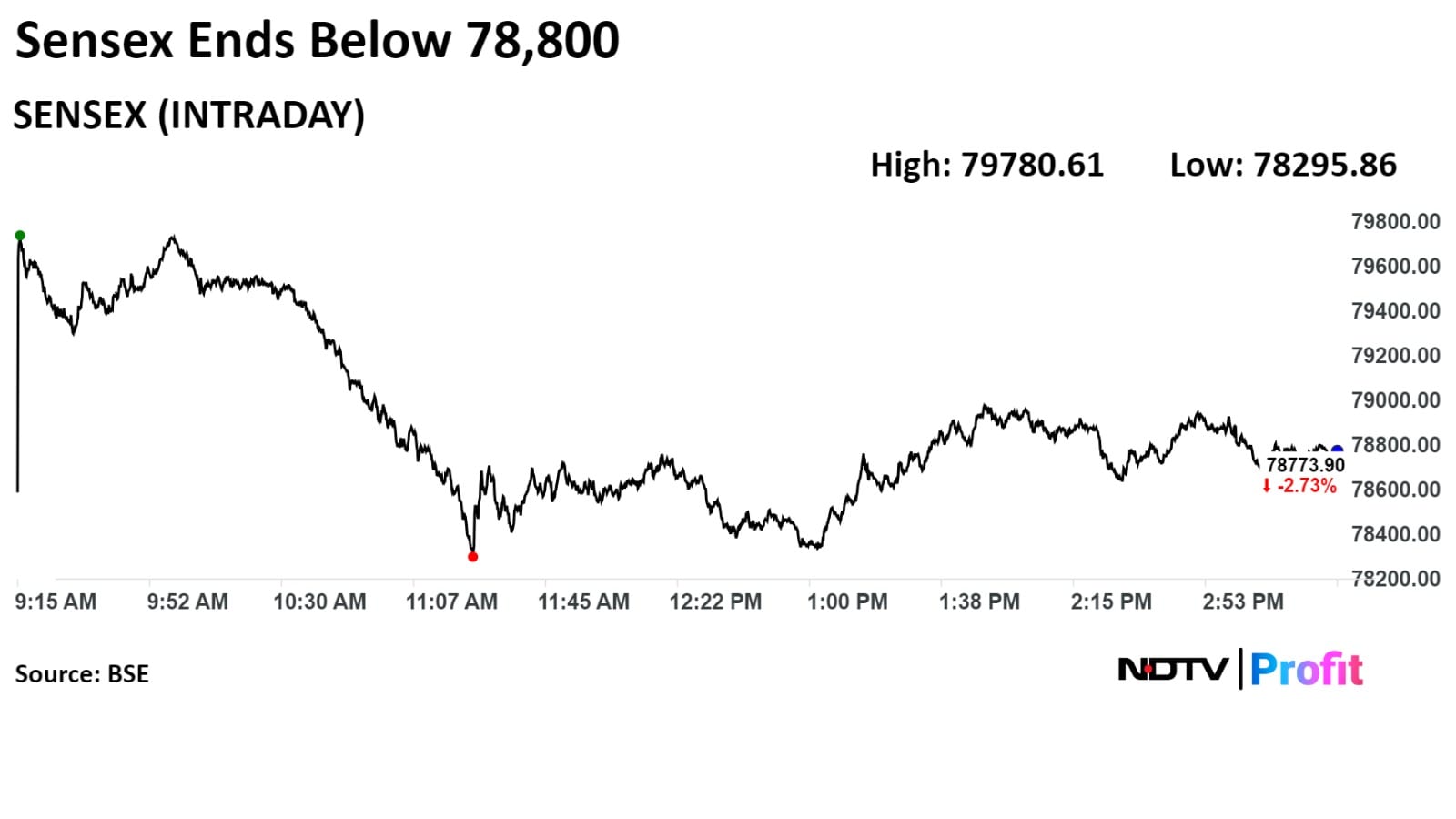

The Indian benchmark indices ended at over a month low on Monday as Reliance Industries Ltd. and HDFC Bank Ltd. declined. The NSE Nifty 50 ended 662.10 points or 2.68%, lower at 24,055.60, the lowest since June 28. The S&P BSE Sensex ended 2,222.55 points or 2.74%, down at 78,759.40, the lowest level since June 26.

