The NSE Nifty 50 is on the cusp of breaking out of a 1,000-point range in the coming sessions, according to Hemen Kapadia.

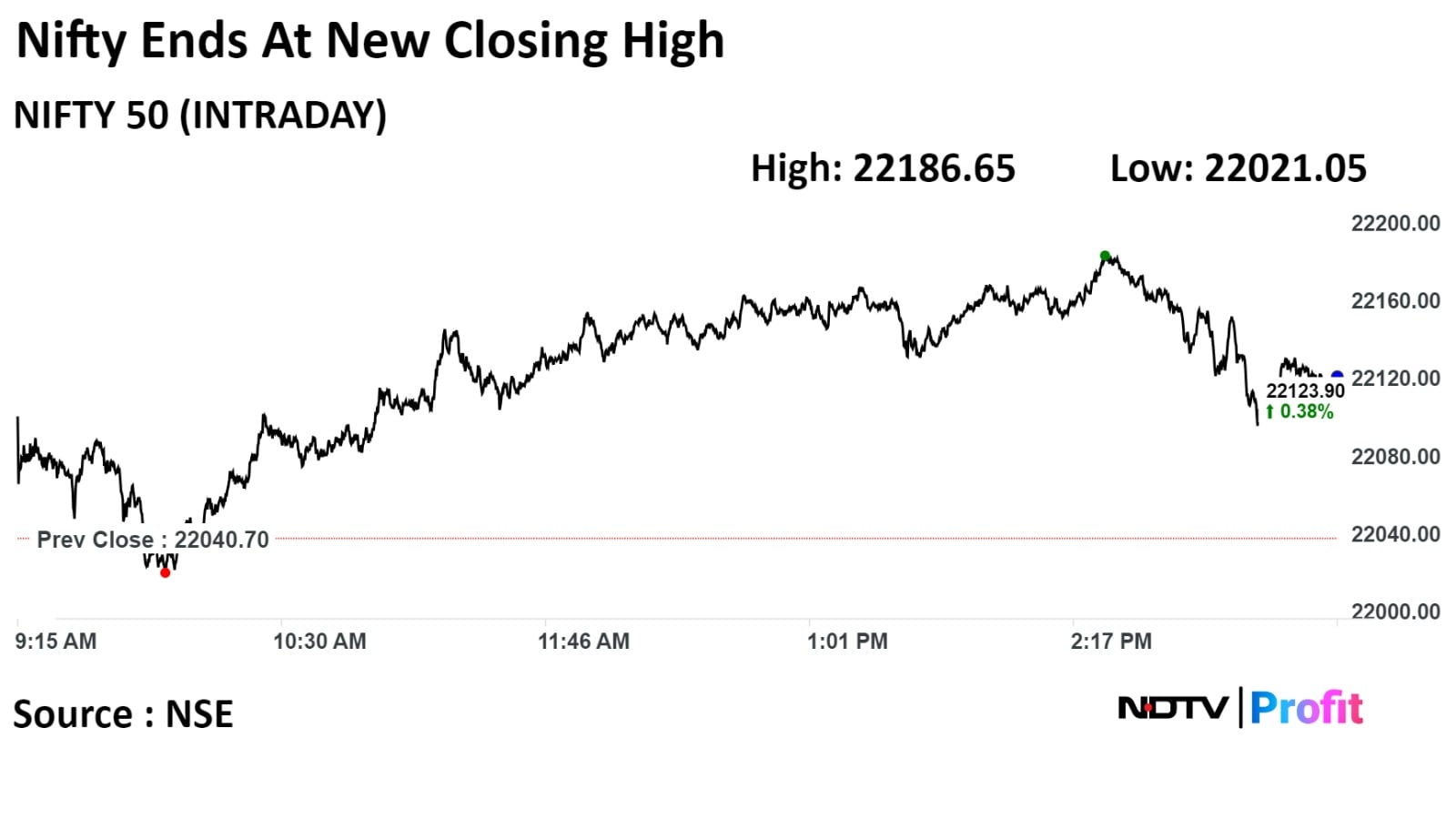

The index hit a fresh all-time high intraday on Monday.

"We are on the cusp of breaking out of the 21,125 and 22,127 ranges (for Nifty). The setup seems promising, and mechanical indicators are supporting it after five weeks. If we break out, the 22,800 level is coming," said Kapadia, senior vice president of institutional equity at KR Choksey Stocks & Securities Pvt.

The S&P BSE Sensex closed 281.52 points, or 0.39% higher, at 72,708.16, while the NSE Nifty 50 gained 81.55 points, or 0.37%, to end at 22,122.25.

Nifty failed to sustain above the pivotal high of 21,125 and pared 70 points from the day's high in the final hour, according to Avdhut Bagkar, technical and derivatives analyst at StoxBox. With this, the price action closed on an indecisive note at a relatively lower volume, he said.

The Indian stock market will hit the $5 trillion mark before the general elections this year, which will create a new euphoria, according to G. Chokkalingam, founder and managing director of Equinomics Research Pvt.

"Those who are holding on stocks showing momentum now in small and mid-caps can continue to hold for another month. The (benchmark) index may rise 2-3%, but a broad-based rally can take the total market cap to $5 trillion," he said.

Public sector enterprises have outperformed the benchmark, said Dhananjay Sinha, director and head of research, strategy and economics, Systematix Group.

"The consensus view is that valuations will still remain despite the outperformance. The electoral mandate of the general elections has been priced in. A continuity of the BJP is seen as positive for PSEs," he said.

Disclaimer: The views and opinions expressed by the investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Watch the full conversation here:

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.