The Nifty IT rose to its highest level since April 5, 2022, on Friday as all its constituents gained after brokerages turned positive on Infosys Ltd. and Tata Consultancy Services Ltd. following Q3 results.

Various brokerages expressed optimism on IT stocks, but noted that headcount decline suggests that demand is unlikely to recover in the near-term.

Despite reporting a dip in revenues, Infosys Ltd., on the upside, has large deal total client value momentum intact and a strong traction in large deal pipeline, according to Motilal Oswal Financial Services Ltd. HSBC also prefers the IT major, on the back of cheaper valuations and faster growth potential.

For Tata Consultancy Services Ltd., brokerages cited better-than-expected topline results, with decent deal wins. The company's third quarter results were in line with estimates, despite macro headwinds and furloughs weighing a seasonally weak quarter.

The overall demand environment remains positive (barring furlough impact), with strong deal-signing across the board, Motilal Oswal said. The deal ramp-ups and execution has been timely with few exceptions, and the revenue conversion remains strong.

Nomura's earnings per share estimate for TCS were 2–5% lower than consensus. The brokerage maintained a 'reduce' rating, but marginally raised the target price on the stock to Rs 3,160 from Rs 3,120 earlier.

IT stocks contributed over 150 points to the 200 points that the NSE Nifty 50 gained to hit a new lifetime high on Friday.

"Even though there is no positive message from the management commentary, the market is likely to respond positively to the absence of any bad news," said VK Vijayakumar, chief investment strategist at Geojit Financial Services Ltd. "But the upside for TCS and Infosys will be limited, since it will take time for clarity to emerge on the prospects for the sector in FY25."

Third quarter results for Wipro Ltd. and HCL Technologies Ltd. are due later in the day.

Share prices of Coforge Ltd., HCL Technologies Ltd., and Persistent Systems Pvt. hit lifetime highs at Rs 6,596 apiece, Rs 1,537.90 apiece, and Rs 7,740.90 apiece, respectively, while that of L&T Technology Services Ltd. hit a 52-week high of Rs 5,540 apiece.

