Goldman Sachs has initiated coverage of Metro Brands Ltd. with a 'buy' and Bata India Ltd. with a 'neutral', citing growth benefits from the penetration of branded footwear in India.

The brokerage set a target price of Rs 1,450 apiece for the Metro Brand, implying an upside of 28% from Thursday's closing price. The brokerage set the target price for Bata India at Rs 1,470 apiece, suggesting a 7% increase from Thursday's closing price.

Organised multi-branded retailers are expected to benefit the most from the decline in market shares of small and unbranded shoes in the country as people lean more towards branded shoes, Goldman Sachs said in a note on Thursday.

Adding to this, India's sports and athleisure footwear segment is at an inflection point. The note expects its value to grow at a 13% CAGR over FY25–FY45E.

Growth in the sports and athleisure segments will get further boosted due to the collaboration between global and local brands, it said.

As such, the brokerage believes that Metro Brands is in a good position to gain from the high growth of the sports and athleisure space in the country, including premiumisation of products.

However, Bata India's growth has not shown a significant revival despite the ramp-up in premiumisation and marketing efforts, Goldman Sachs said.

Key Highlights

Goldman Sachs initiated coverage on Metro Brands Ltd. with a 'buy' and set the target price of Rs 1,450, implying an upside of 28%.

Metro Brands is in a better position to reap the benefits of high growth in sports and athleisure segments.

Metro Brands will start scaling up Fila in FY25 through its existing Metro and Mochi store networks, the brokerage said in a note on Thursday.

Golman Sachs expects METB's S&A business to contribute 17% to revenues by FY35.

The brokerage also initiated coverage on Bata India Ltd. with a 'Neutral' rating of Rs 1,470 target price.

Bata India's initiatives towards portfolio premiumization, increase in marketing spends have not managed to revive growth yet, according to Goldman Sachs.

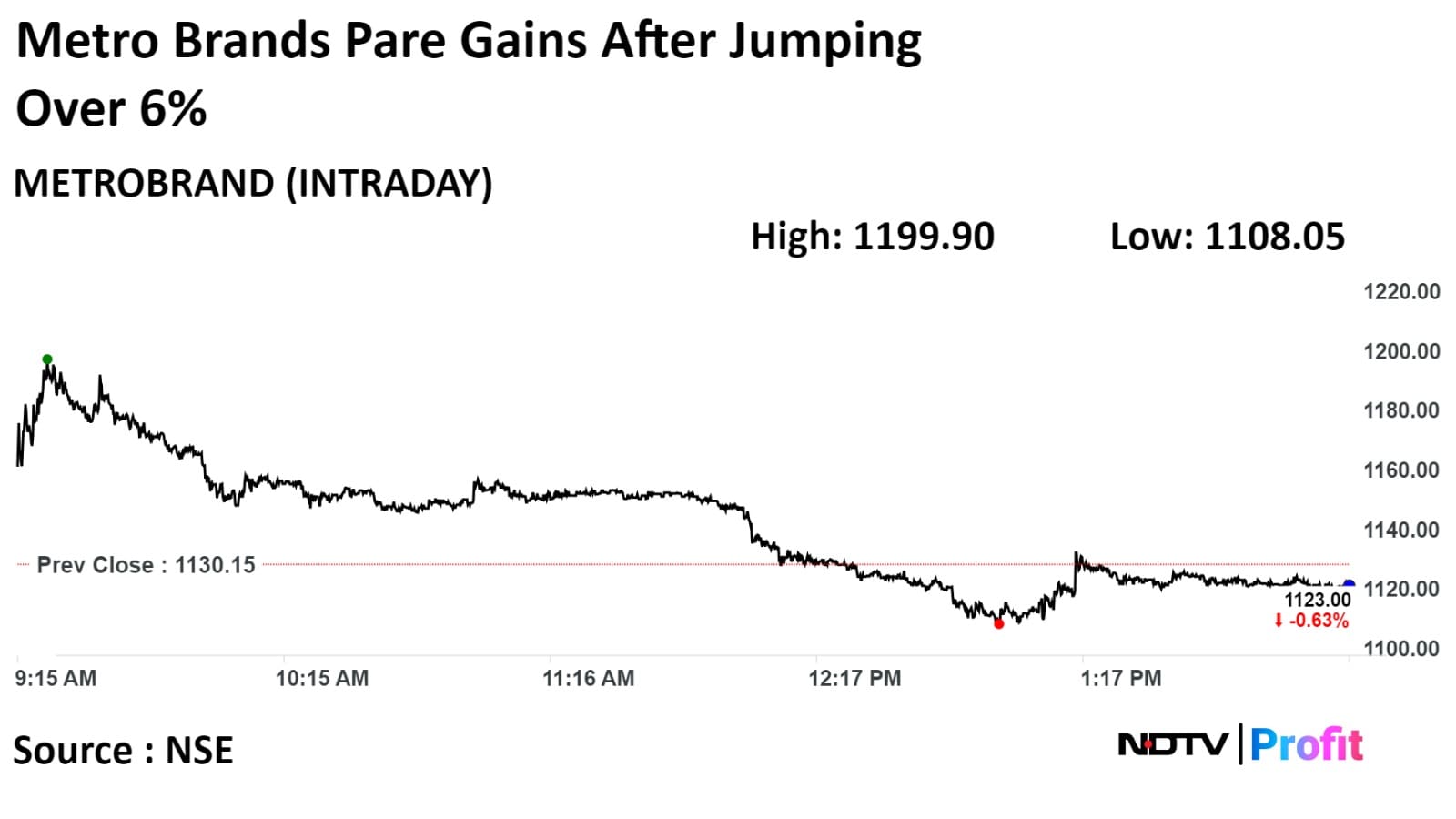

Metro Brands Jumps Over 6% As Goldman Rates It 'Buy'

Shares of Metro Brands rose 6.17% to Rs 1,199. It pared gains and was trading 0.81% lower at Rs 1,121, compared to the 0.44% advance on the NSE Nifty 50 index.

