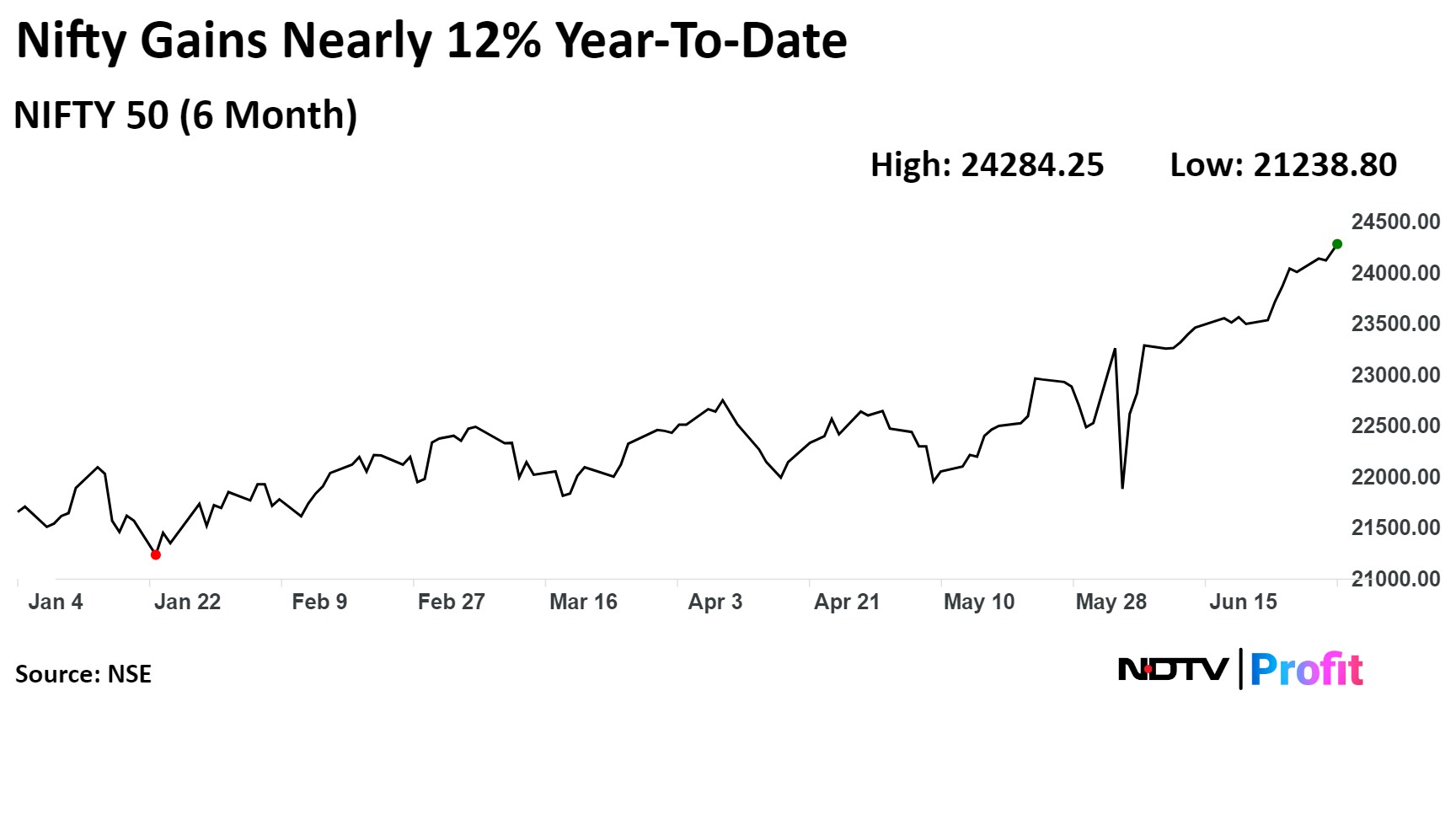

The NSE Nifty 50 changed its all-time high 39 times and added over 2,500 points in just the first six months of the year, but it has not changed NeoTrader Founder CK Narayan's expectations of a bullish second half.

"People have been talking about pullbacks for the last three months and it has simply not come," Narayan told NDTV Profit.

There are several data points due to which the market is expecting a pullback, including a higher long position of the foreign institutional investors and a high put-call ratio of 1.5. However, the ratio has receded to 1.13–1.15 and the short positions of the FIIs were also at a high recently, according to Narayan.

(Source: CK Narayan Website)

In retrospect, in some charts, a year or two from today, there was a 30% or 10% pullback in the index. But then, the very short life of that pullback is keeping people hooked on it, Narayan said, referring to a sharp fall on June 4.

"We have gone through.... wars and several Fed comments, election surprises, and corporate developments," he said, highlighting that the price damage has not happened. "The total absence of price damage in any pullback is what is keeping me chained to the view from the start of the year that we will have an upwardly bias market in the second half."

The sharp drop that he was expecting mid-year already happened on June 4.

Along with the Union budget and corporate results, the market will react to news that has not been factored. There is a very quick sector rotation happening and investors need to be stock-specific, Narayan said.

He said certain stocks are coming up from a good base and strong state of consolidation, including IEX, cement stocks and the Federal Bank Ltd.

Thematically, while he is not so positive on chemicals, infra "definitely has a lot more legs". Data centre and allied sectors will be the emerging themes, he said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.