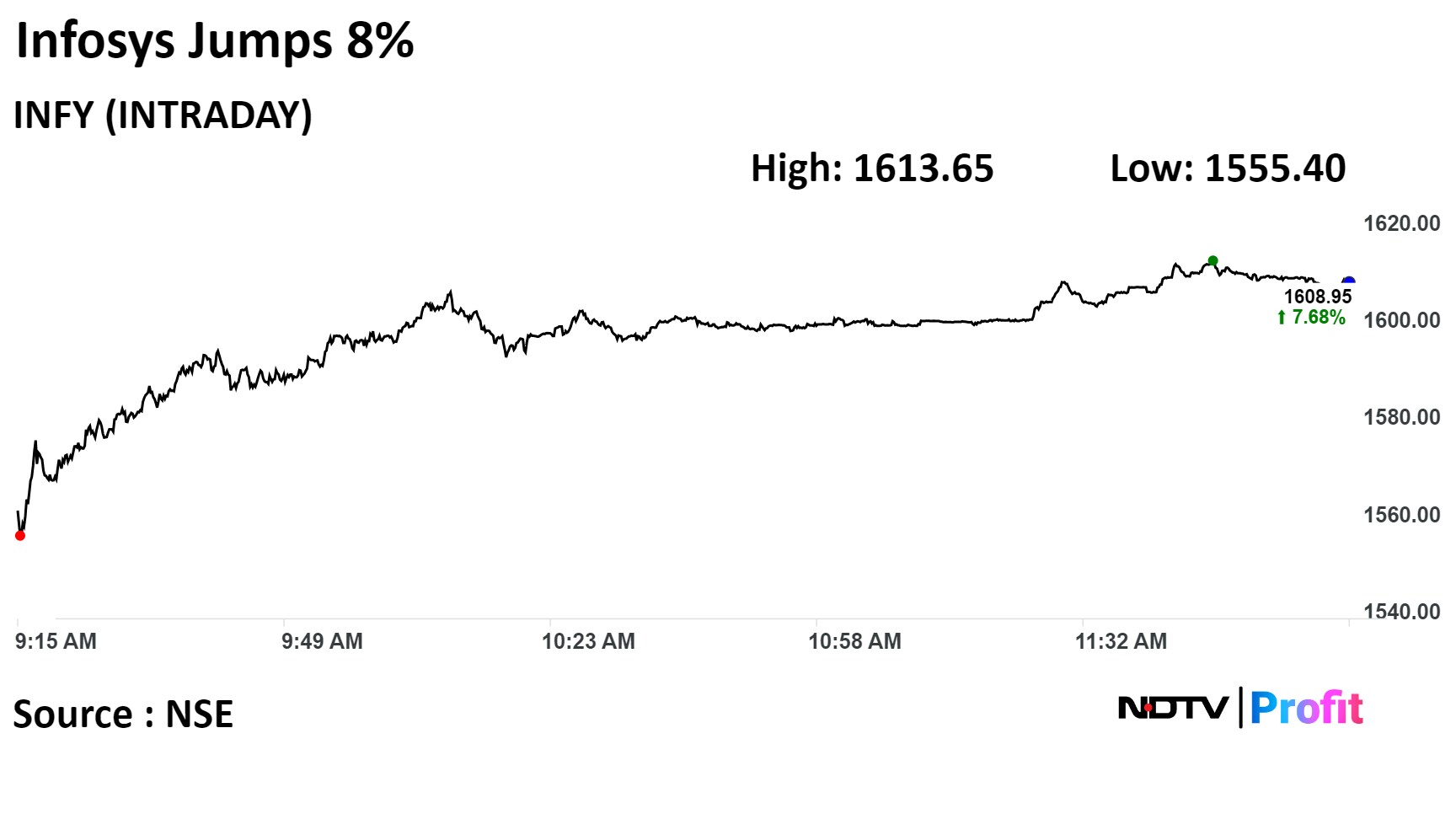

Shares of Infosys Ltd. rose over 7% as brokerages see growth potential on the back of new deal wins, even as its third-quarter profit missed analysts' estimates.

The company is likely to see strong traction in the large deal pipeline despite an adverse demand environment, Motilal Oswal said in a report. The brokerage maintained a 'buy' rating on Infosys with a price target of Rs 1,750 apiece.

Infosys Q3 Results: Key Highlights (QoQ)

Revenue down 0.44% at Rs 38,821 crore (Bloomberg estimate: Rs 38,318 crore).

Ebit down 3.78% at Rs 7,961 crore (Bloomberg estimate: Rs 7,929.5 crore).

Ebit margin at 20.50% versus 21.21% (Bloomberg estimate: 20.50%).

Net profit down 1.64% at Rs 6,113 crore (Bloomberg estimate: Rs 6,628 crore).

Shares of Infosys rose as much as 8%, highest since Feb. 10, 2023, before paring gains to trade 7.63% higher at 12:09 p.m. This compares to a 0.8% advance in the NSE Nifty 50.

The stock has risen 8.62% in the last twelve months. The relative strength index was at 64.09.

Of the 44 analysts tracking the company, 27 maintain a 'buy' rating, nine recommend a 'hold,' and eight suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 1.5%.

TCS Q3 Results: Key Highlights (QoQ)

Revenue up 1.49% at Rs 60,583 crore (Bloomberg estimate: Rs 60,109 crore).

Ebit up 4.6% at Rs 15,155 crore (Bloomberg estimate: Rs 14,787 crore).

Ebit margin at 25.01% (Bloomberg estimate: 25.39%).

Net profit down 2.5% at Rs 11,097 crore (Bloomberg estimate: Rs 11,498 crore).

