India's benchmark stock indices extended gains through midday on Friday, with the NSE Nifty 50 hitting a fresh record high, supported by sharp gains in IT stocks.

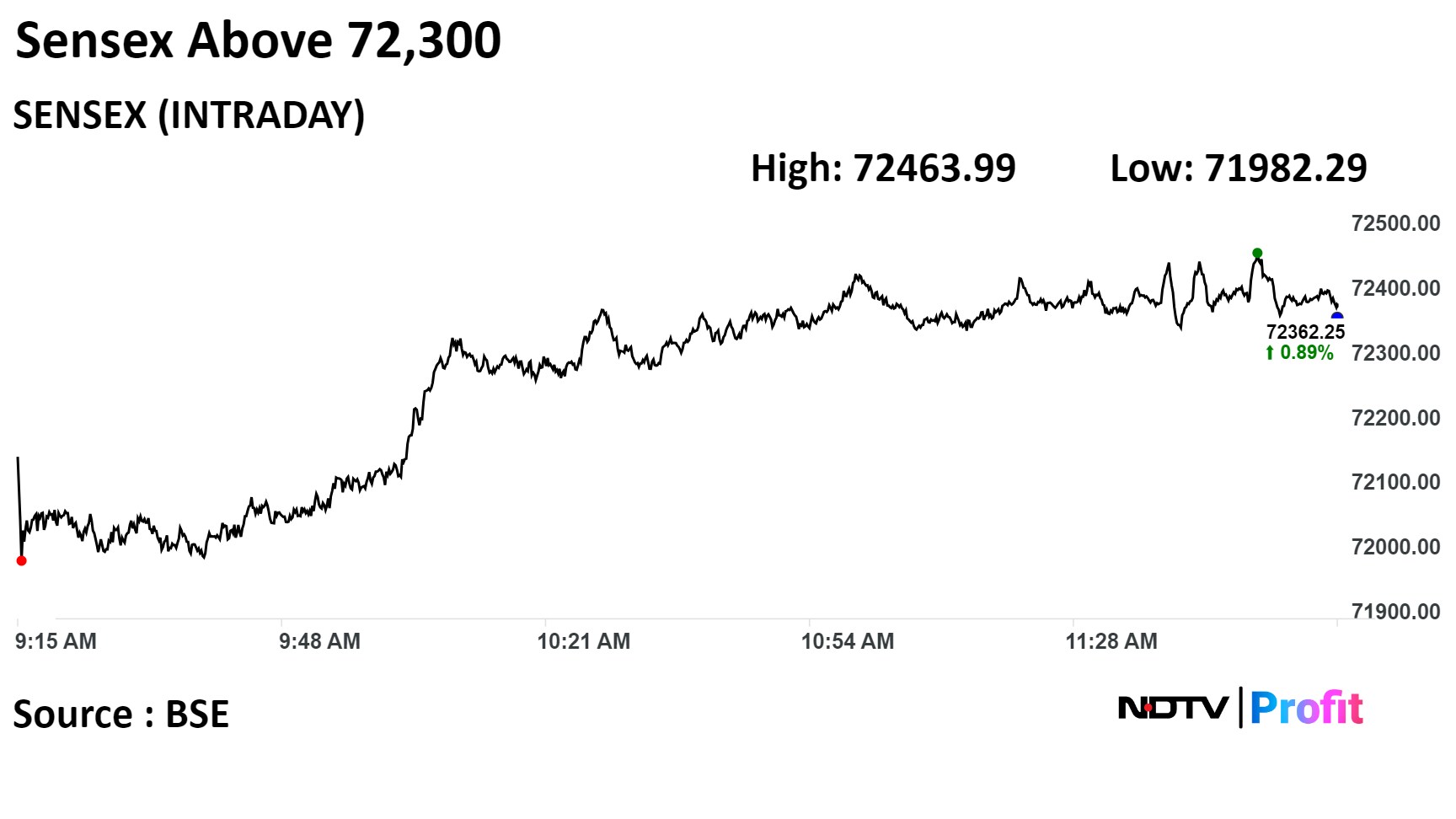

As of 12:11 p.m., the benchmark NSE Nifty 50 surged 0.81%, or 176.25 points, to 21,823.45, while the S&P BSE Sensex gained 0.82%, or 589.47 points, to 72,310.65.

IT stocks are trading at a near-two-year high, led by gains in the shares of Infosys Ltd. and Tata Consultancy Services Ltd. after the companies posted their third-quarter earnings.

The Nifty 50 index touched a fresh life-time high of 21,848.20, while the Sensex hit an intraday high of 72,454.10.

"Resilience in IT stocks and strength in Reliance Industries Ltd. will enable Nifty to consolidate around 21,600 levels. HDFC Bank Ltd. results on Jan. 16 will be keenly watched by the market for cues in the direction of Bank Nifty," said VK Vijayakumar, chief investment strategist, Geojit Financial Services.

The U.S. CPI inflation inching up to 3.4% YoY is slightly negative from the global equity market perspective. The rate cut expected from the Fed in March this year may not materialise. It is likely to be postponed to June, and, therefore, rate cuts by the MPC will also get delayed," he said.

Infosys Ltd, Tata Consultancy Services Ltd, ICICI Bank Ltd, HCL Technologies Ltd, and Reliance Industries Ltd contributed positively to the Nifty.

Mahindra & Mahindra Ltd, Asian Paints Ltd, Titan Company Ltd, Bajaj Finserv Ltd, and Cipla Ltd weighed on the index.

On NSE, 10 sectors advanced, with the Nifty IT jumping 5.00% to emerge as the top gainer among sectoral indices. Around two sectors fell, with the Nifty Auto fell 0.71% to become the top loser.

Broader markets underperformed benchmark indices. The S&P BSE Midcap rose 0.30% while the S&P BSE Smallcap gained 0.67%. On BSE, 18 out of 20 sectors advanced, while two declined.

The S&P BSE surged 5.08% to become the top performing sector, while both the S&P BSE Healthcare and Consumer Durable sectors declined 0.24% to become the worst performing sectors.

The market breadth was skewed in favour of the buyers. Around 2201 shares rose, 1496 shares declined, and 124 remained unchanged on BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.