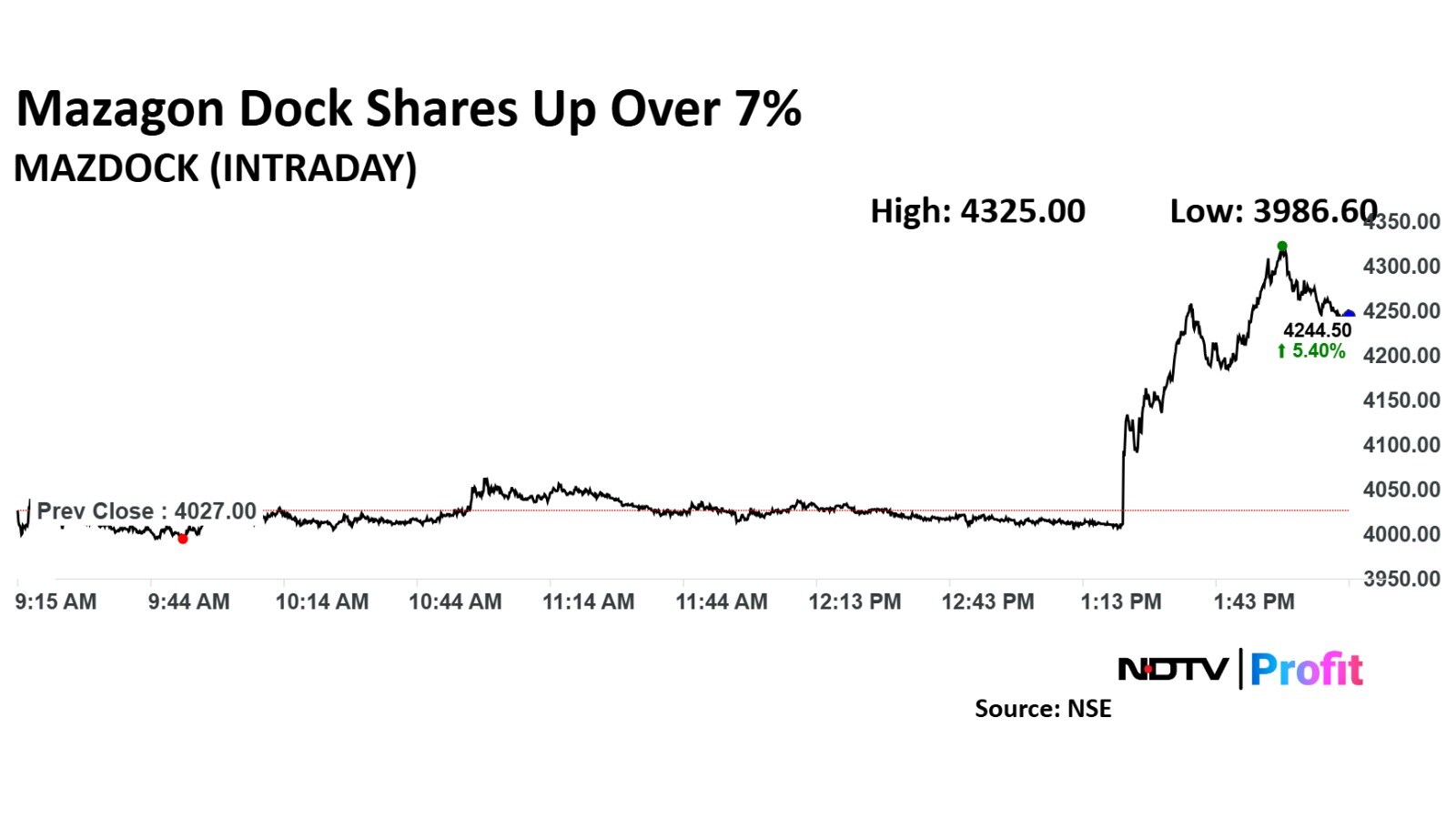

Share price of Mazagon Dock Shipbuilders Ltd. spiked as much as 7.40% to Rs 4,325 apiece after the PSU reported a 76% uptick in net profit, beating estimates.

The board of directors also declared an interim dividend of Rs 23.19 per share.

The defence company reported a net profit of Rs 585 crore for the quarter ending September, according to an exchange filing on Tuesday.

This exceeded the Bloomberg consensus estimate of Rs 489 crore. Revenue for the quarter rose 51% to Rs 2,757 crore, surpassing analyst expectations of Rs 2,148 crore. Total operating expenses as a percentage of revenue dropped to 81.5% in the quarter, compared to 90.3% in the same period last year.

Mazagon Dock Q2 FY25 Result Highlights (Consolidated, YoY)

Revenue up 51% at Rs 2,757 crore (Bloomberg estimate: Rs 2,148 crore).

Ebitda up 189% at Rs 511 crore (Bloomberg estimate: Rs 364 crore).

Margin expanded to 18.5% versus 9.7% (Bloomberg estimate: 16.90%).

Net profit up 76% at Rs 585 crore (Bloomberg estimate: Rs 489 crore).

Mazagon Dock Share Price Today

Mazagon Dock stock rose as much as 7.40% before paring gains to trade 5.09% higher at Rs 4,232 apiece, compared to an 0.79% advance in the benchmark Nifty 50 as of 2:23 p.m.

It has risen 118.34% in the last 12 months and 85.5% on a year-to-date basis. Total traded volume so far in the day stood at 1.7 times its 30-day average. The relative strength index was at 51.03.

Two out of four analysts tracking the PSU have a 'buy' rating on the stock, one recommends a 'hold' and one suggests a 'sell', according to Bloomberg data. The average of 12-month analysts' price targets implies a potential downside of 22%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.