NHPC Ltd.'s share price declined nearly 5% in Friday's session after the company reported more decline in its net profit for the quarter ended in September than analysts' expectations. The state–run power company's consolidated net profit slumped 37% year-on-year to Rs 1,069.3 crore, against the Rs 1,178 crore that analysts projected in Bloomberg survey.

In the previous quarter ended in June, the net profit was at Rs 1,693.3 crore.

NHPC's profit margin declined 140 basis points to 58.9% in July–September from 60.3%. Bloomberg survey had projected 59.8% margin for the quarter.

NHPC's topline rose 4.1% on the year to Rs 3,051.19 crore in the second quarter from Rs 2,931.3 crore. The revenue numbers largely met the estimates of Rs 3,023 crore from the Bloomberg survey.

NHPC also reported operating profit in line with Street estimates. It rose 2% to Rs 1,798.8 crore compared to Rs 1,808 crore estimates.

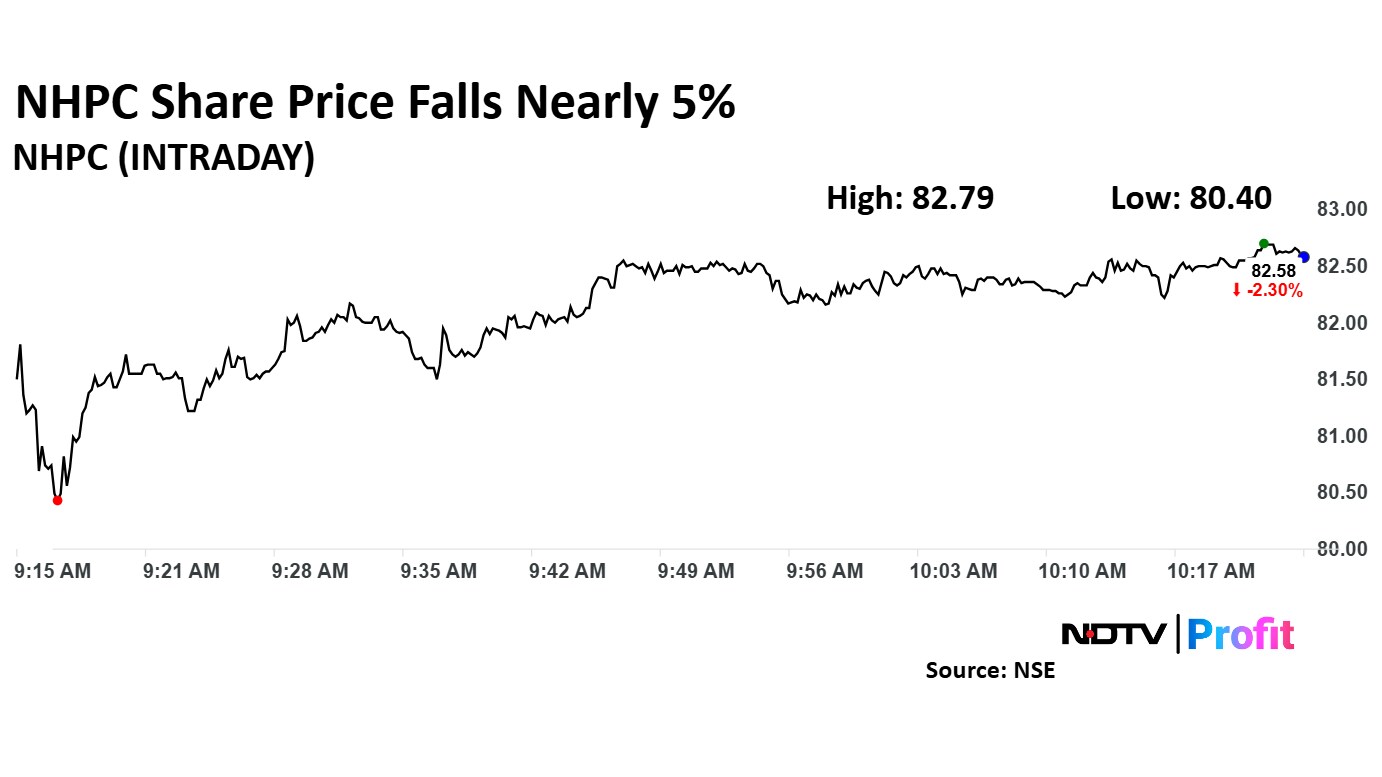

NHPC share price declined 2.30% to Rs 82.58 apiece.

NHCP Ltd. share price declined 4.87% to Rs 80.40 apiece, the lowest level since Nov 5. The stock price pared losses to trade 2.33% lower at Rs 82.55 apiece as of 10:25 a.m., as compared to 0.04% advance in the NSE Nifty 50 index.

NHPC's 52-week high level is Rs 118.40 apiece, which it touched on July 15.

The stock price rose 60.33% in 12 months, and 27.17% on a year-to-date basis. Total traded volume so far on NSE in the day stood at 0.56 times its 30-day average. The relative strength index was at 43.1.

Out of 10 analysts tracking the company, five maintain a 'buy' rating, one recommends a 'hold,' and four suggest to sell, according to Bloomberg data. The average 12-month consensus price target implies an upside of 13.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.