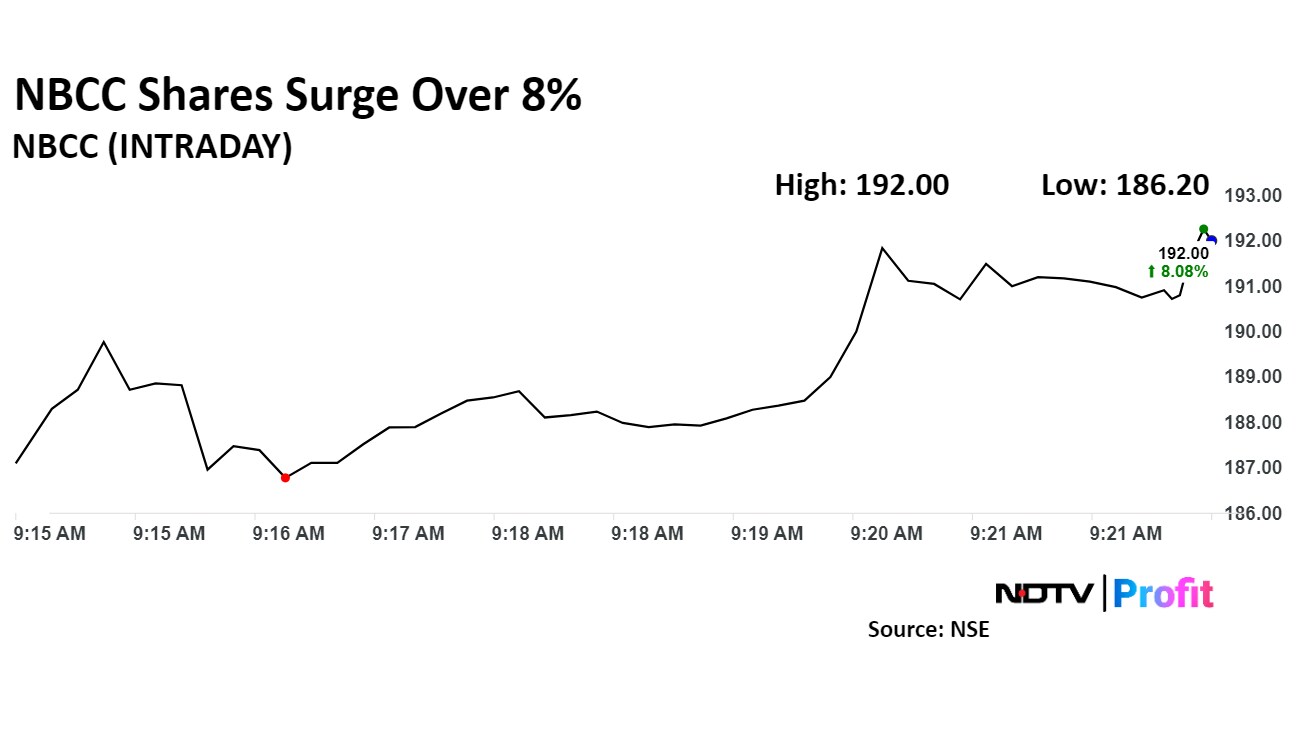

Shares of NBCC India Ltd. surged over 8% on Wednesday after it said it would consider issuing bonus shares in its upcoming board meeting on Aug. 31.

The trading window for the company's share will be closed from Aug. 28 till 48 hours after the conclusion of the board meeting, according to an exchange filing on Tuesday.

Adding to this, about 97.3 lakh shares changed hands in multiple large trades during the market opening, according to Bloomberg.

Earlier this month, its subsidiary received an order worth Rs 528 crore for the procurement of biomedical equipment and hospital furniture in Haryana. It won another contract worth Rs 9.97 crore from the Institute of Company Secretaries of India for the construction of a new building in Hyderabad.

State-owned NBCC's profit rose by 38% to Rs 107.19 crore year-on-year for the April-June quarter in 2024, as compared to Rs 77.41 crore for the same period last year.

The public sector undertaking's income surged to Rs 2,197.83 crore for the quarter ended June 2024, as compared to Rs 1,974.03 crore in the same period last year.

Shares of NBCC rose as much as 8.42% during the day to Rs 192.6 apiece on the NSE, the highest since July 16. It was trading 8% higher at Rs 191.9 apiece, compared to a 0.11% advance in the benchmark Nifty 50 as of 9:20 a.m.

The stock has advanced 270% during the last 12 months and has soared 134% on a year-to-date basis. The relative strength index was at 60.

One out of the four analysts tracking the company has a 'buy' rating on the stock, another one suggests a 'hold' and two have a 'hold', according to Bloomberg data. The average 12-month analyst price targets implies a potential downside of 11%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.