A rating of information technology companies is on the cards because of the expected management commentary in the coming earnings season about new contracts, especially related to artificial intelligence, according to Deven Choksey, managing director of DRChoksey Investment Managers Pvt.

"Markets want to see the new narrative. Not sure how much it would reflect in the immediate quarter, but the belief will be that downside (growth) is arrested," he said.

The NSE Nifty IT registered its strongest June performance in over 20 years, with the technology benchmark index advancing over 11.7% last month. This marks the best monthly returns since June 2003 and stands in contrast to a nearly 7% rise in the broader NSE Nifty 50.

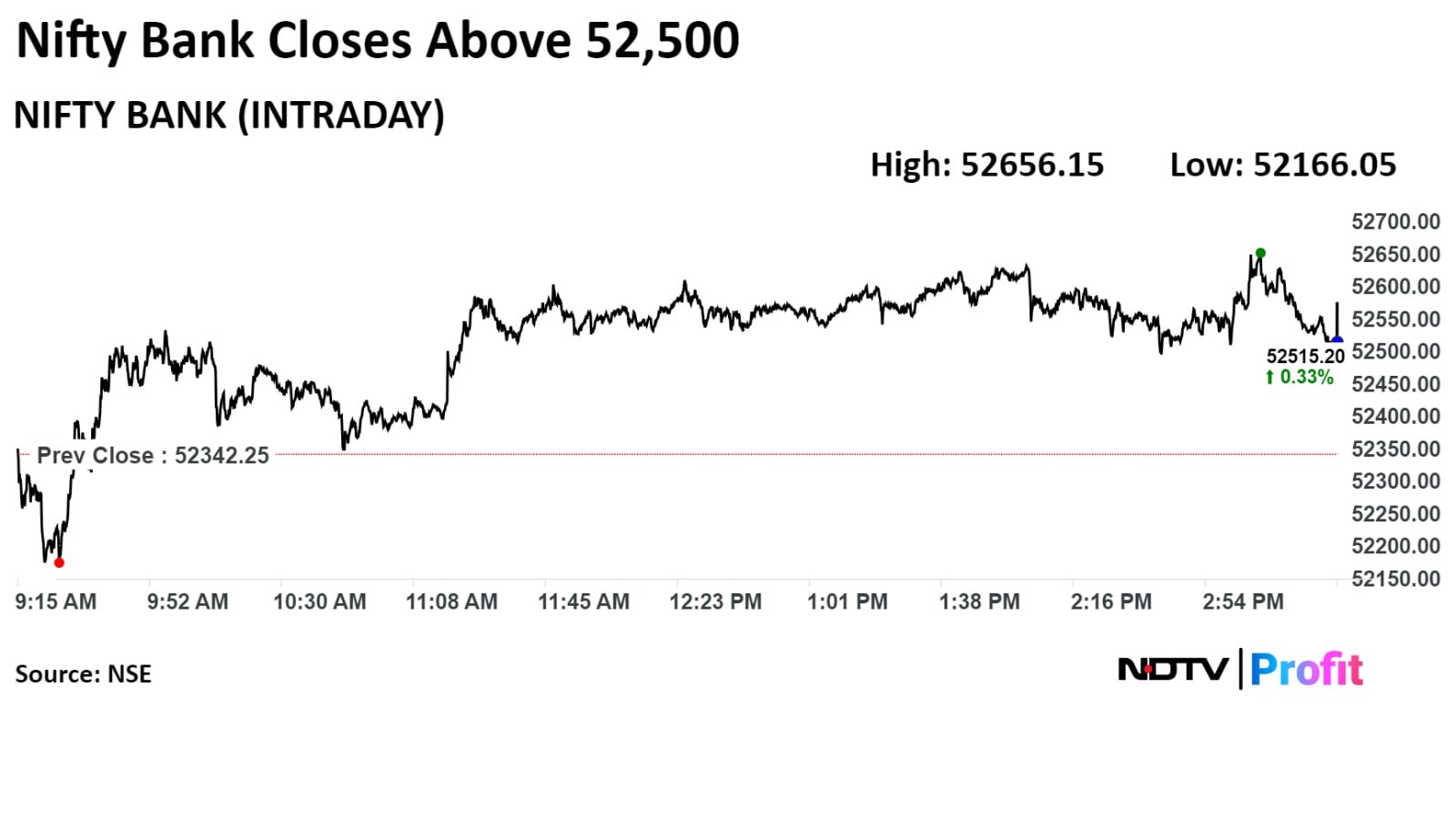

Over at the benchmark counters, the NSE Nifty 50 and Bank Nifty can witness a small decline for a day or two, as some oscillators are not supporting the current upward move, said Hemen Kapadia, senior vice president of institutional equity at KR Choksey Stocks & Securities Pvt.

"Currently, we are close to the resistance level. Reliance Industries Ltd. is cooling off; HDFC Bank Ltd. has not broken out (of resistance), while Kotak Mahindra Bank Ltd. could, but not yet," he said.

