The next support level for Nifty 50 is expected to be around the 24,700 mark, while resistance is pegged at 25,000–25,300, according to analysts. Nifty's six-day losing streak continues amid growing concerns over the geopolitical tension and a shift in foreign investor sentiment, which has reduced India's weight in favour of China.

"The bulls have taken the back seat as Nifty continued to plunge lower for the sixth consecutive session and plummeted below the 50-day exponential moving average (DEMA) on the daily chart. Our domestic market sentiments have turned sceptical, with the index cooling down over 5% from its peak," according to Osho Krishan, Senior Analyst, Technical & Derivatives, Angel One Ltd.

Krishan further explained that Nifty is now positioned in a critical zone that has historically served as strong support. "A decisive breakdown below the 24,800 zone is likely to disrupt the short-term chart structure, potentially leading to further corrections. On the lower end, 24,700 is expected to provide immediate support, with a stronger support level around 24,500. On the upside, resistance levels range from 25,000–25,100 to 25,200–25,300," Krishan said.

Adding to the market's anxiety, the volatility index, INDIA VIX, surged by 6.74%, settling at 15.08. This jump indicates increased market volatility, according to Hrishikesh Yedve, AVP Technical and Derivatives Research at Asit C. Mehta Investment Intermediates Ltd.

"Technically, on the daily chart, the index formed a red candle, signalling weakness. However, it managed to defend the 24,750 level, providing some relief for the bulls. As long as the index holds within the 24,700–24,750 range, a short-term pullback could be possible. However, if Nifty sustains below 24,700, we could see deeper declines," Yedve added.

Bank Nifty, which closed on a negative note at 50,479 on Monday, will face immediate resistance near the 51,000–51,100 levels on the upside, according to Yedve. "On the downside, the psychological level of 50,000 will act as important support, followed by 49,650," he stated.

"Going ahead, it is crucial to exercise extreme caution as such correction has taken place after a long haul, and rushing for bottom fishing should certainly be avoided. It is advisable to take one step at a time as the week is going to be eventful, with the MPC meeting followed by the commencement of quarterly earnings," Krishnan said.

FII/DII Activity

Overseas investors stayed net sellers of Indian equities for the sixth straight day on Monday, while domestic institutional investors record the highest single-day buying so far in 2024.

Foreign portfolio investors offloaded stocks worth Rs 8,293.41 crore, while domestic institutional investors bought stocks worth Rs 13,245.12 crore, according to provisional data from the National Stock Exchange.

Market Recap

India's benchmark stock indices closed lower for the sixth straight day, shedding over 5% to over one-month low on Monday, led by losses in HDFC Bank Ltd., Reliance Industries Ltd., and Axis Bank Ltd. This was its worst six-day decline since March 2022. The state election results kept the market jittery.

The Nifty 50 ended 218.85 points, or 0.87%, lower at 24,795.75, and the Sensex closed 638.45 points, or 0.78%, lower at 81,050.00.

During the session, Nifty 50 declined 1.82% to 24,694.35 and the Sensex declined 1.75% to 80,726.00, marking their lowest level since Aug. 21. The Nifty 50 index dipped below the support level of 24,750.

The Nifty Bank ended 1.91% lower at 50,478.90, the lowest closing level since Aug. 19. Intraday, it fell 3.17% to 50,194.30, its lowest level since Aug. 16.

On NSE, 11 out of 12 sectors ended lower and one closed higher. The NSE Nifty Media was the worst performing sector, and the NSE Nifty IT was the top performing sector.

Major Stocks In News

Bharat Electronics (BEL): The company has received an additional order worth Rs 500 crore. The order includes EMI shelters, AMC for integrated air command and control system nodes, upgrade spares for gun systems, spares for radars, and communication systems.

HDFC Bank: The bank to sell its wholly owned subsidiary, HDFC Education and Development Services Pvt., to Vama Sundari Investments (Delhi) Pvt. for a cash consideration of Rs 192 crore.

Hero Motors: The company withdrew its draft papers for its 900 crore initial public offering. The IPO was a combination of fresh issues of shares at Rs 500 crore and an offer for sale or OFS at Rs 400 crore.

Global Cues

Most stocks in Asia opened lower on Tuesday, taking cues from an overnight decline on Wall Street, while traders await the opening of China's stock market after a week-long holiday.

The Japanese benchmark Nikkei 225 was 358 points, or 0.94% lower at 39,354, while Australia's S&P ASX 200 was up 13 points, or 0.16% at 8,205 as of 05:38 a.m.

Stocks in China are poised for a frantic Tuesday, with markets reopening after a long holiday when the nation's top leaders will hold a briefing to discuss policies aimed at boosting economic growth.

