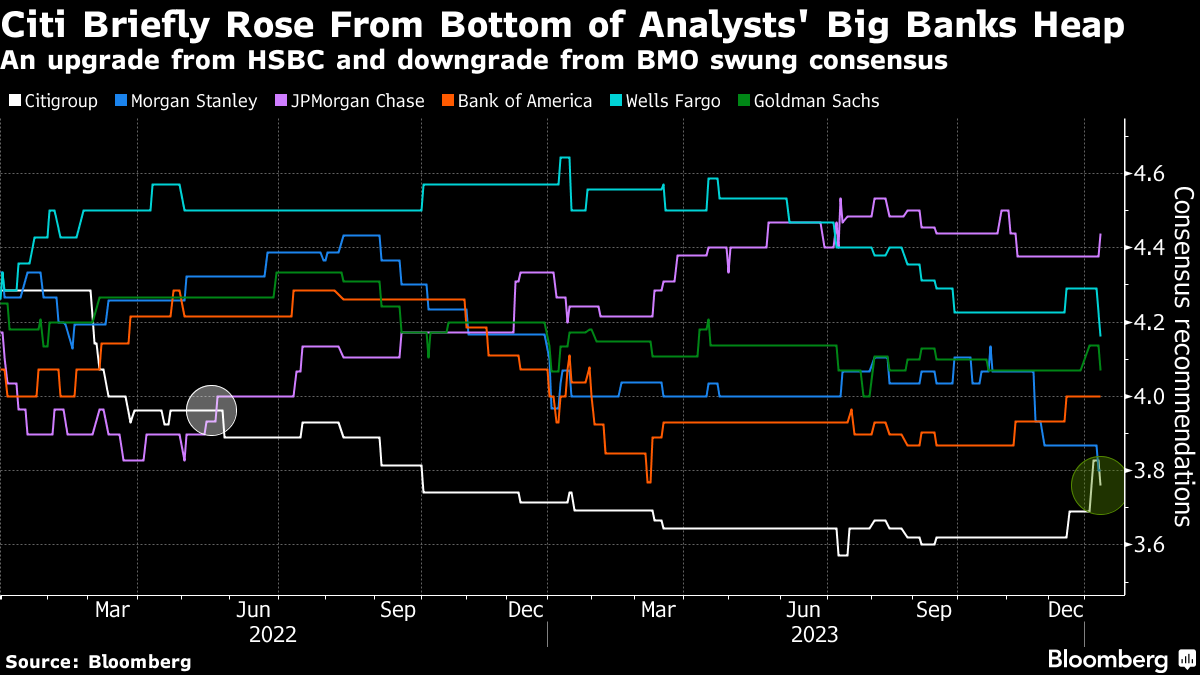

(Bloomberg) -- Citigroup Inc. briefly shed its standing as the least-loved big bank stock on Wall Street, pushing Morgan Stanley to the bottom of the pile. Then another analyst chimed in.

Citigroup, helmed by Jane Fraser, had held the lowest consensus rating among the six biggest US banks since May 2022, data compiled by Bloomberg show. That changed this week when an analyst at HSBC Holdings Plc shuffled his recommendations — upgrading Citigroup and lowering Morgan Stanley.

“Citigroup is an attractive vehicle to gain bank exposure,” HSBC's Saul Martinez wrote in a note, adding that the firm is “our preferred choice among large-cap banks.”

Then, late Tuesday, BMO analyst James Fotheringham downgraded Citigroup to market perform. That pushed the stock narrowly back below Morgan Stanley's consensus rating.

As bank-stock analysts have reconfigured their ratings for 2024, Citigroup scored upgrades, including from Wolfe Research. Wells Fargo & Co.'s Mike Mayo named it his top pick and said the stock could double over the next few years.

Read more: Fed-Up Fraser Turns to Downsizing to Cure Citi's Painful Slump

The balance of analysts recommending buying Citigroup tipped more positive earlier in the week ahead of earnings reports, before BMO downgraded the stock alongside a broader note saying that banks and specialty finance stocks appear “vulnerable” after a late-2023 rally. Analysts' price targets overall still indicate they expect the stock to rise about 8% over the next 12 months.

Meanwhile, the majority of analysts recommend investors hold Morgan Stanley, but not to add shares. No analysts give it a sell rating. The average price target is for an advance of more than 3% in the next year. Ted Pick took over as the firm's chief executive officer this month, succeeding James Gorman.

For HSBC's Martinez, Goldman Sachs Group Inc. is a better way than Morgan Stanley to play an expected rebound in the capital-markets business.

Four of the biggest US banks, including Citigroup, are set to release earnings on Friday, kicking off the reporting for Corporate America.

(Updates to add BMO downgrade.)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.