The stock has risen 42.85% in 12 months. Total traded volume so far in the day stood at 5.8 times its 30-day average. The relative strength index was at 51.

Out of 19 analysts tracking the company, 10 maintain a 'buy' rating, four recommend a 'hold,' and five suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 8.8%.

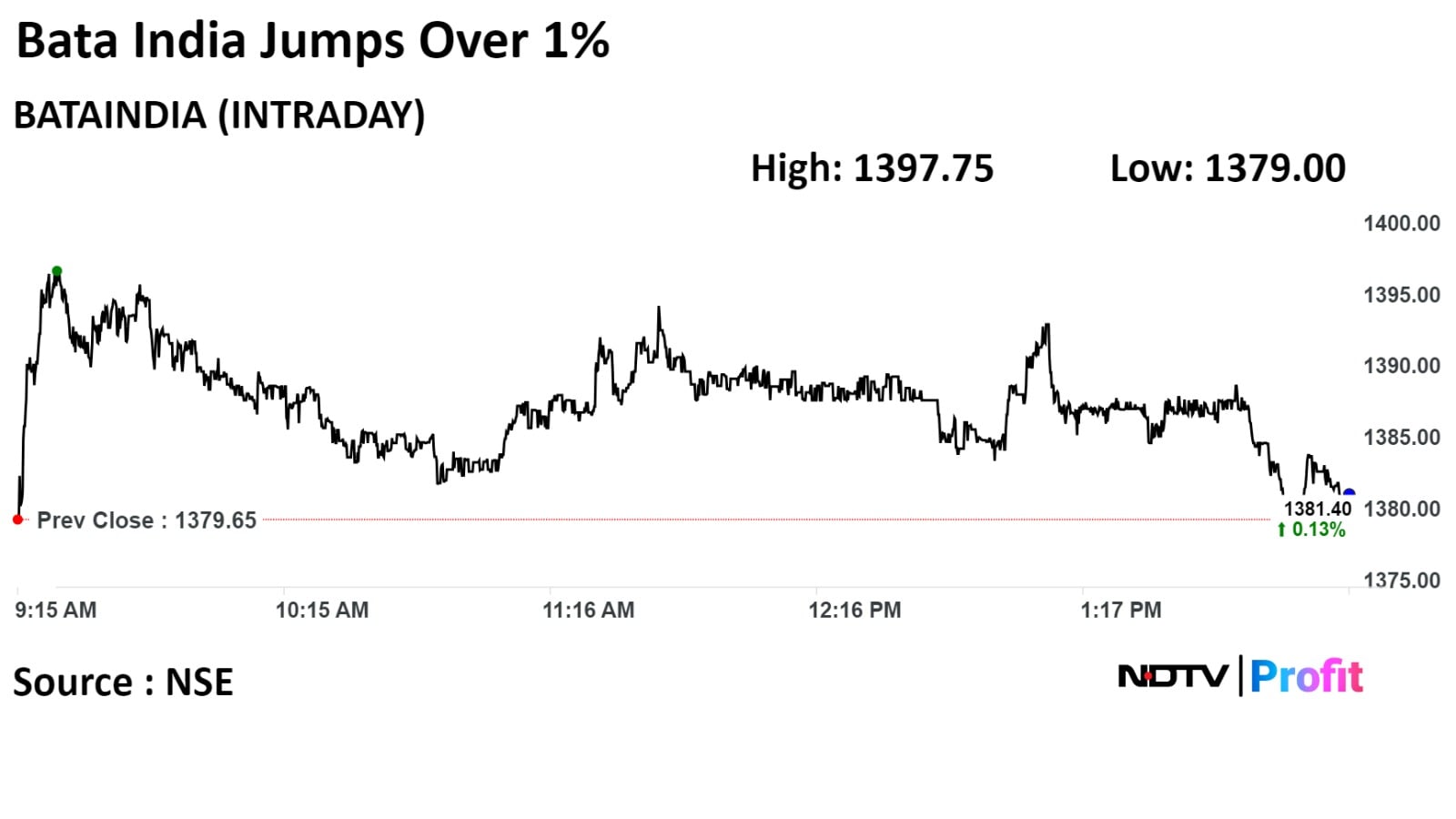

Bata India Rises Over 1% As Goldman Sachs Initiates Coverage

Shares of Bata India rose 1.31% to Rs 1,397. It pare gains and was trading 0.15% higher at Rs 1,381, compared to 0.44% advance on NSE Nifty 50 index.

Out of 22 analysts tracking the company, 12 maintain a 'buy' rating, five recommend a 'hold,' and five suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 7.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.