The selloff in global equities, as traders unwound their carry-trade bets on the Japanese yen after it rose against the US dollar, put pressure on the benchmarks.

During the day, the Nifty declined as much as 3.33% to 23,893.70 and the Sensex slumped 3.32% to 78,295.86, the lowest levels since June 4. The market cap of Nifty 50 companies decreased from Rs 5.5 lakh crore to Rs 191.8 lakh crore on Monday.

The selloff is more of a short-term volatility by way of profit-booking, according to Tanvi Kanchan, head of UAE Business & Strategy at Anand Rathi Shares & Stock Brokers.

There is no indicator of any long-term panic mode set in the Indian equities, Kanchan said. "For investors looking at entering the equity market, a staggered entry during volatile periods can be considered."

The India VIX, the index that gauges volatility in Indian equities, jumped 61.68% to 23.15 on Monday, touching the highest level since June 4. It ended 42.63% higher at 20.43.

After a long time, the Nifty/Sensex closed below the 20-day simple moving average, which is largely negative. It also formed a long bearish candle on daily charts, which supports further weakness from the current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

Kotak Securities is of the view that the current market texture is weak and volatile but due to temporary oversold conditions, the markets could expect one intraday pullback rally. For the day traders now, 24,000/78,500 would be the immediate reference point, Chouhan said.

.jpeg)

