Indian equities may be up for more pain as their premium over Asian peers is yet to level with long-term average, according to veteran investor Manishi Raychaudhuri.

Indian equities were trading at 80-90% premium to Asia ex-Japan during the peak in September, he said. That premium has now reduced to 50%, yet is above the last 15-year average of 25%. "If premiums were to come down to 40%, it would still mean a 15% correction," he told NDTV Profit on Tuesday.

This correction can happen in two ways: Asian markets move up and India stays muted or India declines while Asian equities rise, according to Raychaudhuri.

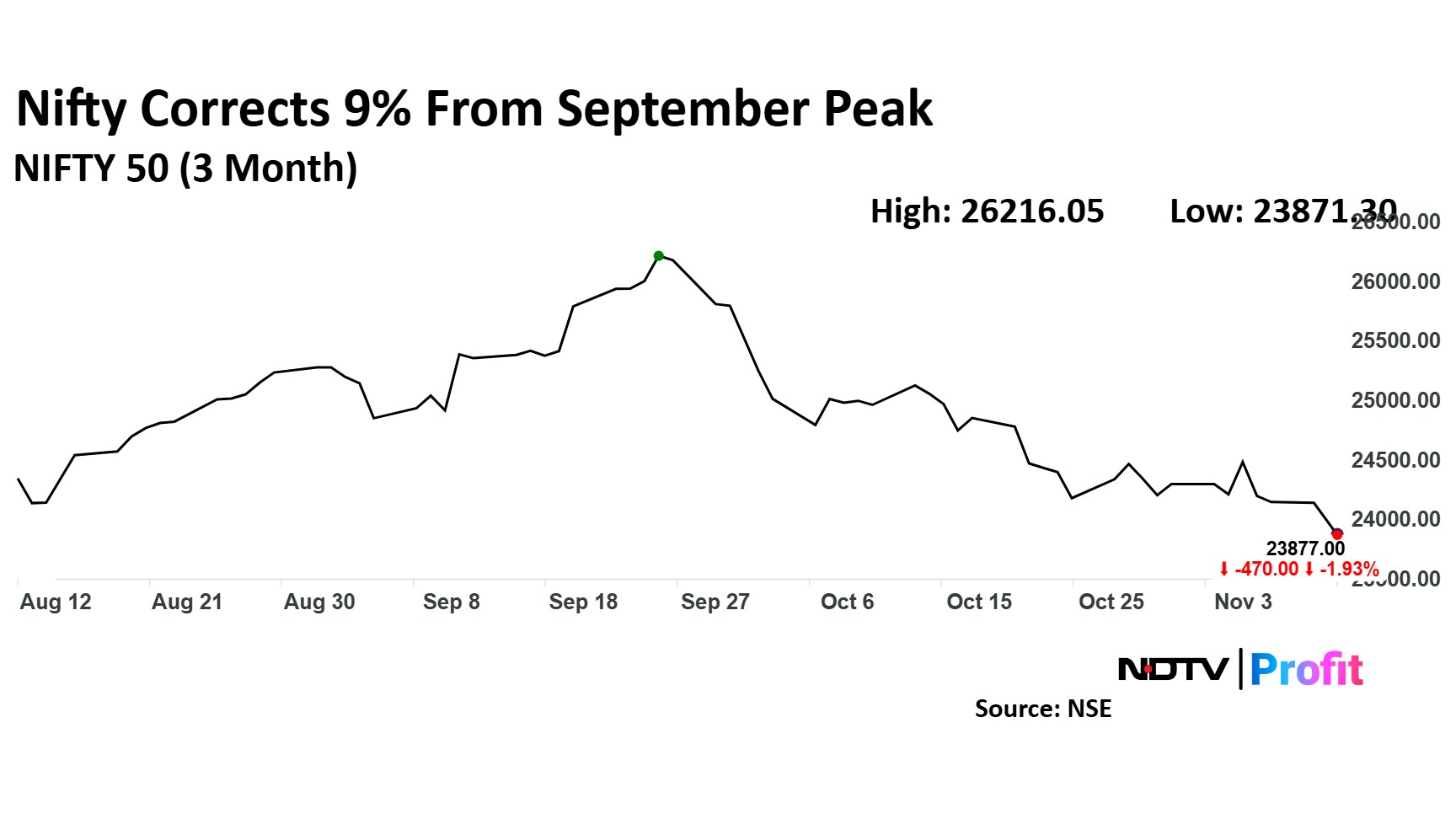

The benchmark Nifty 50 has corrected nearly 9% since its peak in late September.

The reason for this correction has to do with both local headwinds and global fund flow. Raychaudhuri noted consensus earnings estimates have seen a 5-10% downgrade for this year and the next as growth slows for Indian companies.

Moreover, since China announced massive stimulus in late September, global funds have reallocated capital from India to there.

"There's been a reallocation from India to North Asian markets. It started in late September from China after their stimulus and even that has disappointed. There is confusion about Asian equities among foreign investors, compounded by a strong US equities and dollar," Raychaudhuri said.

The market is in such a zone that investors are looking at any bounce in prices as a selling opportunity, compounding the downward pressure, he said.

Raychaudhuri's long term bets are Indian private sector banks, industrials and consumer discretionary.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.