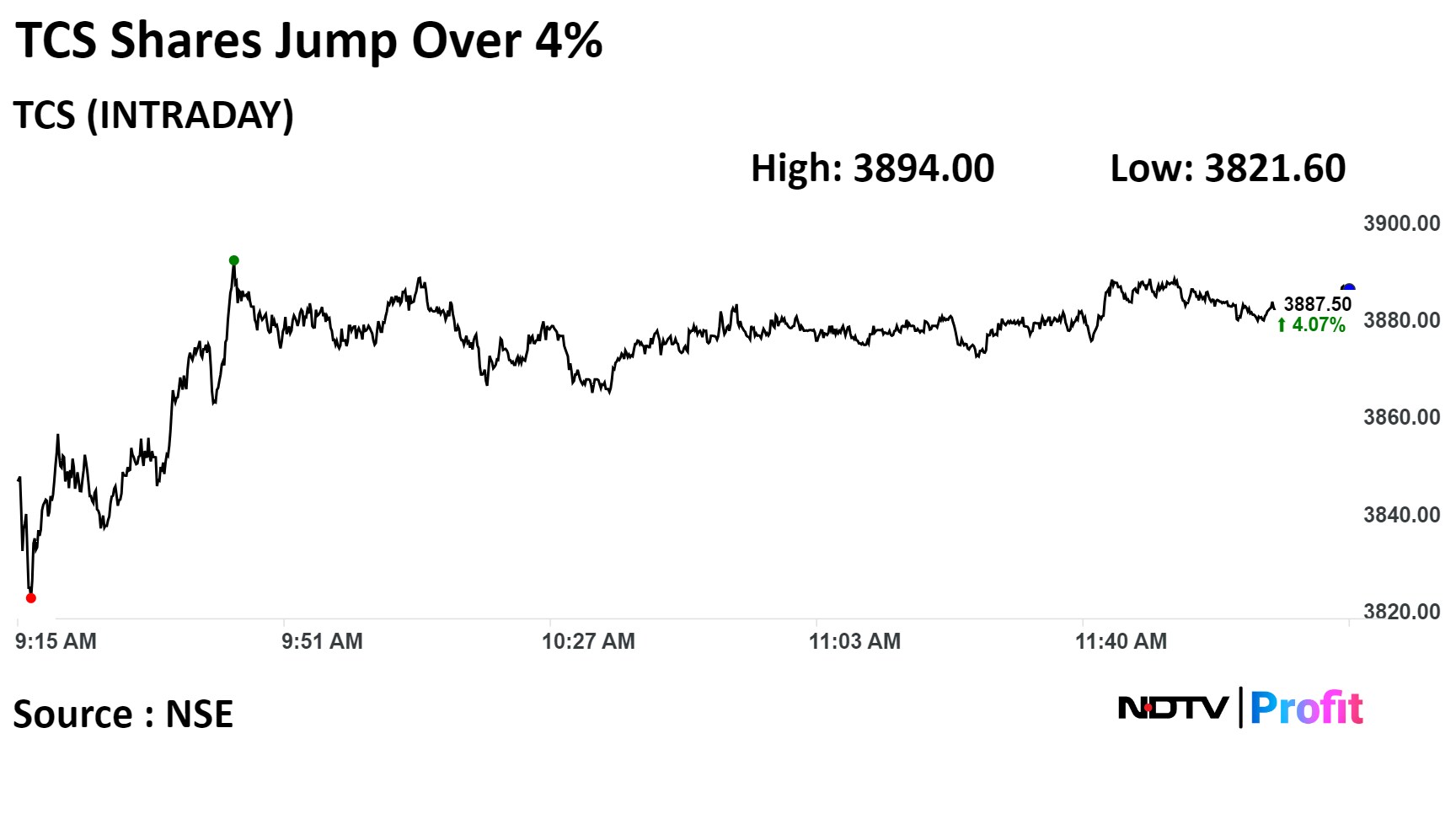

Shares of the Tata company advanced 4.24% intraday, the most since Dec. 15, 2023. They pared some gains to trade 4.07% higher at 12:18 p.m., compared to a 0.86% advance in the NSE Nifty 50.

The stock has risen 16.59% in the last twelve months. The relative strength index was at 65.43.

Of the 44 analysts tracking the company, 24 maintain a 'buy' rating, 11 recommend a 'hold,' and nine suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 1.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.