The selloff in equities on Wednesday has to do with monthly contract expiry-related action due on Thursday and the benchmark Nifty 50 can be volatile around the 22,000 level, according to Akshay P. Bhagwat of JM Financial Ltd.

"There has been a good selloff in the market, which has to do with expiry-related action. 22,000 is the pivotal zone, where a lot of put positions were seen a day prior," Bhagwat, a senior vice president at the investment firm, told NDTV Profit.

Currently, there is a lot of open interest in call and put options. "Tomorrow is the expiry date for the Nifty and all this volatility is about whether it holds $22,000 or not," he said.

Directionally, Bhagwat said 22,100 is the key resistance for Thursday. "There is a good chance the market may head below that to head for the recent low of 21,850."

The benchmark equity indices closed over 1% lower as Reliance Industries Ltd. and bank stocks dragged the most.

The NSE Nifty 50 ended 247.20 points, or 1.11% down at 21,951.15 and the S&P BSE Sensex closed 790.34 points, or 1.08% lower at 72,304.88.

Nifty logged its biggest loss in 25 sessions, while Sensex recorded its biggest fall in 21 sessions.

The market can go through a "dull face," but there is no reason for a deeper correction on global cues or a satisfactory earnings season, said Hemang Jani, equity strategist at Motilal Oswal Financial Services Ltd. "This is a phase of consolidation."

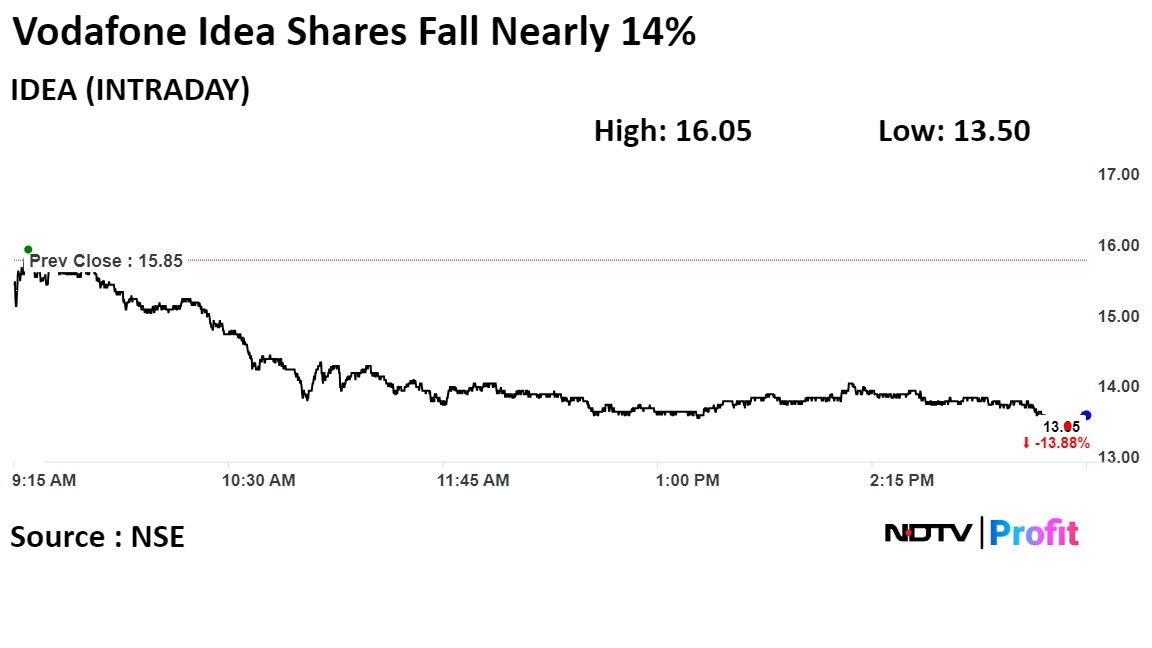

Vodafone Idea Ltd.'s recent plan to raise Rs 45,000 crore via a mix of equity and debt will not be a permanent solution for the company's woes, he said. "Given the size of the amount, if there are no big investors, it will be a tough order for the plan."

The trade level for the telecom operator was at support level on Wednesday. "The entire momentum buildup was out today. It will consolidate if it holds on at the support level. The stoploss is at Rs 12.5," Bhagwat said.

On the contrary, Indus Tower Ltd. has given a "strong breakout" on a weekly basis. In the short term, the stock can head towards the upside level of Rs 260–265, he said.

Bhagwat has a bullish call on Tata Motors Ltd. with a target of Rs 997-1,012 and a stoploss at Rs 942.

Asian Paints Ltd. has a "bearish setup" with a strong negative build-up on the short side. The target is Rs 2,650–2,700, with a stop loss of Rs 2,905.

The views and opinions expressed by the investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Watch the full conversation here:

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.