Market analysts have lowered their support and resistance estimates for the NSE Nifty 50 as the benchmark index slid for a second consecutive day on Thursday. For the Diwali muhurat trading on Friday, the crucial resistance zone lies in the range of 24,300-24,000.

Currently, Nifty 50 is close to the crucial support level of 24,200, said Shrikant Chouhan, head of equity research at Kotak Securities Ltd. "If it succeeds to trade above the same, then we could see a sharp technical bounce back till 24,300," he said.

Further upside may also continue, which could lift the index to 24,400, Chouhan added. On the other hand, if the index falls below the 24,200 level, it could potentially decline to between 24100 and 24500, according to Chouhan.

"Technically, Nifty formed a red candle on the daily chart, suggesting weakness, and has been consolidating between 24,000 and 24,500 for the past few sessions. A breakout on either side of this range could set the next direction for Nifty," explained Hrishikesh Yedve, assistant vice president for technical and derivatives research at Asit C. Mehta Investment Intermediates Ltd.

For Bank Nifty, 51,000-51,150 will provide short-term support, while resistance stands near the previous swing high at 52,580, Yedve said.

Notably, the markets will not operate as per the usual hours on Friday due to the festival of Diwali. However, special trading session has been scheduled from 6 p.m. to 7 p.m.

FII/DII Activity

Overseas investors remained net sellers of Indian equities for the 24th consecutive session and offloaded stocks worth a total of Rs 1.25 lakh crore during the period, while domestic institutional investors stayed net buyers for the 28th straight session.

Foreign portfolio investors offloaded stocks with an approximate value of Rs 5,813.3 crore, according to provisional data from the National Stock Exchange. The DIIs bought stocks worth Rs 3,514.6 crore.

In the last five sessions, the FPIs have sold equities valued at Rs 17,240.5 crore, while the DIIs have purchased shares worth Rs 14,323.1 crore.

F&O Cues

The Nifty November futures were down by 0.41% to 24,405 at a premium of 200 points, with the open interest up by 35.16%.

The Nifty Bank November futures were down by 0.43% to 51,954 at a premium of 479 points, while its open interest was up 15.3%.

The open interest distribution for the Nifty 50 Nov. 7 expiry series indicated most activity at 27,000 call strikes, with the 22,450 put strikes having maximum open interest.

For the Bank Nifty options expiry on Nov. 6, the maximum call open interest was at 60,500 and the maximum put open interest was at 47,500.

Stocks In The News

Multi Commodity Exchange: The company announced that Praveena Rai, who has over three decades of experience in India's financial sector, has taken charge as its managing director and chief executive officer with immediate effect.

Reliance Industries: The bonus shares allotted by the company, as part of its 1:1 bonus issue, will be available for trading from Nov. 1, as per a notice issued by the BSE. In a separate development, the European Commission has issued its nod for RIL's joint venture with Walt Disney Co. to merge their entertainment business in India.

Market Recap

The festive cheer failed to lift the markets, as the frontline indices slipped for a second day in a row on Thursday. Nifty 50 closed 135.5 points, or 0.56% down at 24,205.35, while the S&P BSE Sensex ended 553.12 points, or 0.69% lower at 79,389.06.

Intraday, Nifty 50 fell as much as 0.7% and Sensex fell as much as 0.8%. However, small-cap indices outperformed the benchmarks and continued to rise for a fourth consecutive session. Nifty Smallcap 100 closed 1.15% higher at 18,602.60, while Nifty Smallcap 250 rose 1.5% to close at 17,751.20.

Despite the day's decline, Nifty snapped its four-week losing streak and Sensex ended the week flat ahead of the special session on Diwali day.

