Shares of Maruti Suzuki India Ltd. extended their record rally to Thursday after most analysts raised their target price for the stock citing that a better product mix will support growth.

Citi Research selected Maruti Suzuki India as its top pick in the sector and raised the stock's target price to Rs 15,500 from Rs 15,100. The current target price implies an uptick of 15% from Wednesday's closing price.

The brokerage also estimates EBIT by 2-4% for the financial year 2025–27 and earnings estimates by 2-5% for the same period, as cost reduction, a better product mix, and expected lower commodity prices support the company's profitability.

Maruti Suzuki is the least appreciated original equipment maker in the space, according to Bernstein, because its value creation gets less attention, according to Bernstein. The Swift maker will continue to benefit from the increase in the SUV and CNG mix, and there is room for hybrids to create further value.

Maruti Suzuki is now trying to beat the decline in the small car segment with the launch of the Swift and limited Dream series hatchbacks, Bernstein said. The brokerage maintained an 'outperform' rating on the stock with a target price of Rs 14,400 apiece.

The company was able to beat margin estimates thanks to a rise in the CNG mix to 33% from 28%. And strong CNG sales will continue, and SUV sales will also inch up a bit, according to Bernstein.

Maruti Suzuki will add over 10 new models and one new electric vehicle each year until 2030 to drive volume growth, which has posed concern, according to Nomura. The brokerage has raised the target price to Rs 13,133 from Rs 12,523. The current target price implies a 0.1% upside from Wednesday's market price.

Maruti Suzuki reported higher than expected earnings in the first quarter, supported by low raw material costs, sales, and a stable forex situation, Nomura said. However, in the near-term, the volume growth is likely to remain subdued.

Maruti Suzuki Q1 Results Key Highlights (Standalone, YoY)

Revenue up 9.9% to Rs 35,531 crore (Bloomberg estimate: Rs 34,829.95 crore).

Ebitda up 50.9% to Rs 4,502 crore (Bloomberg estimate: 4,040.74 crore).

Margin expanded to 12.7% from 9.2% (Bloomberg estimate: 11.60%)

Net profit up 46.9% at Rs 3,649.9 crore (Bloomberg estimate: Rs 3,271.88 crore).

One basis point is one-hundredth of a percentage point.

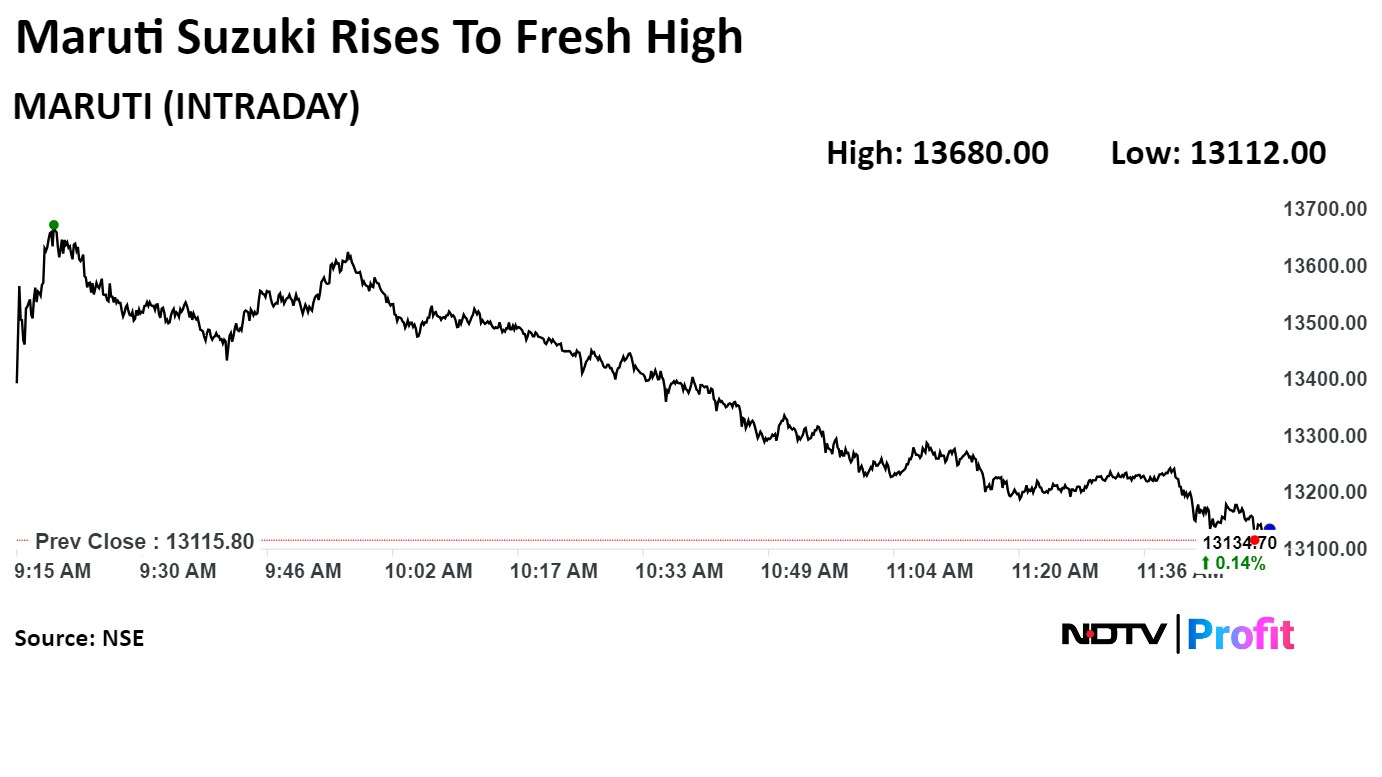

Shares of Maruti Suzuki jumped 4.30% to Rs 13,680, the highest level since its listing on July 9, 2003. It was trading 0.21% higher at Rs 13,144.00 as of 11:53 a.m., compared to 0.16% advance in the NSE Nifty 50 index.

The stock gained 35.17% in 12 months, and 27.61% on year to date basis Total traded volume on NSE so far in the day stood at 2.02 times its 30-day average. The relative strength index was at 68.61.

Out of 53 analysts tracking the company, 31 maintain a 'buy' rating, 11 recommend a 'hold,' and 11 suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 6.2%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.