Meanwhile, stocks in the US slipped as fears of an escalating war in West Asia kept traders nervous. Israel said it intercepted most of a barrage of rockets fired by Hamas and other Iran-backed groups, Bloomberg News reported. Amidst these tensions, Brent crude jumped above $80 a barrel.

Further, stocks on Wall Street fell amid growing expectations of a small rate cut in the November Fed meeting as solid job data cemented a soft landing for the economy. Treasuries in the US continued to drop, with the 10-year yield crossing 4%.

The S&P 500 and Nasdaq Composite tumbled 0.96% and 1.18%, respectively. The Dow Jones Industrial Average declined by 0.94%.

Key Levels

US Dollar Index at 102.42

US 10-year bond yield at 4.01%.

Brent crude down 0.15% at $80.81 per barrel.

Bitcoin was 0.86% down at $62,467.18

Gold spot was up 0.06% at $2,644.21

Money Market

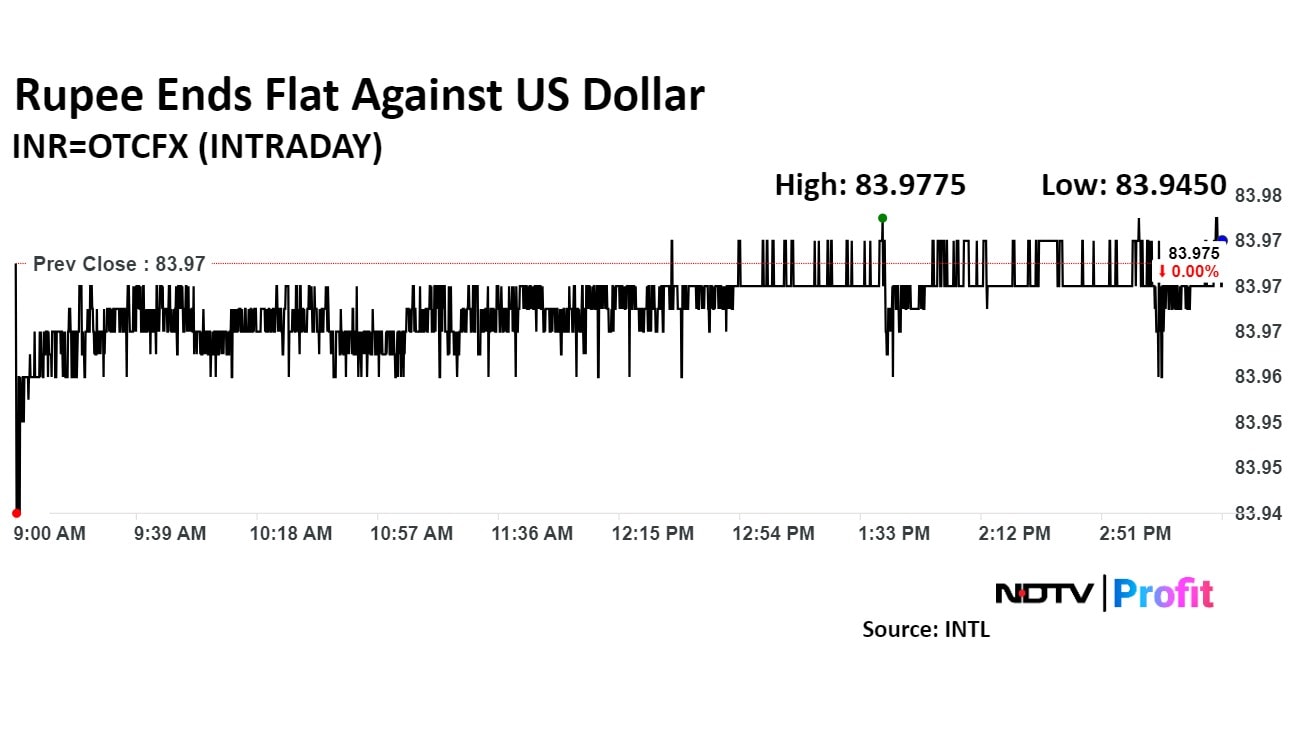

The Indian rupee closed flat at Rs 83.98 against the dollar steady on Monday, tracking a rise in the dollar index and Brent crude oil prices.

The Indian unit opened at Rs 83.96 on Monday, after it had closed at Rs 83.97 on Friday.

Brent prices were up 1.93% at $79.56 per barrel after a stellar week, sparked by tensions in the Middle East. The dollar index was up 0.07% at 102.59.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.