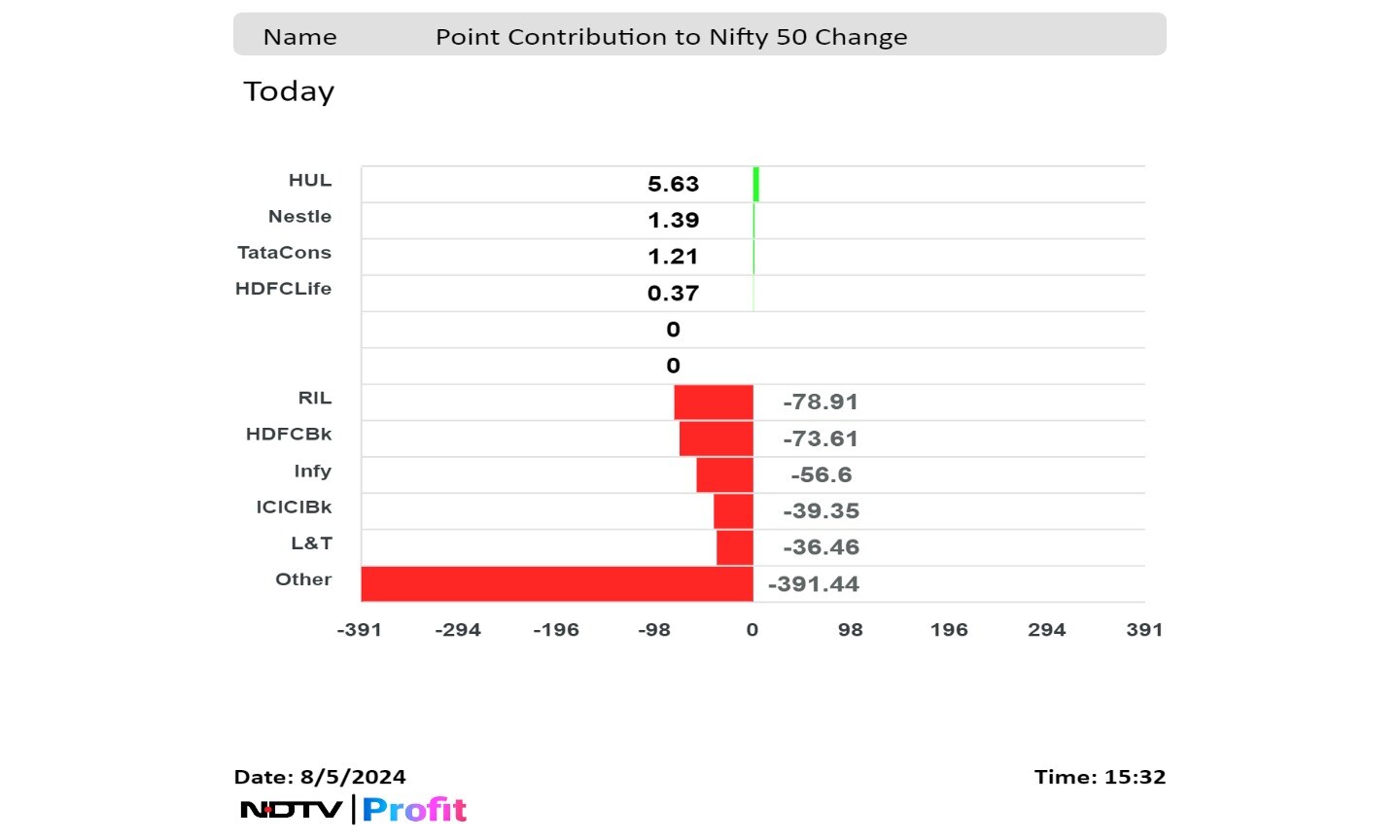

RIL, HDFC Bank, Infosys Ltd., ICICI Bank Ltd. and Larsen & Toubro Ltd. weighed on the Nifty.

Hindustan Unilever Ltd., Nestle India Ltd., Tata Consumer Products Ltd., and HDFC Life Insurance Co. Ltd. contributed the most to the gains.

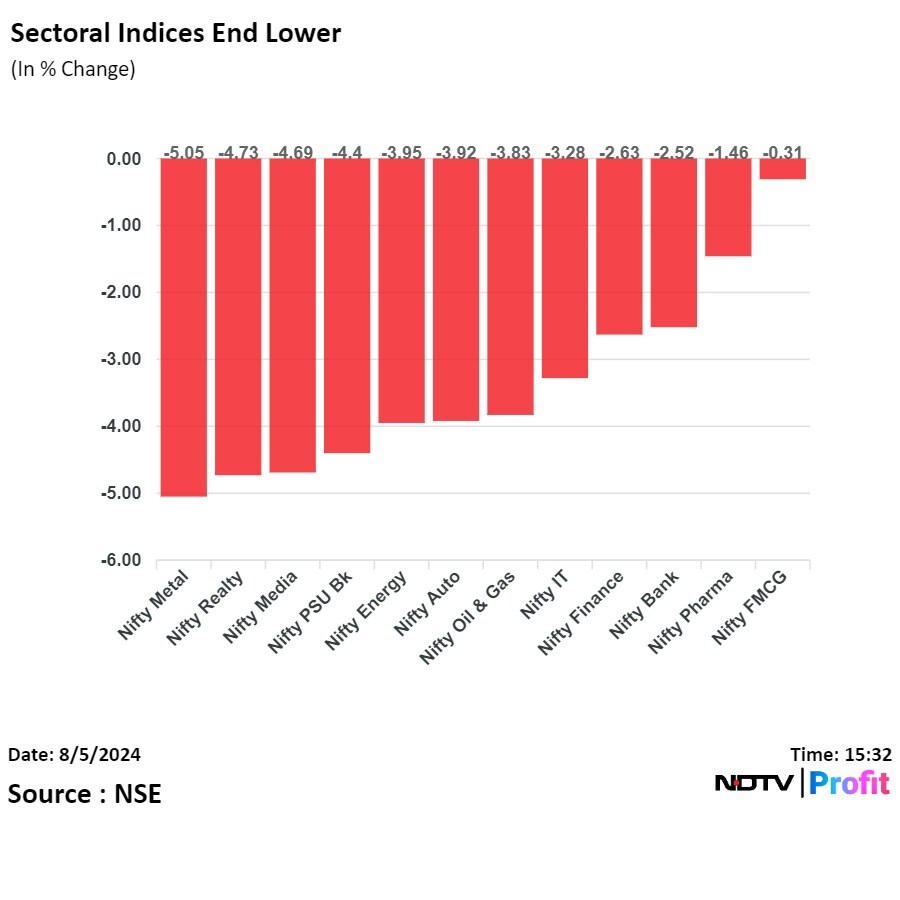

On the NSE, all 12 sectors ended lower, with the Nifty Metal leading the losses.

The broader indices underperformed as the BSE MidCap ended 3.60% lower and the SmallCap closed 4.21% lower.

All 20 sectoral indices on the BSE ended lower, with Metal and Services falling the most.

The market breadth was skewed in the favour of the sellers as 3,408 stocks fell, 670 rose and 111 remained unchanged on the BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.