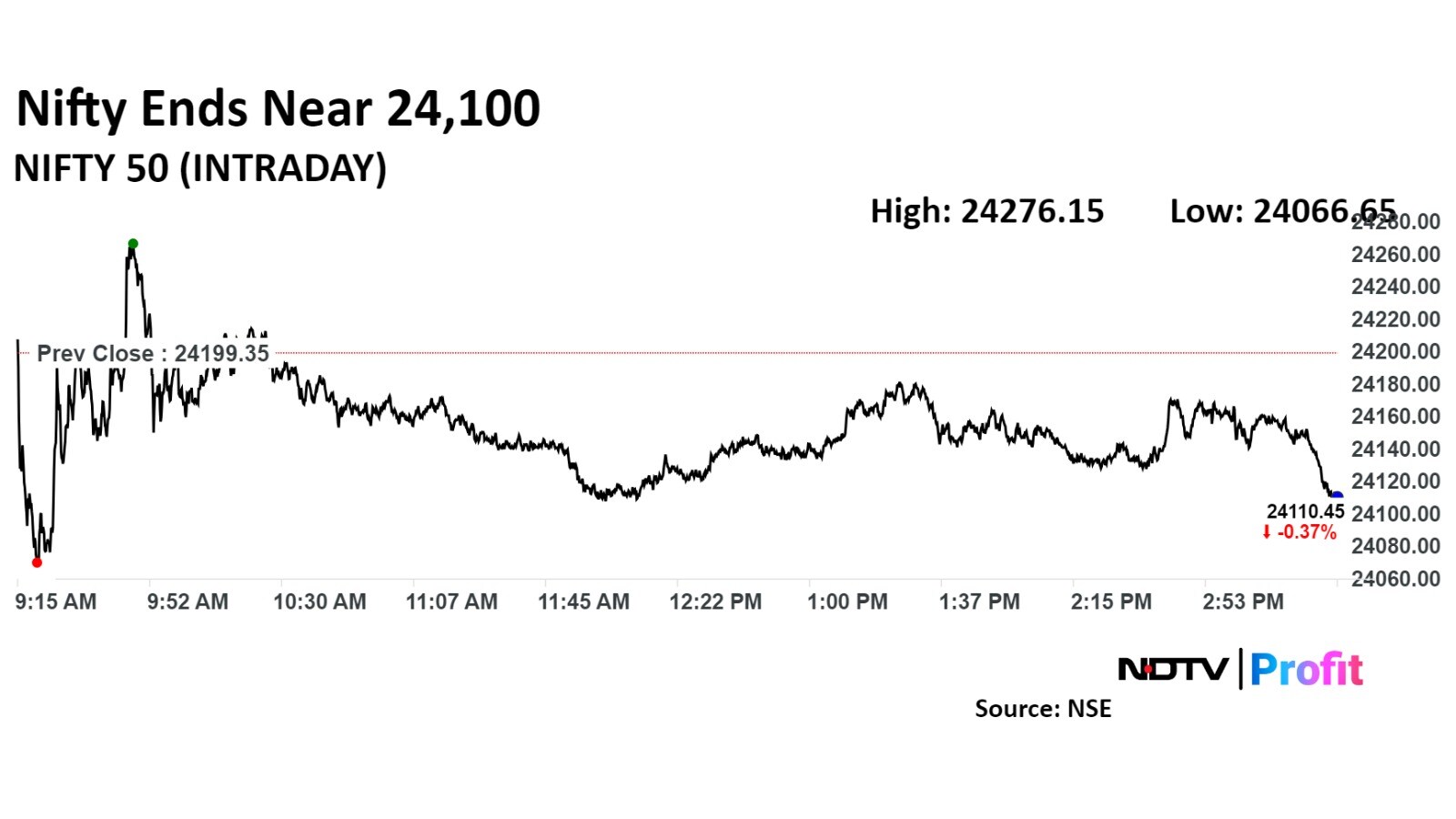

NSE Nifty 50, which closed lower on Friday, faces key support at 23,800 level, according to analysts. On the upper side, the frontline index faces resistance at 24,700, they said.

"In the immediate term, we expect the index will consolidate in the range of 23,800 to 24,700. A decisive breakout on either side will determine the next direction of the index. Until then, traders should aim to buy near support and sell near resistance," said Hrishikesh Yedve, assistant vice president of technical and derivatives research at Asit C Mehta Investment Interrmediates Ltd.

Technically, on a daily basis, the index formed a red candle, indicating weakness, according to Yedve. "Thus, on the higher side, the index's initial hurdle will be around 24,500, followed by 24,700," he added.

Deepak Jasani, head of retail research at HDFC Securities Ltd., sees the next lower support for Nifty 50 at around 23,800 levels. The immediate resistance is placed at 24,537 levels, he said.

"The street view suggests that the story for Indian stocks is likely to be driven by domestic consumption and investment trends despite a 25-basis-point rate cut by the US Federal Reserve," according to Akshay Chinchalkar, head of research at Axis Securities.

In terms of local equities, a wave of foreign selling and underwhelming second-quarter earnings have led to an 8% decline in the Nifty. However, the medium-term trend remains stable, with the level of 23,800 acting as support on the downside, he said.

