The Nifty 50 index's resistance level is seen at 24,600–24,700, while support is seen at 24,378, according to analysts. The Nifty 50 ended the day on a negative note at 24,436, signalling weakness in the broader market. The INDIA VIX, which measures market volatility, climbed 1.31% to 14.59, reflecting increased uncertainty.

The Nifty 50 has formed an inverted hammer candle on the daily chart, which follows the breakdown of a head and shoulder pattern. "This candlestick formation typically indicates strength," according to Hrishikesh Yedve, AVP Technical and Derivatives Research at Asit C. Mehta Investment Intermediates Ltd.

"The 24,378 level is crucial short-term support. If Nifty holds above this, we might witness a pullback towards the 24,600–24,700 zone, which aligns with the neckline of the head and shoulder pattern," he said.

Yedve further warned that if the Nifty breaks below 24,370, the index could drift lower towards the 24,200–24,000 levels. "Traders are advised to use any bounce to book profits, considering the overall weakness in the market," he noted.

"Considering the price and momentum indicator, we expect the rangebound price action to continue. The range is likely to be 24400–24750. Sell on rallies to 24680–24750 is the preferred trading strategy for the target of 24200–24000," according to Jatin Gedia, Technical Research Analyst at Sharekhan by BNP Paribas.

"We expect markets to remain range-bound with stock-specific action due to the ongoing quarterly results season," said Siddhartha Khemka, Head of Research, Wealth Management at Motilal Oswal Financial Services Ltd.

The Bank Nifty also opened with a gap down but found support near its 100-DEMA at 51,100, which spurred buying interest. Despite this, the index closed the day relatively flat at 51,239.

"On the daily scale, Bank Nifty also formed an inverted hammer candle near its 100-DEMA support, signalling strength. The 51,000–51,100 range offers solid short-term support. As long as Bank Nifty holds above this range, a pullback rally is possible. However, a sustained break below 51,000 could trigger further downside," Yedve commented on the Bank Nifty's technical position.

F&O Action

The Nifty October futures were down by 0.21% to 24,487 at a premium of 52 points, with the open interest down by 1.7%.

The Nifty Bank October futures were down by 0.14% to 51,352 at a premium of 113 points, while its open interest was down 6.5%.

The open interest distribution for the Nifty 50 Oct. 24 expiry series indicated most activity at 25,000 call strikes, with the 24,000 put strikes having maximum open interest.

For the Bank Nifty options expiry on Oct. 30, the maximum call open interest was at 62,000 and the maximum put open interest was at 51,000.

FII/DII Activity

Overseas investors remained net sellers of Indian equities for the 18th consecutive session on Wednesday, while domestic institutional investors stayed net buyers for the 22nd straight session.

The FPIs offloaded stocks worth Rs 5.685.7 crore, while DIIs bought stocks worth Rs 6,039.9 crore, according to provisional data from the National Stock Exchange.

Market Recap

The NSE Nifty 50 and the BSE Sensex closed lower for the third consecutive day on Wednesday to end at their lowest level since Aug. 14 again amid quarterly earnings releases. The indices saw a volatile session as they gained as much as 0.5% during the day and fell as much as 0.4% as well to finally close a little lower.

The Nifty 50 closed 36.60 points or 0.15%, down at 24,435.50 and the Sensex ended 138.74 points or 0.17%, lower at 80,081.98.

Major Stocks In The News

Hindustan Unilever Ltd.: The company's second-quarter profit fell 2.3% year-on-year, meeting analysts' estimates. Apart from that, HUL's board has given its nod for the separation of the company's ice cream business, which does not significantly contribute to profitability.

GMR Group Ltd.: GMR Group, the parent of GMR Airports Ltd., on Wednesday announced that it has secured funding of Rs 6,300 crore from the Abu Dhabi Investment Authority.

Maruti Suzuki India Ltd.: The company that operates two plants in Haryana has received an upheld tax demand of Rs 139.3 crore from the Haryana GST Appeals Authority.

Piramal Pharma Ltd.: The pharmaceutical company's consolidated net profit jumped over fourfold in the second quarter of the current financial year but still missed analysts' estimates.

Adani Power Ltd.: The company's board to consider raising funds for not more than Rs 5,000 crore via public issue or private placement of non-convertible debentures in one or more tranches on Oct. 28.

Global Cues

Stocks in the Asia-Pacific region traded lower during Thursday's opening following a fall in Wall Street as traders trimmed rate-cut bets by the US Federal Reserve.

Australia's S&P ASX 200 was 18 points, or 0.22%, lower at 8,198, while the Japanese Nikkei 225 was down 292 points, or 0.76%, at 37,781 as of 5:50 a.m. Futures contracts pointed at a negative start for stocks in Hong Kong and China.

On Wednesday, the Japanese yen fell to its weakest level against the dollar in almost three months, reinforcing bets that the central bank will intervene to support the currency.

