Netweb Technologies India Ltd.'s share price rose to life high on Monday after the company reported a jump in its net profit in the second quarter of fiscal 2025. The net profit rose 70.2% on the year to Rs 25.7 crore in the July-September period, compared to Rs 15.1 crore the same period last year.

The net profit rose following its revenue growth. The revenue rose 73.2% on the year to Rs 251 crore in the second quarter from Rs 145 crore. The operating profit jumped 85.5% on the year to Rs 35.7 crore from 19.2 crore in the corresponding period of previous financial year, the company said in an exchange filing. Netweb Technologies India's margin rose 90 basis points to 14.2% in the second quarter from 13.3%, the exchange filing said.

The company has a pipeline of Rs 3,703.8 crore and order book of Rs 3,697 crore, it said in its investor presentation.

Netweb Technologies India offers high–end computing solutions provider with fully integrated design and manufacturing capabilities. Its HCS offering comprises HPC, private cloud and HCI, artificial intelligence systems and enterprise workstations, high performance storage and data centre servers.

Netweb Technologies India Share Price Today

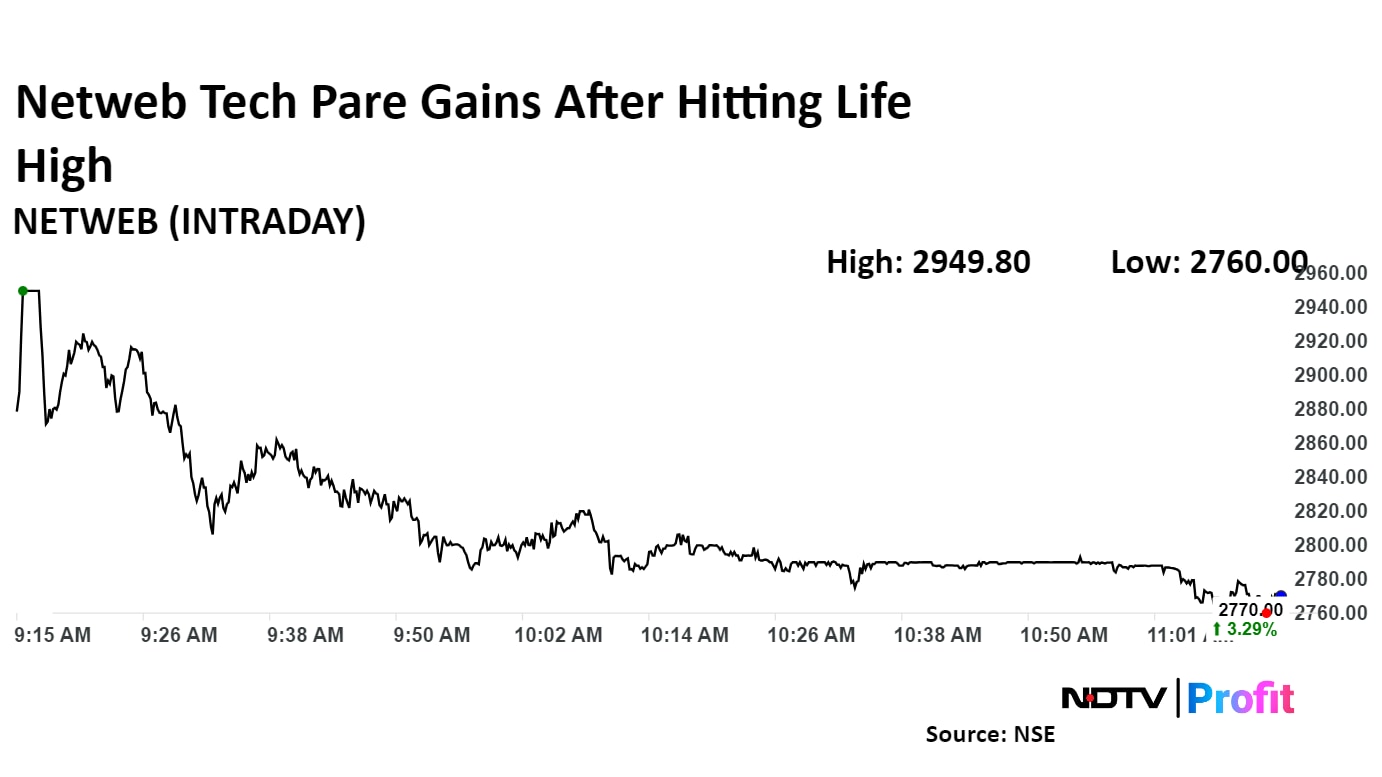

Netweb Technologies India Ltd. share price hit a 10% upper circuit and rose to Rs. 2,949.80 apiece.

Netweb Technologies India Ltd. share price hit a 10% upper circuit and rose to Rs 2,949.80 apiece, the highest level since its listing on the bourses on July 27, 2023. The stock pared gains to trade 3.29% higher at Rs 2,770.00 as of 11:12 a.m., as compared to 0.21% decline in the NSE Nifty 50.

The stock gained 214.28% in 12 months, and 134.94% on year-to-date basis. Total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 63.48.

Two analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 3.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.