Bank Nifty, Yedve observed, has been consolidating around the range of 50,500 to 52,580 over the last few weeks. The index has forming higher lows but unable to cross the barrier of 52,580, he said.

"If the index sustains above 52,580, only then a fresh up move could be possible. Otherwise, the index will continue its consolidation," the analyst added.

FII/DII Activity

Overseas investors remained net sellers of Indian equities for the 30th consecutive session on Friday, while domestic institutional investors also stayed net buyers.

Foreign portfolio investors sold stocks worth Rs 3,404 crore, according to provisional data from the National Stock Exchange. The DIIs mopped up stocks worth approximately Rs 1,748.4 crore.

F&O Cues

The Nifty November futures were down 0.43% to 24,919 at a premium of 71 points, with the open interest down 1.22%.

The Nifty Bank November futures were down by 0.84% to 51,788 at a premium of 227 points, while its open interest was up 2.7%.

The open interest distribution for the Nifty 50 Nov. 14 expiry series indicated most activity at 25,000 call strikes, with the 22,250 put strikes having maximum open interest.

For the Bank Nifty options expiry on Nov. 13, the maximum call open interest was at 52,500 and the maximum put open interest was at 49,000.

Market Recap

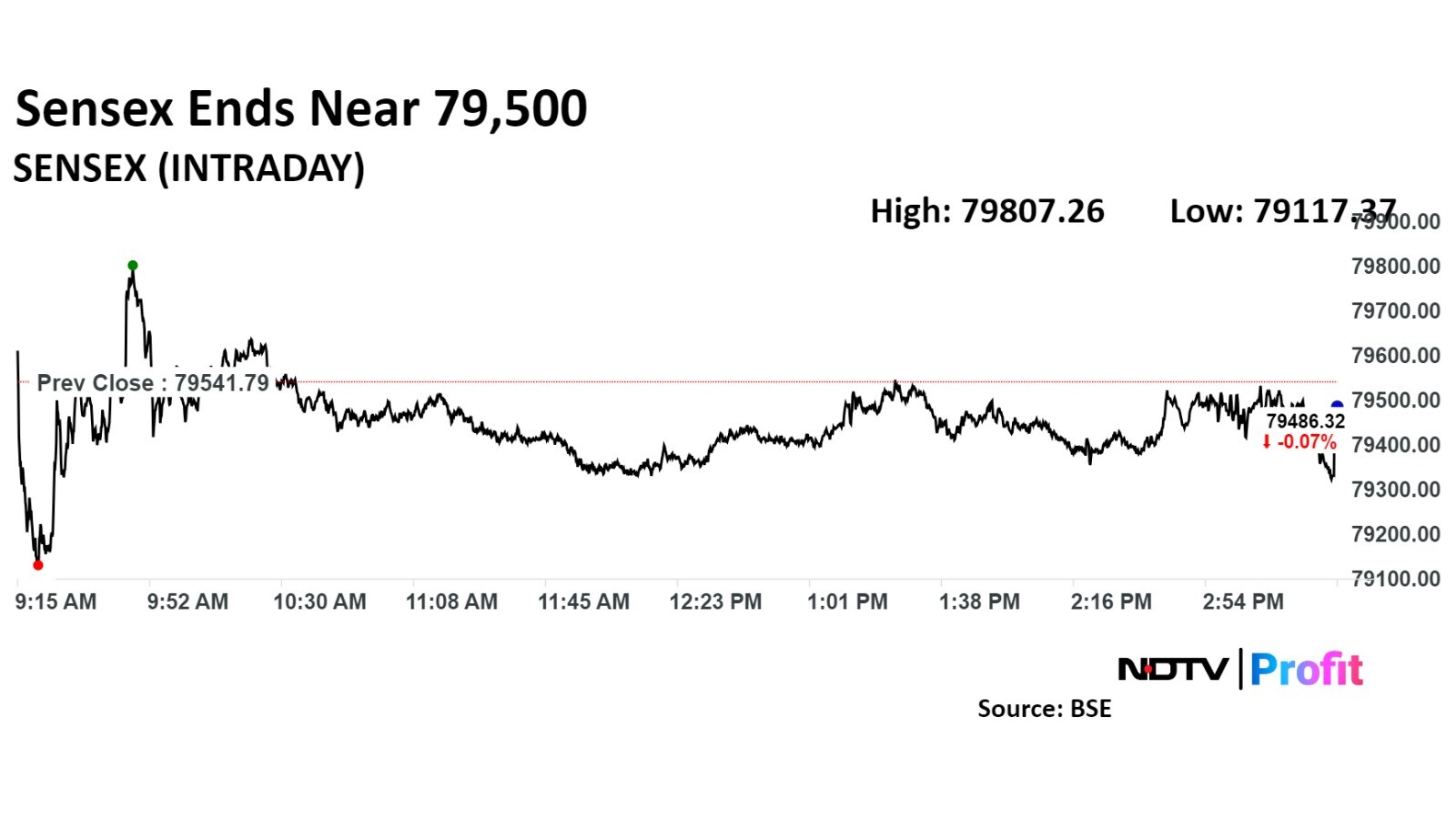

The NSE Nifty 50 and the BSE Sensex erased weekly gains as global political and economic events caused volatility in the domestic markets. The benchmark indices ended lower for second day in a row on Friday, as ICICI Bank Ltd. and Reliance Industries Ltd. share prices dragged.

