.jpg?downsize=773:435)

Suzlon Energy share price gained on Thursday after ICICI Securities revised its target price upward.

The company announced a significant transaction involving the sale and leaseback of its corporate office in Pune, Maharashtra. This move, valued at Rs 4.4 billion, will see Suzlon lease the property for the next five years and is expected to release critical capital to support its core business operations.

In light of this development, ICICI Securities has revised its target price for Suzlon's stock to Rs 80, up from Rs 70, reflecting an 8% potential upside. The revised valuation is based on 50 times the company's expected earnings per share for fiscal 2026. ICICI Securities maintains an 'add' rating, reflecting confidence in Suzlon's growth prospects.

This transaction aligns with Suzlon's ongoing strategy to offload non-core assets, a plan initially set forth in April 2022 during a period of debt restructuring.

The capital raised from the sale and leaseback deal will play a crucial role in bolstering Suzlon's operational capabilities and expanding its order book. Currently, Suzlon's order book stands at an all-time high of 4 gigawatts, providing the company with a solid execution pipeline for the next two years. With a large portion of pending orders—approximately 1.5 GW—from public sector entities, Suzlon is poised to capture over 2 GW in new orders during fiscals 2025 and 2026, according to ICICI Securities.

Suzlon's recent acquisition of a 74% stake in Renom Energy Services, India's largest third-party operations and maintenance provider, further complements this strategy.

The Rs 6.6 billion investment in Renom is aimed at scaling up Suzlon's O&M capabilities, ensuring robust support for its assets.

The wind energy sector is experiencing a positive shift, claims ICICI Securities, with the Indian government committing to tendering at least 10 GW of wind capacity annually. This policy change, combined with growing demand from commercial and industrial sectors for reliable, round-the-clock power, positions Suzlon as a primary beneficiary.

Suzlon's order book, which stood at 3.8 GW as of June 2024, represents a five-fold increase over fiscal 2024's wind turbine generator volume of 710 MW.

Potential risks include the possibility of delays in execution or an upside surprise in wind turbine generation volume, notes ICICI.

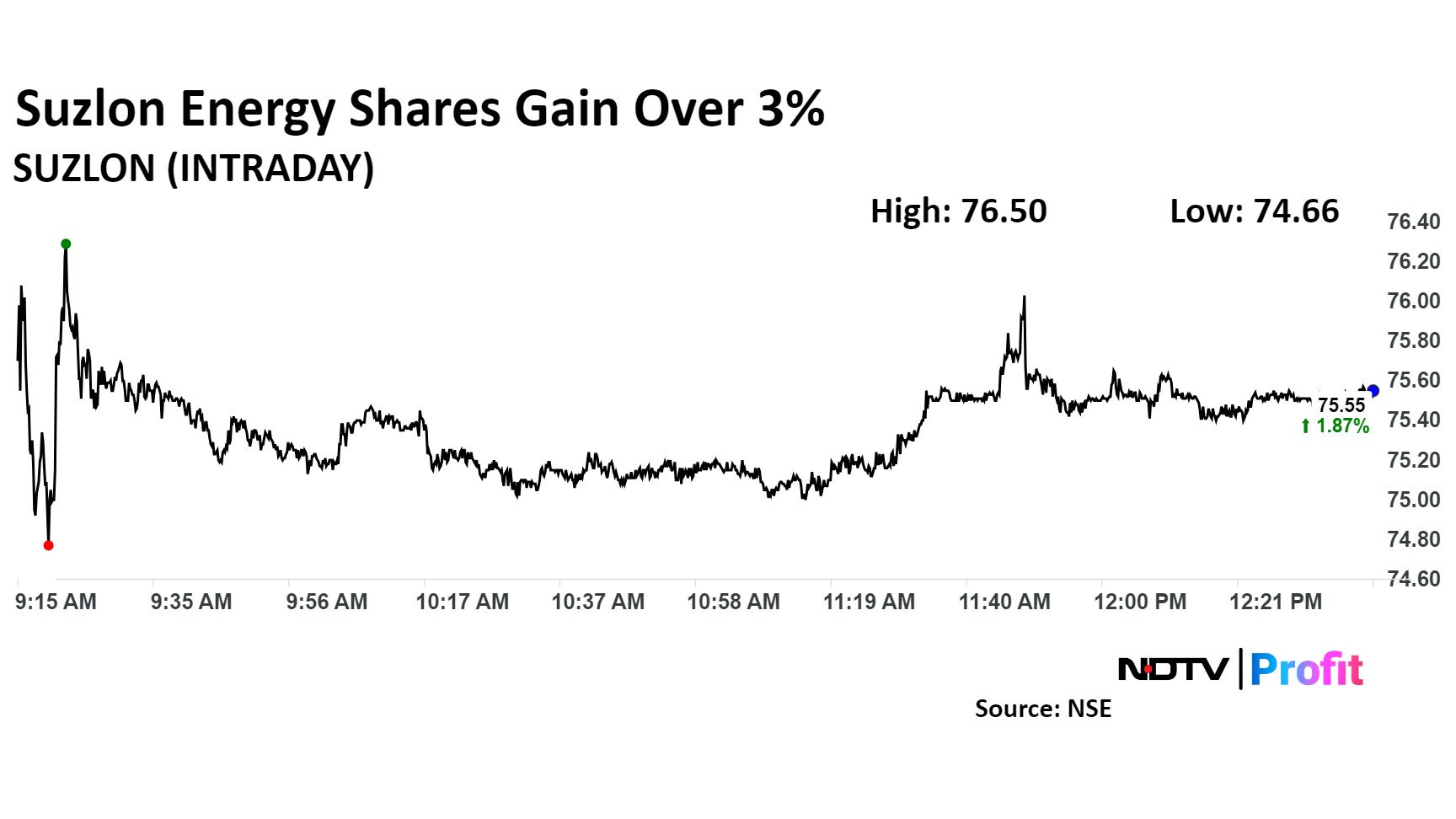

The scrip rose as much as 3.16% to Rs 76.50 apiece, the highest level since Aug. 30, 2024. It pared gains to trade 1.82% higher at Rs 75.52 apiece, as of 12:37 p.m. This compares to a 0.09% decline in the NSE Nifty 50 index.

It has risen 97.64% year-to-date and has advanced 193.57% in the last twelve months. Total traded volume so far in the day stood at 0.31 times its 30-day average. The relative strength index was at 55.64.

Out of five analysts tracking the company, three maintain a 'buy' rating, and two recommend a 'hold,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 5.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.