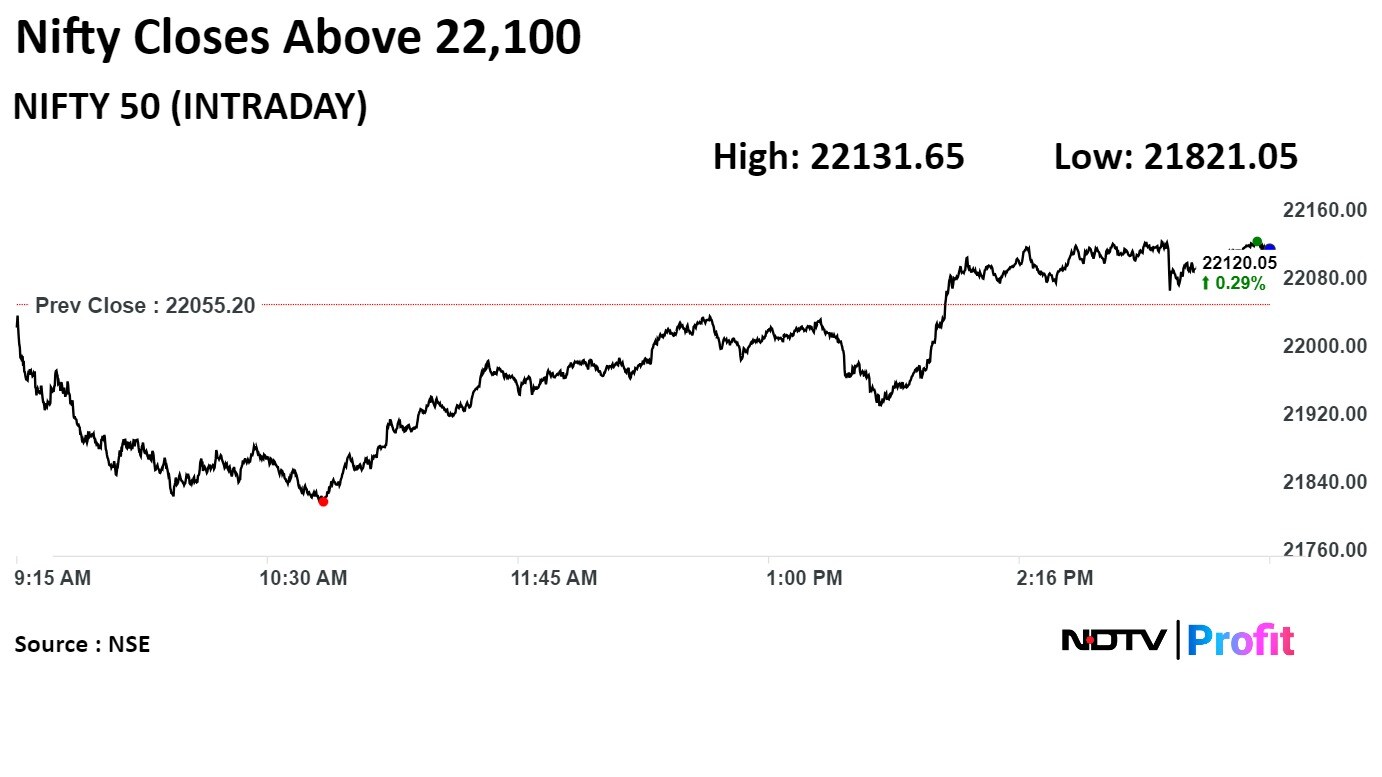

The comments come as the benchmark indices recovered from the day's low to close higher for a second consecutive session. The volatility index hit an intra-day high of 21.48 before closing at 18.47.

"The pullback looks good enough to initiate long positions," Hemen Kapadia, senior vice president of institutional equity at KRChoksey Shares and Securities Pvt., told NDTV Profit. "One gets the feeling that the 1,000-point selloff witnessed in the last few trading sessions has halted."

Kapadia held 21,834 as the important support level for the Nifty. "This warrants selective long positions. But India VIX needs to pull down a bit," he said.

Election-related nervousness will remain till the Lok Sabha polls are over, leading to consolidation in the Nifty in the range of 21,700–22,400, according to Pankaj Pandey, head of research at ICICI Direct.

He pointed to historical trends when the benchmark corrected 6% during the previous general elections. "We are already at about 4%, so possibly more consolidation. Global cues, domestic inflows have been positive, but markets have not been reacting to it," he said.

Watch The Conversation Here

Disclaimer: The views and opinions expressed by the investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.