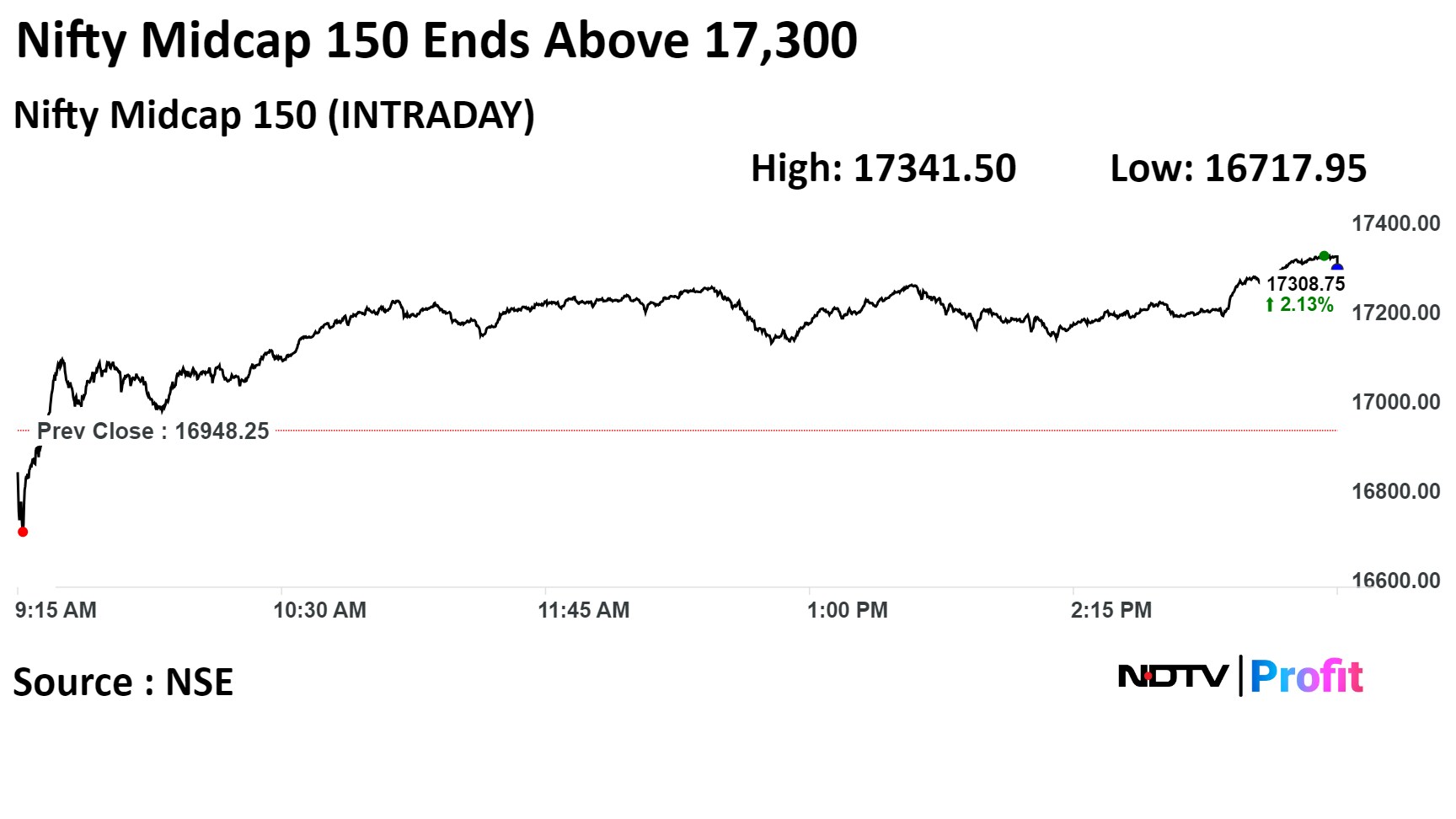

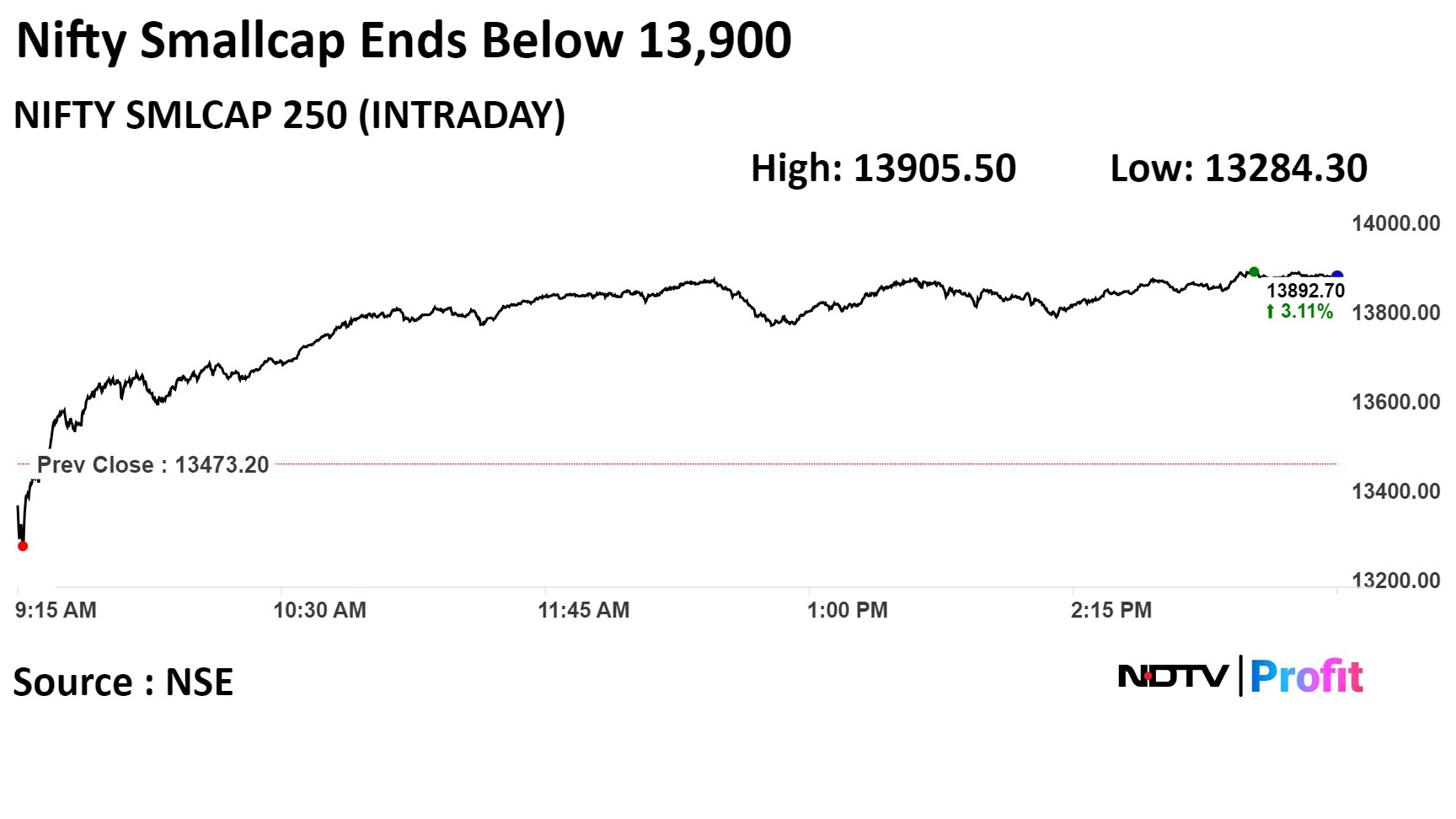

There may be a respite for the broader markets that witnessed a selloff on Wednesday.

That's according to Rajesh Palviya, senior vice president of technical and derivatives research at Axis Securities. Most mid- and small-cap stocks, he said, were in over-sold territory in the near term and have now corrected to their 50-day moving average.

"Recovery is taking place in the broader market," he told NDTV Profit. "There has been supply pressure for most mid- and small caps. A bounce back has now given comfort. This is giving market the confidence."

The analyst pegged a target of 22,200 for the Nifty 50 index, with a support level of 22,000. "There could be short-covering action that could lead the benchmark higher to 22,350."

Bank Nifty is struggling to recover and 47,000 is the major supply zone based on call concentration area, Palviya said. "On the downside, 46,500 is the major support area."

