Mazagon Dock Shipbuilders Ltd.'s share price declined over 7% on Tuesday, as initial reaction to setting a record date for dividend payment for financial year 2025 faded. The board of directors has fixed Oct. 30 as the record date for dividend payment on equity shares for financial year 2025, the company said in an exchange filing on Oct. 17.

Mazagon Dock Shipbuilders' share price snapped a two–day winning streak on Tuesday, as it erased gains shortly after open. The shares had gained 3.10% in last two days.

The board of the company is set to meet on Tuesday to take decision on a stock split and dividend declaration for financial year 2025. Further details on dividend payment are awaited by investors, the company said in an exchange filing on Monday.

Shares of the company declined the most among shipbuilder stocks on the National Stock Exchanges on Tuesday. A slump in shipbuilding stocks also weighed on the sentiment for Mazagon Dock Shipbuilders' stocks.

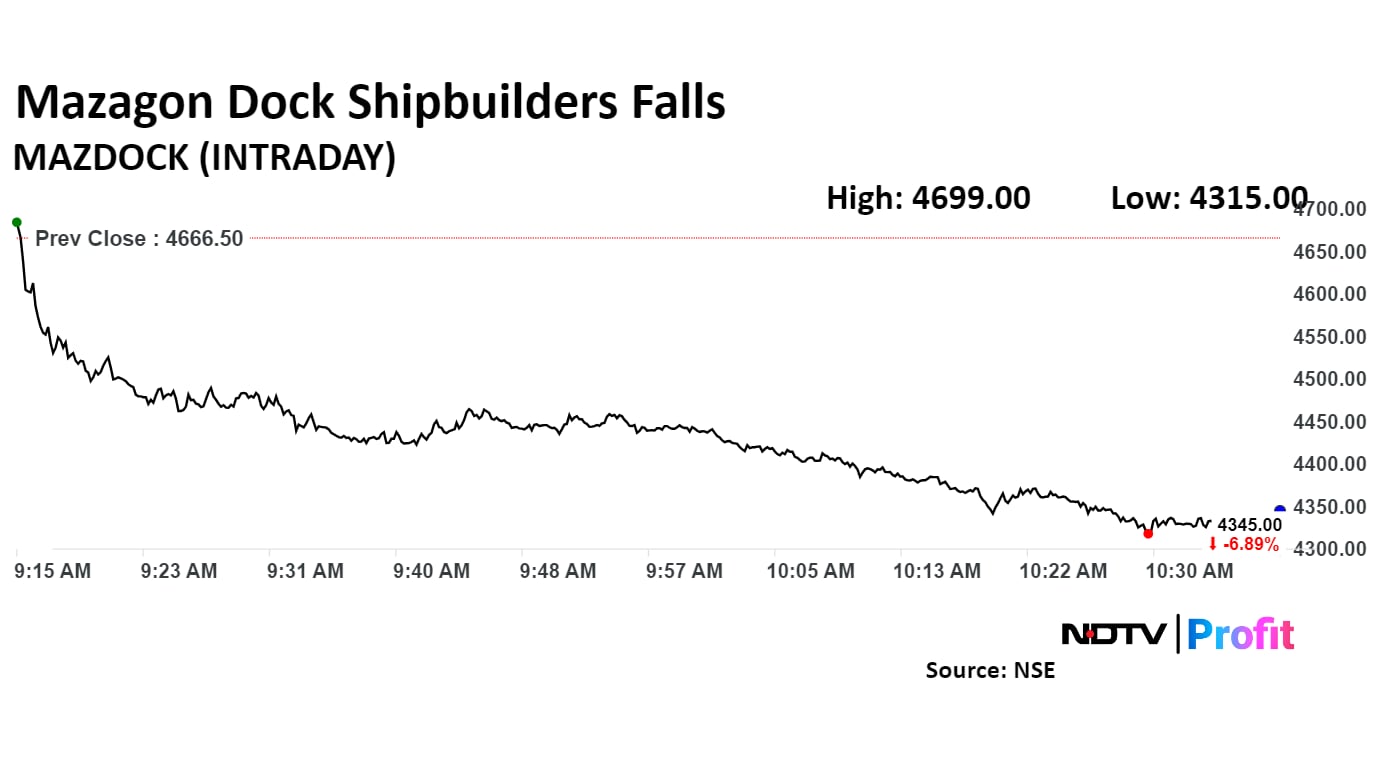

Mazagon Dock Shipbuilders Share Price

Mazagon Dock Shipbuilders share price declined 6.89% to Rs 4,699.00 apiece.

Mazagon Dock Shipbuilders' share price declined 7.30%, the lowest level since Oct. 18, before paring some loss to trade 7.09% lower at Rs 4,335.50 apiece as of 10:37 a.m. This compared to a 0.48% decline in the NSE Nifty 50.

The stock gained 128.6% in 12 months, and 93.39% on year-to-date basis. Total traded volume so far in the day stood at 1.9 times its 30-day average. The relative strength index was at 52.39.

Out of four analysts tracking the company, two maintain a 'buy' rating, one recommends a 'hold' and one suggests 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 25.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.