Elsewhere, stocks in the US extended their losses while bond yields rose as traders cut down the magnitude of rate cu by the Fed. Swap traders are less than 100% certain of rate cuts over the two remaining policy meetings this year, Bloomberg News reported.

The yield on the 10-year Treasury yield saw another session of advance to 4.24%, posting a similar rise seen during 1995, when the erstwhile Fed Chair Alan Greenspan started cutting interest rates to engineer a soft landing.

Brent crude was trading 0.53% higher at $75.36 a barrel as of 6:07 a.m. IST. West Texas Intermediate was up 0.58% at $71.18.

Key Levels

US Dollar Index at 104.43.

US 10-year bond yield at 4.23%.

Brent crude up 0.56% at $75.38 per barrel.

Bitcoin was up 0.65% at $67,021.94

Gold spot was up 0.19% at $2,720.81

Money Market

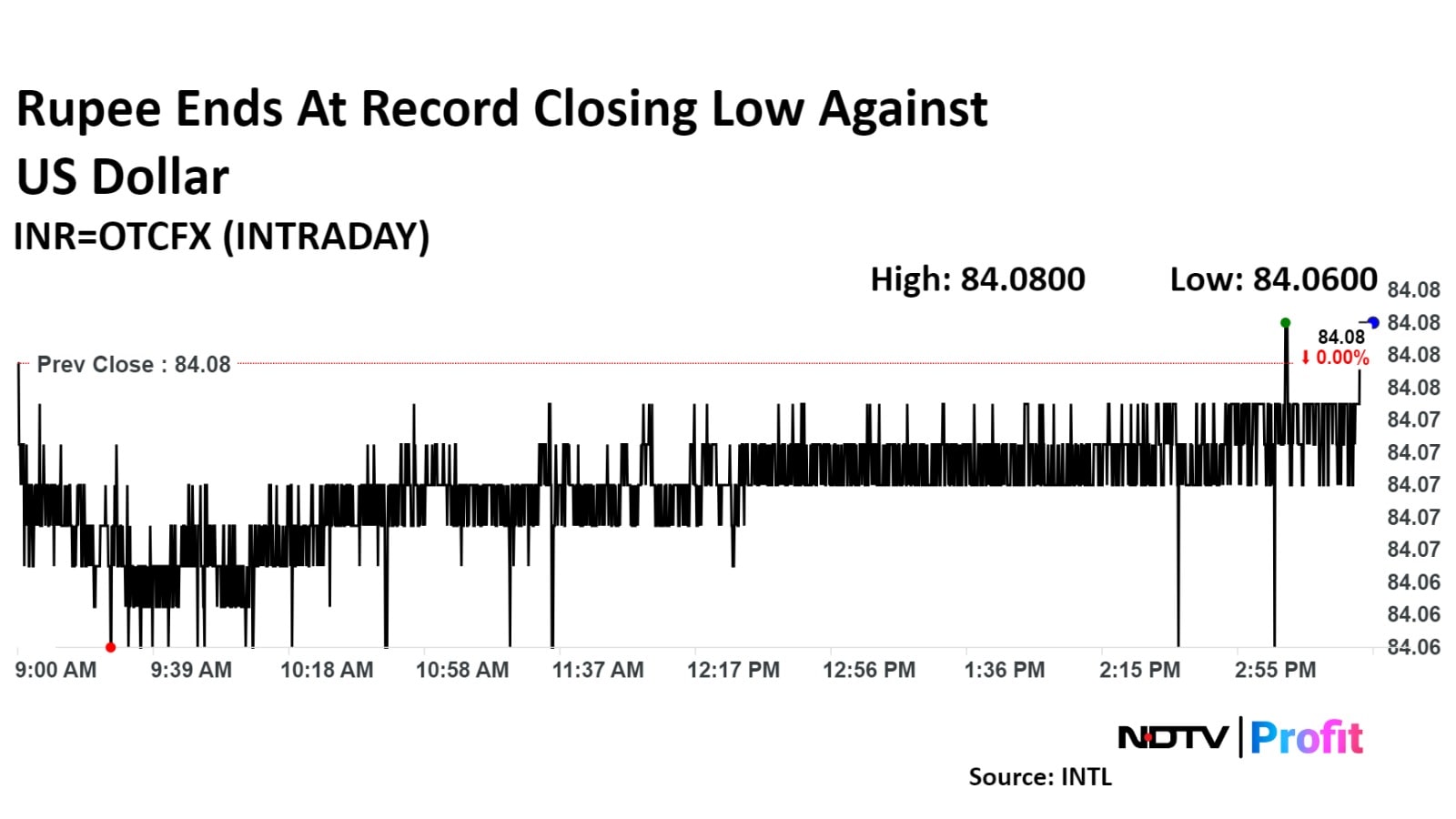

The Indian rupee closed at a record closing low against the US dollar on Wednesday as the greenback strengthened globally.

The local currency ended at Rs 84.082 as compared to the previous day's close of Rs 84.076. Intraday, it weakened to an all-time low of Rs 84.085.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.