Shares of Indian information technology companies surged tracking tech surge in the U.S. as a rate cut pivot by the U.S. Federal Reserve boosts expectations of higher client spending.

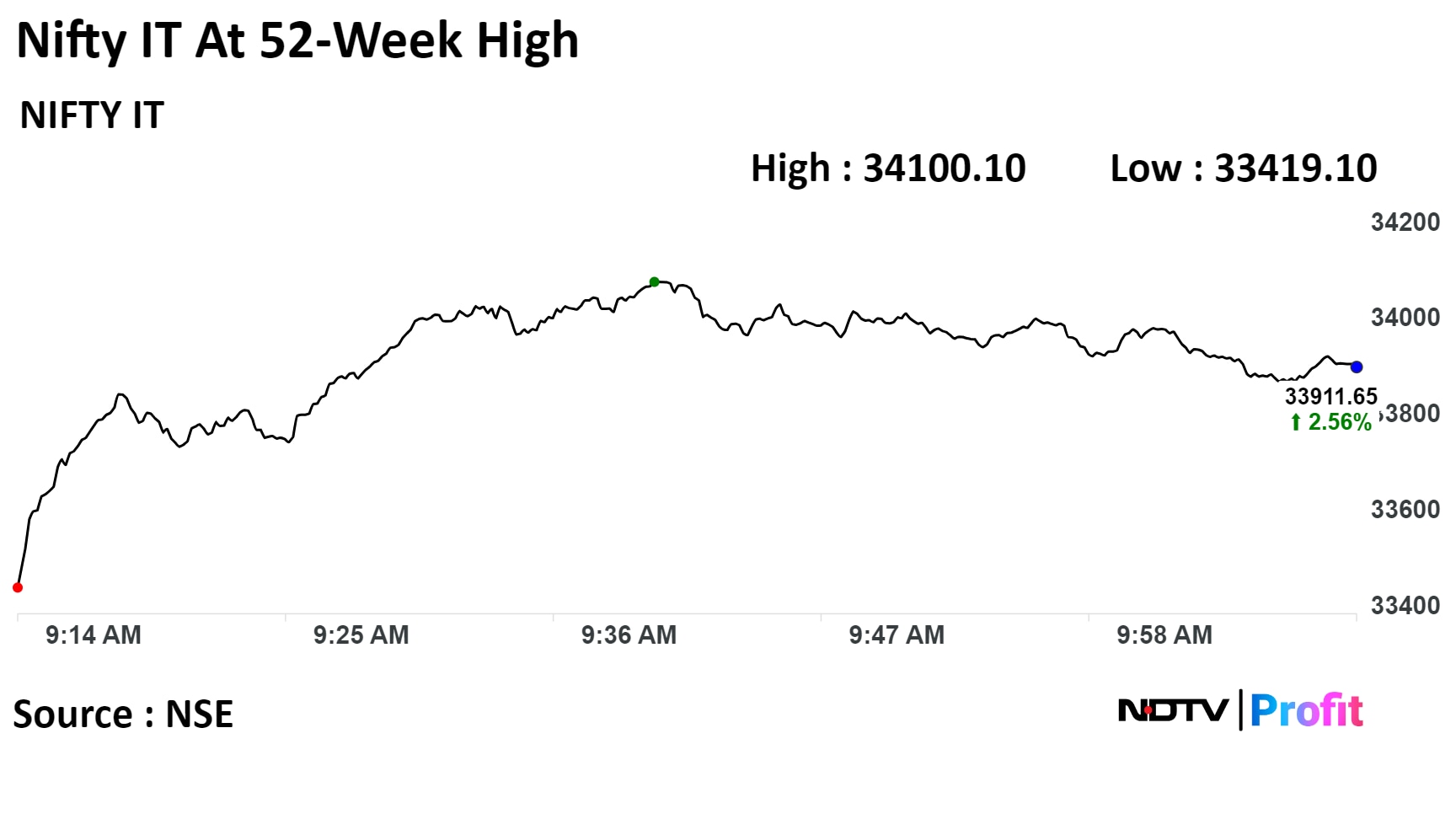

The Nifty IT index surged over 3% to a 52-week high on Thursday as the Fed guided for three rate cuts in 2024.

U.S. tech stocks zoomed and Nasdaq closed 1.8% higher. Slowing inflation and rate cut bets boosted sentiment for the Indian IT industry as the U.S. is its biggest market.

Mphasis, Coforge Lead IT Gains

Mphasis Ltd. was the biggest gainer among IT stocks, rising as much as 6.94% in morning trading. HCL Technologies Ltd. jumped 3.6% to a life-time high. LTMindtree Ltd. jumped as much as 3.36% to a 20-month high, while the Wipro Ltd. rose 2.94% to a three-month high.

The U.S. Federal Reserve kept its benchmark Federal Fund rates unchanged at current level of 5.25–5.50%, a 22-year high at the end of its two-day policy meeting on Wednesday.

For the first time, U.S. policymakers didn't write down any signals for further rate hikes since March 2021, Bloomberg reported. Fed projections pegged the median rate in 2024 at 4.6%, down from 5.1%, implying three cuts of 25 basis points each.

The dovish stance came in the backdrop of U.S. inflation slowing down. The U.S. CPI stood at 3.1% on year in November.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.