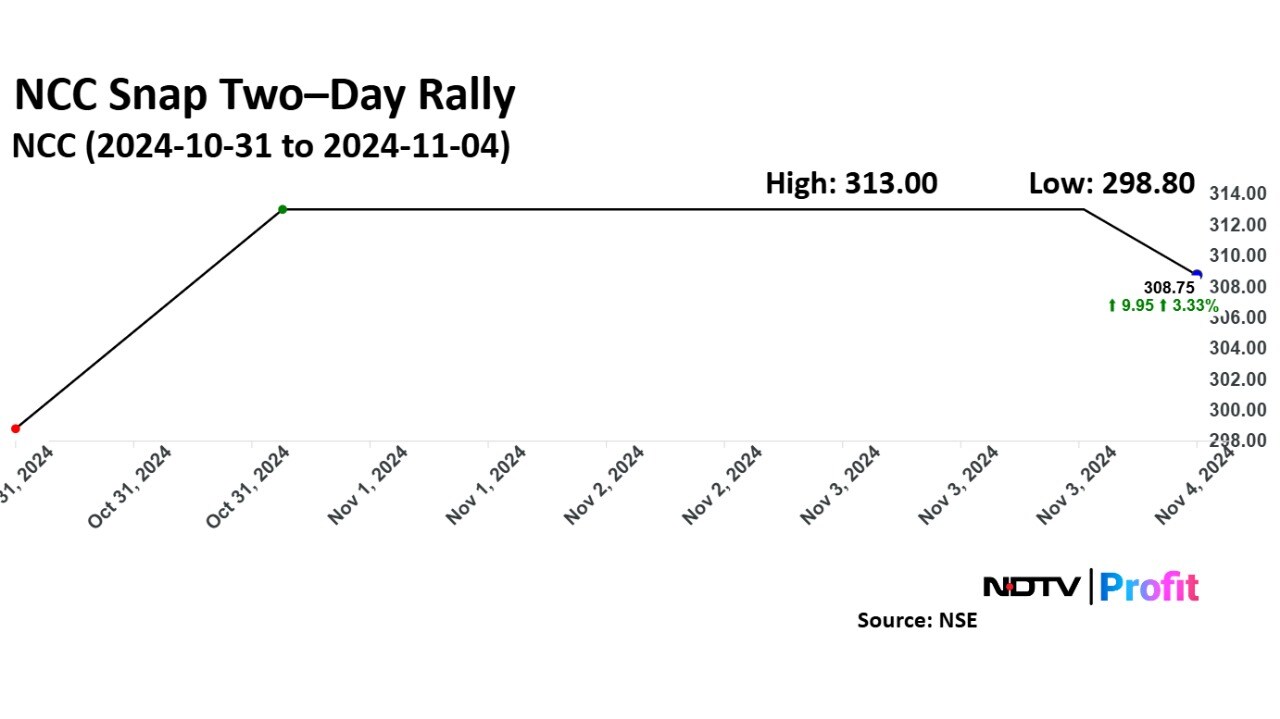

NCC Ltd.'s share price retreated from over one-month high, snapping a two-day rally on Monday. The stock had rallied in the last two trading sessions after the company disclosed its order wins for October.

The stock rose to the highest level since Sept. 13 during the special annual trading session held for Diwali on Friday after it announced that it had received orders worth total Rs 3,496 crore in October. The stock rose 4.62% in the last two trading sessions.

The stock hit a 52–week high of Rs 364.50 apiece on July 31.

NCC's board of directors will meet on Nov. 7 to approve release of its earnings numbers for July–September quarter and first half of the current financial year 2024-2025, the company said in an exchange filing on Oct. 28

Shares of the company rose as much as 1.63% to Rs 317.70 apiece, the highest level since Sept. 13. However, the stock erased all gains to trade 0.30% lower at Rs 311.65 as of 9:57 a.m., compared to 1.07% decline in the NSE Nifty 50 index. It has opened flat at Rs 317.70 apiece today.

The stock rose 104.83% in the past 12 months and 86.84% so far this calendar year. Total traded volume so far in the day stood at 2.6 times its 30-day average. The relative strength index was at 58.48.

Out of 14 analysts tracking the company, 10 maintain a 'buy' rating, one recommends a 'hold', and three suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 7.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.