Marksans Pharma Ltd. jumped over 13% to a near two-week high on Wednesday after its profit surged over 26% in the first quarter of the fiscal year 2025.

Due to better operating efficiency, the pharmaceutical company's consolidated net profit rose 26.4% year-on-year to Rs 89 crore in the quarter ended June 2024, according to an exchange filing.

The rise in share of existing customers, new launches, favourable raw material costs, and a better product mix supported bottom line growth, said Managing Director and Chief Executive Officer Mark Sandalha.

uring the same period, consolidated revenue grew 18.1% on the year to Rs 591 crore. Operating profit grew 26% on an annualised basis to Rs 128 crore from 102 crore. The margin expanded 130 basis points on the year to 21.7% from 20.4%.

Due to the Red Sea crisis, Marksans Pharma experienced freight cost pressures during the first quarter.

Further, it saw an annual rise in employee expenses during the quarter because it added new people at its new facility, the exchange filing said. Meanwhile, sequential employee costs came down as a one-time annual incentive payment was made in the preceding quarter.

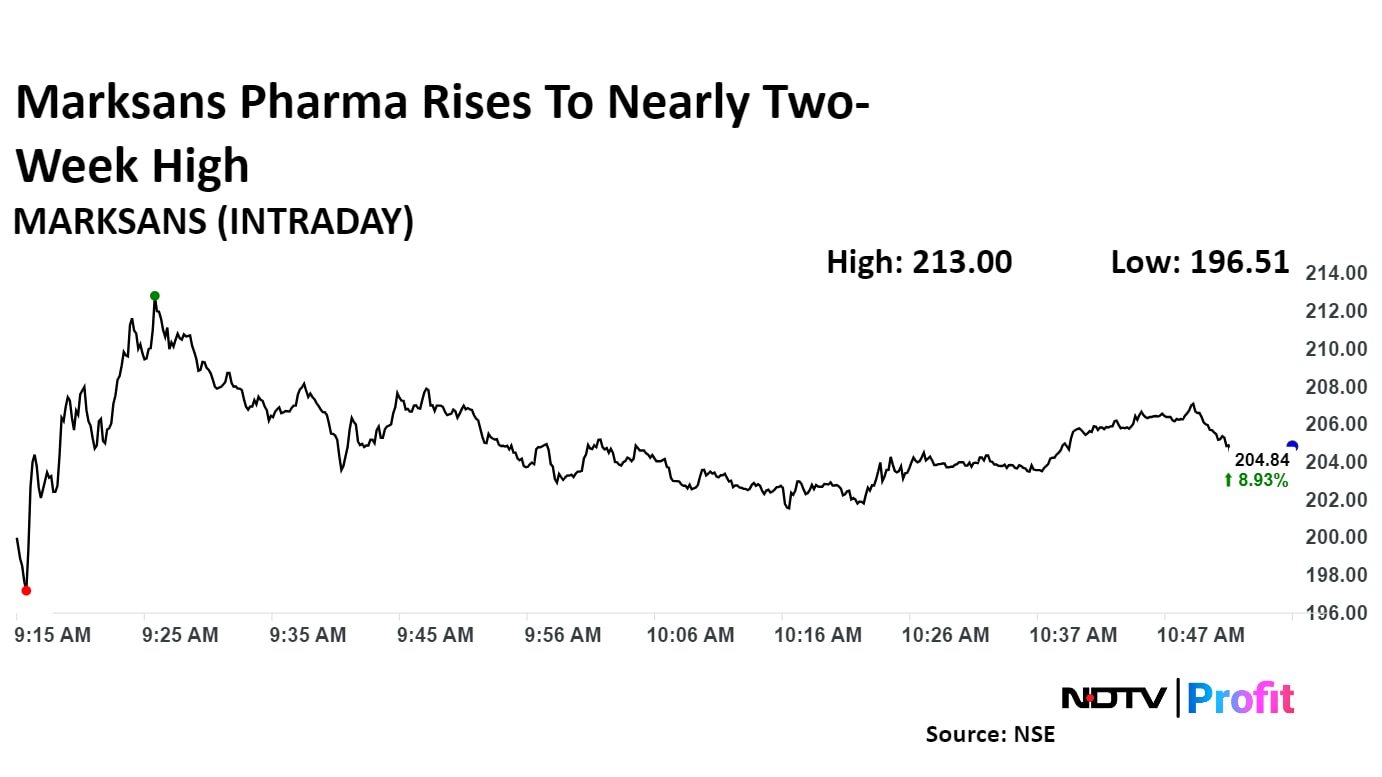

Shares of Marksans Pharma rose 13.27% to Rs 213.00, the highest level since Aug. 1. It pared gains to trade 8.89% to Rs 204.76 as of 11:02 a.m., as compared to flat NSE Nifty 50 index.

The stock gained 79.69% in last 12 months and 27.03% on year to date basis. Total traded volume so far in the day stood at 6.7 times its 30-day average. The relative strength index was at 59.33.

All the five analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 11.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.