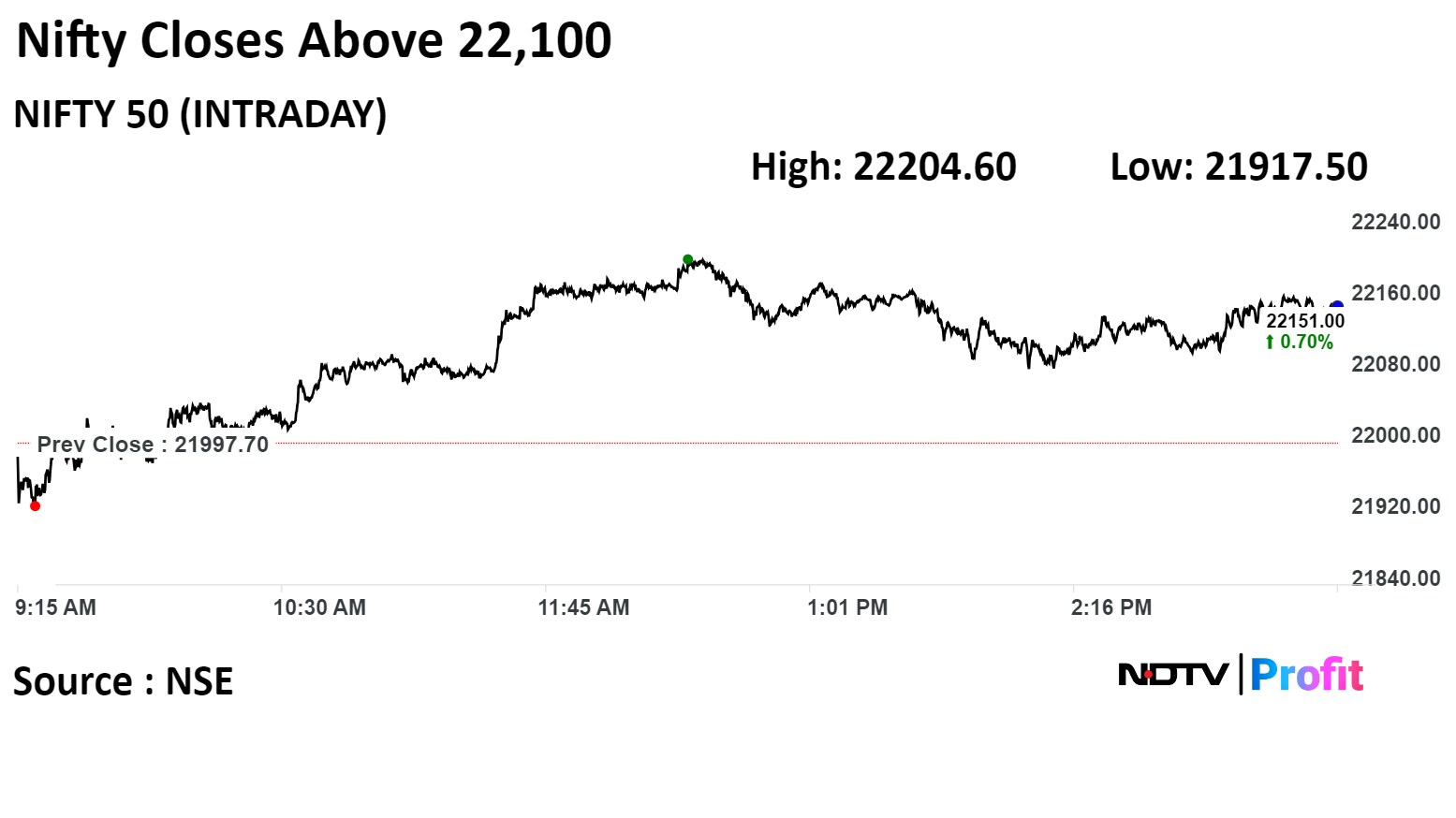

The benchmark equity indices recovered from their worst selloff in over a month to end higher on Thursday.

The NSE Nifty 50 closed 153.30 points up, or 0.7% higher, at 22,151.00, and the S&P BSE Sensex rose 335.39 points, or by 0.46%, to 73,097.28.

Palviya is upbeat about the long-term trajectory of railway stocks, even amid near-term hiccups like broader market corrections that can impact prices. IRFC Ltd., RVNL Ltd. and Ircon International Ltd. are in his focus.

What Are The Worries?

According to G. Chokkalingam, founder and managing director of Equinomics Research, there are two worries in the mid- and small-cap space.

The first set of stocks where promoter holding is zero or near zero with no business fundamentals but with a huge market cap of Rs 1,000-2,000 crore. The second, whose profit is growing by 20% but has a price-to-earnings ratio of 40, indicates the stock is overvalued or that investors expect high growth rates.

"The kind of nervousness we saw in the market on Wednesday might get repeated in the short term," he said. "Apply these criteria and use the opportunity to restructure portfolio."

He gave a 'sell' call for metals, citing a poor growth outlook in the global economy except for the U.S.

Watch the full conversation here:

The views and opinions expressed by the investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.