Money Market

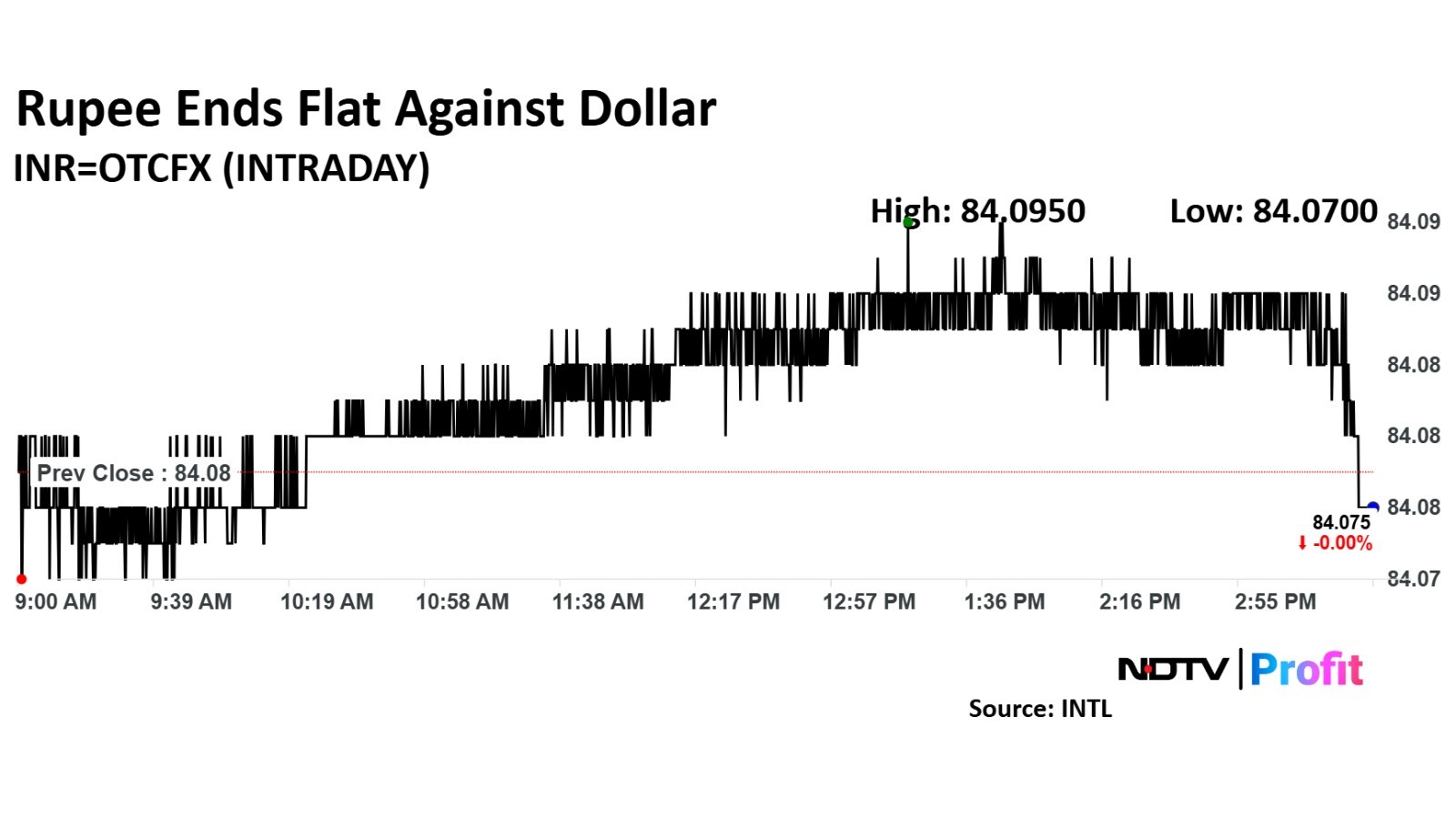

The Indian rupee closed little changed against the US dollar on Thursday, recovering from an all-time low it hit during the day.

The local currency ended the trading session at Rs 84.0837 per dollar, compared to the previous close of Rs 84.086, as per Bloomberg data. Intraday, it hit a record low of 84.1.

The relief to the domestic currency came after intervention by the central bank. Public sector banks have been selling dollars on behalf of the Reserve Bank of India to support it near the 84.09 level, Informist reported citing forex dealers.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.