The Nifty 50 ended 51.15 points, or 0.21% down at 24,148.20, and the Sensex ended 55.47 points, or 0.07% lower at 79,486.32.

Stocks In The News

HAL: Hindustan Aeronautics Ltd. has secured a contract to upgrade the avionics of the Dornier-228 transport aircraft.

Mahindra Lifespaces: A subsidiary of Mahindra Lifespace Developers Ltd. and GKW Ltd. will jointly develop a land in Mumbai's Bhandup spanning approximately 37 acres.

Dividend stocks: TD Power Systems Ltd. and DCM Shriram Ltd. will turn ex-dividend on Monday.

Money Market

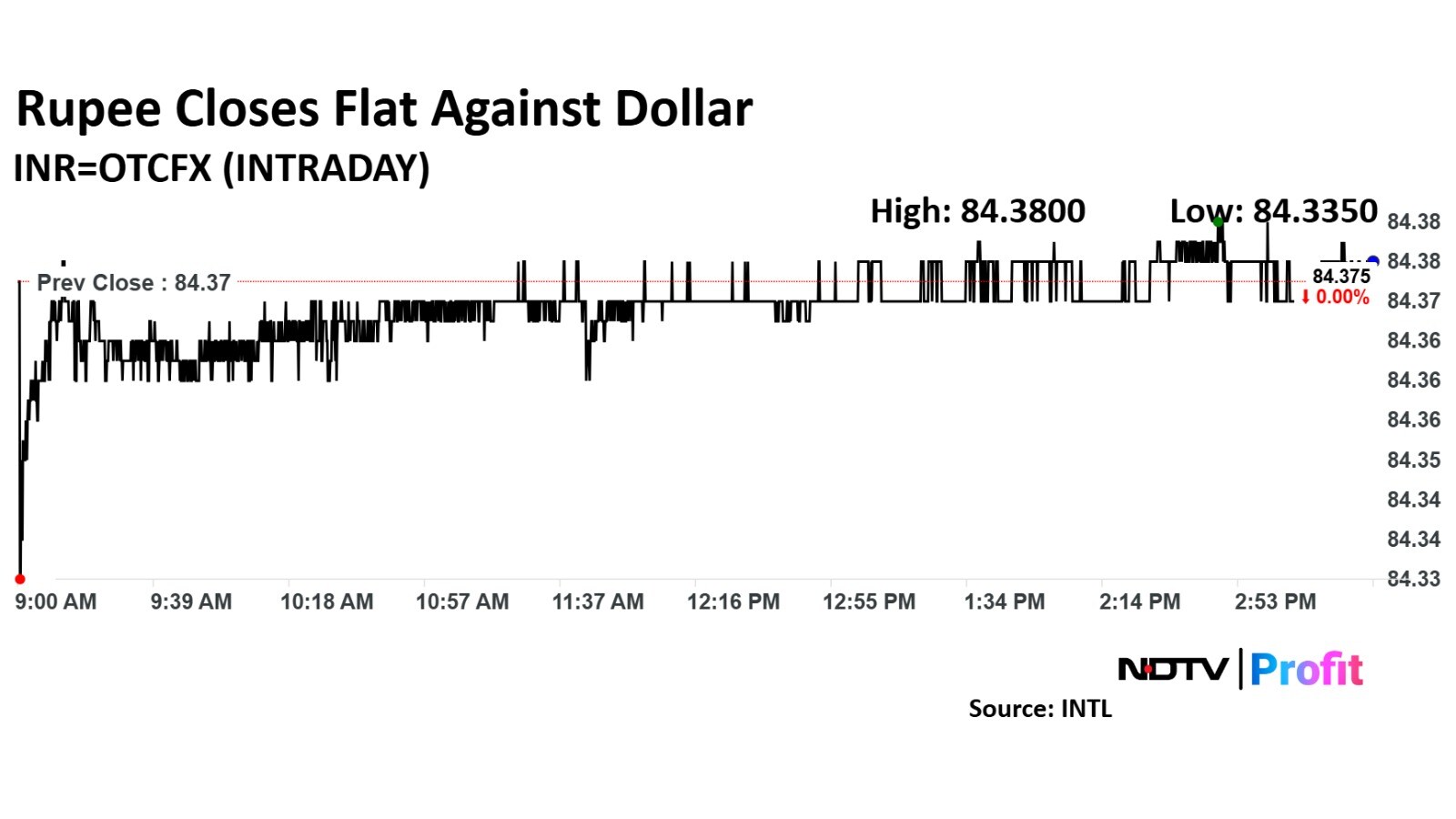

The domestic currency closed flat at Rs 84.376 after opening two paise stronger at Rs 84.36 on Friday. It closed at Rs 84.376 on Thursday, according to Bloomberg data.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.