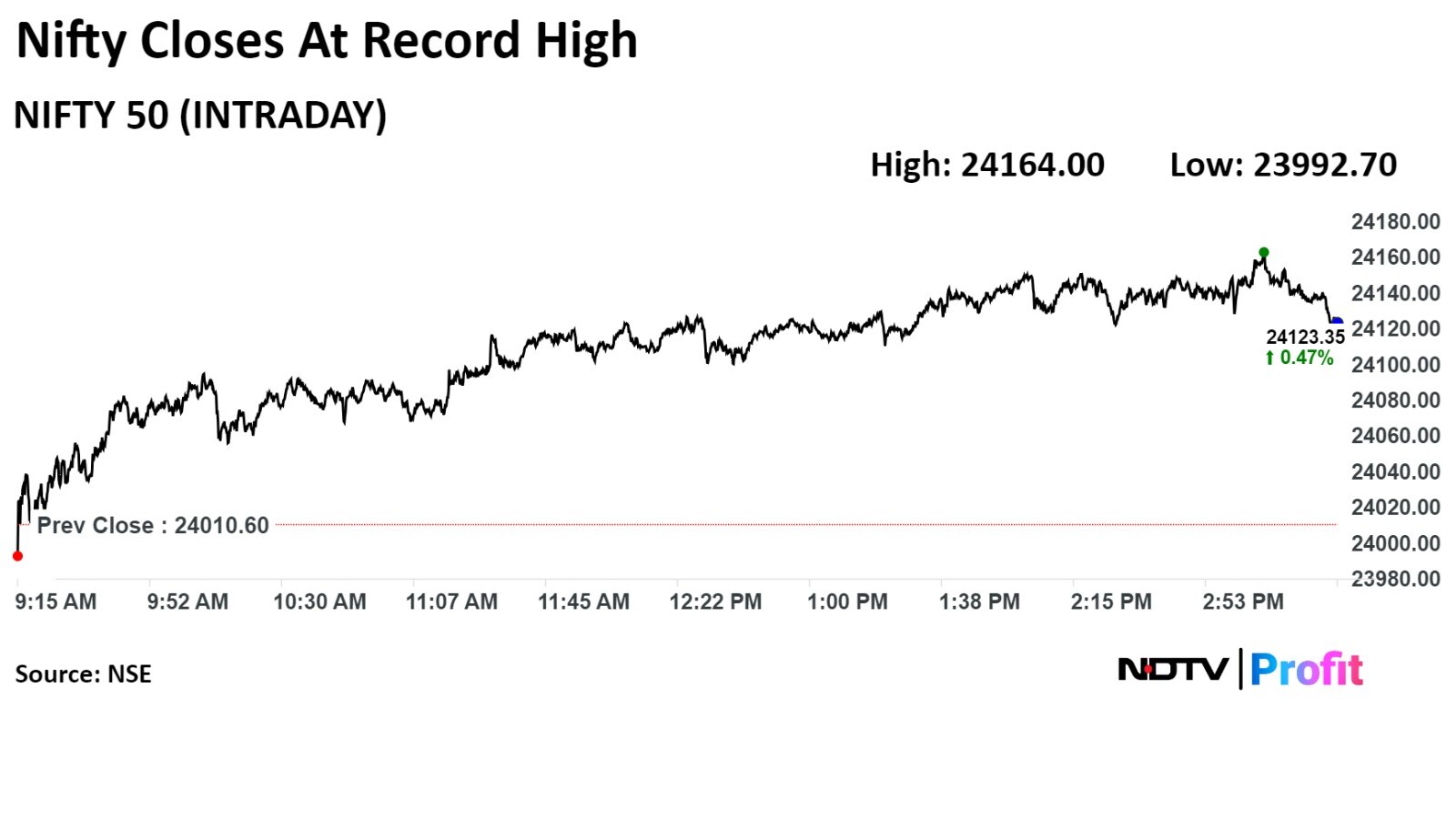

The Indian benchmark indices recouped losses from last session and closed at all-time highs on Monday, tracking gains in shares of HDFC Bank Ltd. and Infosys Ltd.

The NSE Nifty 50 ended at 131.35 points, or 0.55%, higher at 24,141.95, and the S&P BSE Sensex closed at 443.46 points, or 0.56%, up at 79,476.19.

The recent bump in tyre stocks can be attributed to a catch-up rally in the wider auto space, said Mayur Milak, senior vice president of research, auto and aviation at Asian Markets Securities Pvt.

"In the last two-three months, all auto ranks have seen a sharp rally, except tires. The gap between tyres and others in the auto space was high. The jump (in tyre stocks) is a catch-up game on valuation rather than fundamentals," he said.

Moreover, sales figures for tractors have met expectations, but figures for cars and two-wheelers suggest it is an inventory jack-up rather than actual sales.

"June is 18–20% lower than May sales. Dispatches that happen over that will add to the already high dealer inventory level."

Watch The Full Conversation Here:

The views and opinions expressed by the investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.